Netflix Q4 2025 Earnings Recap

Why the market is wrong about the $NFLX + Warner Bros. deal

Accrued Interest TL/DR: Netflix, NFLX 0.00%↑ posted a “beat and raise” Q4, yet the stock is down nearly -8% YTD as Wall Street panics over the $82.7B Warner Bros. acquisition and rising content costs. I believe this sell-off is a gift. In this article, I argue that the market is mispricing execution risk while ignoring three massive catalysts: 1) A rapidly maturing ad business set to double to $3B in 2026; 2) The “Netflix Effect” proving it can finally break the 10% TV usage ceiling; and 3) The strategic brilliance of buying the HBO / Warner Bros. library forever rather than renting competitors’ hits for billions. I am maintaining my OUTPERFORM rating and buying the dip.

If you have been reading Accrued Interest for a while, you know my golden rule for media investing: Follow the growth in intrinsic value, not just the headlines.

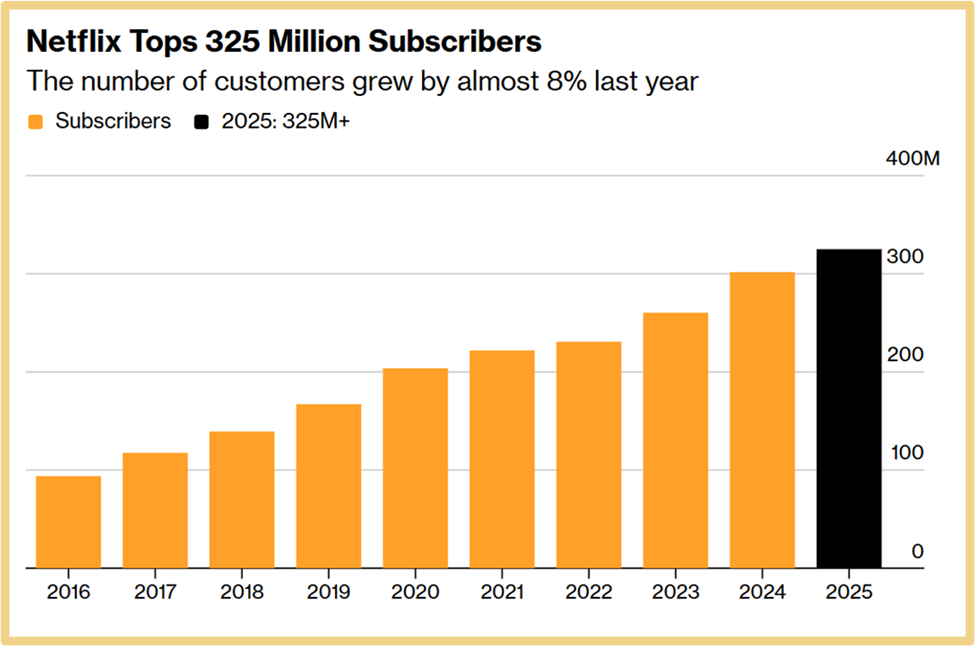

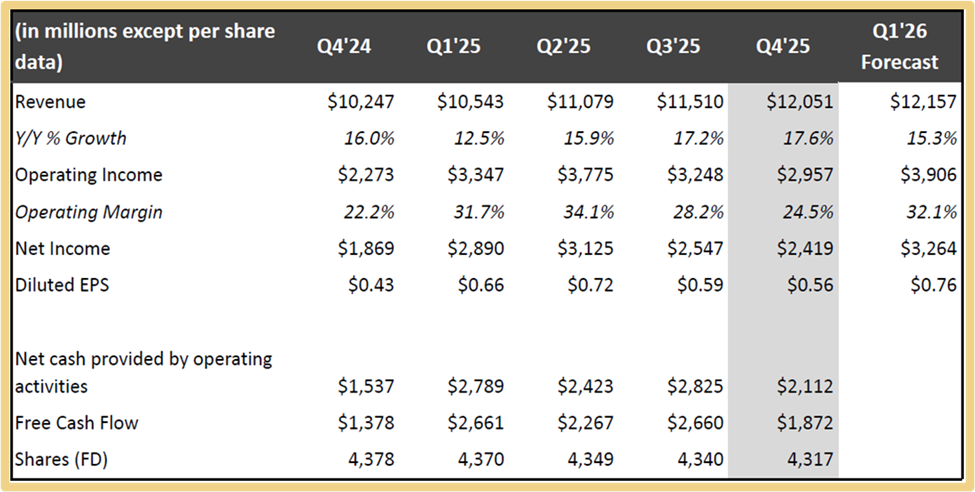

This week, Netflix (NFLX) reported its Q4 2025 earnings. On paper, it was a “beat and raise” quarter. Revenue hit $12.05 billion (+18% YoY), operating income grew +30% YoY, and they added millions of new subscribers to hit a massive 325 million global paid memberships.

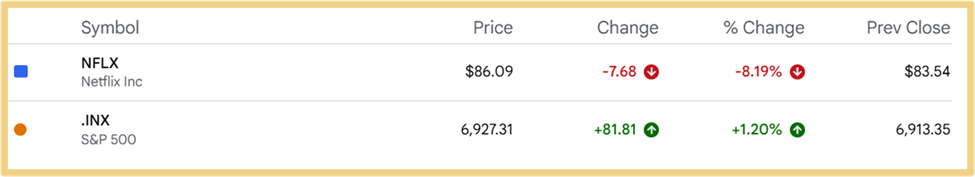

Yet, the stock is down nearly -8% year-to-date, trailing the S&P 500 by -9% on a relative basis.

Why? Because Wall Street is allergic to complexity. The narrative right now is messy: “Growth is slowing,” “Expenses are rising,” and “The Warner Bros. acquisition is a distraction.”

I see it differently. The dip in Netflix shares this week is a gift. It is a classic case of short-term arbitrage where the market is pricing in execution risk for the Warner Bros. deal while completely ignoring the intrinsic power of the core Netflix machine.

Here is why I am maintaining my OUTPERFORM rating on Netflix and why I am buying this pullback with a 2-year time horizon.

The Bear Case: Why Everyone Is Panicking

Let’s steelman the argument against the stock. Why are some investors selling right now? It boils down to three fears:

The “Expense” Surprise: Netflix guided for slightly higher programming expenses in 2026. For a market addicted to “margin expansion stories,” seeing a company ramp up spend feels like a step backward.

The “Growth Ceiling” Anxiety: Bears are looking at the Q1 2026 guidance and whispering that the organic growth engine is sputtering. If you strip away the price hikes, is subscriber growth stalling?

The WBD Hangover: This is the big one. The decision to switch the Warner Bros. deal to an all-cash transaction ($82.7B) and pause share buybacks has spooked investors who were enjoying the capital return party. The fear is that Netflix is buying a “melting ice cube” (linear networks) that will drag down its pristine balance sheet.

As CFO Spence Neumann admitted on the call regarding the 2026 outlook, the company is leaning into investment rather than short-term margin maximization:

“We are increasing our expense growth a bit this year... to invest into those opportunities, all while continuing to expand our margins and deliver strong dollar profit growth.”

And regarding the Warner Bros. integration, Co-CEO Greg Peters emphasized that while they are excited, they are realistic about the work ahead:

“We know how to go do that. By the way, Warner Bros. will be doing the same in parallel as well. And then you get into the close period... We think we can deliver more. There’s upside in the deal at the end of the day.”

These are valid concerns. But they miss the forest for the trees.

The Bull Case: Why The Market Is Wrong

Here is the reality: Netflix is not just a streaming service anymore; it is the operating system of global culture. The Q4 data proves that the company’s competitive moat is widening, even as legacy media collapses.

1. NFLX’s Ad Business is a Sleeping Giant

The most underappreciated number in the Q4 report was the ad revenue. Netflix generated roughly $1.5 billion in ad revenue in 2025. That sounds small for a company of this size, but look at the trajectory. Management expects this to double to ~$3 billion in 2026.

Why am I so confident they will hit this? Netflix finally has its own Ad Tech Stack.

Remember, Netflix has only been operating on its own ad technology for less than a year. They launched their proprietary ad server in Canada in November 2024 and rolled it out to the US in April 2025. Before this, they were relying on Microsoft and third-party band-aids. Now, they own the stack.

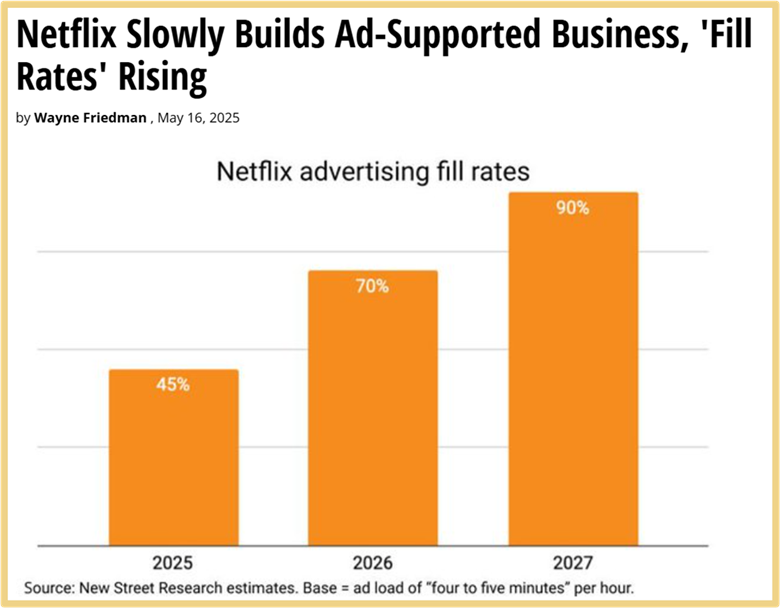

This matters because of fill rates (ad inventory utilization). According to a May 2025 report from MediaPost, analysts estimated Netflix’s fill rate—the percentage of ad slots actually sold—was hovering around 45%. In the mature digital TV world, that is remarkably low, but for an investor, it represents massive “low hanging fruit.”

As Wayne Friedman noted, “The streamer would have around a 45% ‘fill rate’... for the remainder of 2025.”

This means Netflix has been leaving money on the table simply because they lacked the maturity to sell all their inventory. As their tech improves and they integrate the massive inventory from Warner Bros., they will close that gap.

Targeting: First-party data from 325 million users is the holy grail for advertisers.

Pricing Power: As they unlock better targeting in 2026, CPMs (cost per thousand views) will stabilize even as inventory grows.

We are in the early innings of Netflix monetizing its eyeballs. If they just achieve parity with industry-standard monetization rates, the ad business alone could be a $10B+ line item by 2028. While that may seem aggressive given the $3B forecast for 2026, the addition of premium Warner Bros. inventory (HBO and other WB Studios television shows and movies) accelerates this timeline significantly.

2. NFLX Has a Plan to Capture “Total TV Time”

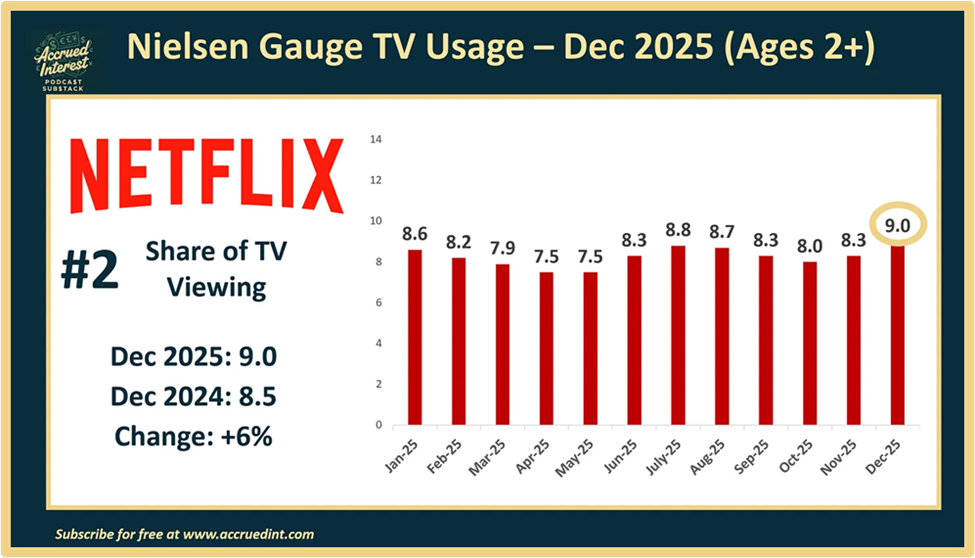

For over a year, I have been writing about Netflix’s struggle to grow its share of total TV viewing above 9%. In last monthly recap Media Stock Insights from Nielsen’s Dec-25 TV Snapshot, I highlighted how they only just reached this milestone.

Management even called this out directly on the earnings call:

“It’s worth noting that our share of viewership in even our biggest countries is still less than 10% of TV time.”

Bears have used this metric to argue that Netflix has hit a ceiling. However, December 2025 proved otherwise.

According to Nielsen’s The Gauge report, streaming viewership shattered records, capturing a historic 47.5% of total TV usage in December 2025. More importantly, on Christmas Day—driven by Netflix’s NFL games—streaming captured 54% of TV usage.

While Christmas and the Stranger Things finale were outliers, they serve as a proof of concept. By adding new content forms—such as live sports, video podcasts, and eventually the massive Warner Bros. library—Netflix is building a content engine capable of breaking that 10% ceiling.

The “ceiling” wasn’t structural; it was a content supply issue. Warner Bros. solves that.

3. The “Netflix Effect” vs. The “YouTube Threat”

There was a fascinating data point circulating this week: YouTube’s viewing reach in the UK officially surpassed the BBC’s for the first time in Q4 2025.

The bears see this as a threat to Netflix (”YouTube is eating the world”). I see it as confirmation that linear TV is dead, and there are only two winners left standing.

Netflix isn’t competing with the BBC or any network anymore. It is competing for time. And while YouTube wins on “short-form dopamine,” Netflix is the undisputed king of “premium immersion.”

Engagement: Netflix users average 2 hours per day on the platform.

Retention: Churn remains near historic lows despite price hikes.

Culture: When Squid Game Season 2 or the Stranger Things finale drops, the entire world tunes in.

This “Best of Both Worlds” strategy is exactly what I wrote about in my 12 Days of Pitch-Mas series back in December. See the full pitch I made last month in Why Netflix Should Acquire Warner Bros. ($NFLX & $WBD).

As I noted in my PSKY short pitch - Why Paramount Skydance Won’t Win Warner Bros. ($PSKY & $WBD) , Netflix’s move to acquire Warner Bros. is a vertical integration play that regulators should view favorably because it creates a counterweight to the Big Tech monopolies:

By acquiring Warner Bros., Netflix isn’t buying “old TV channels.” They are buying the HBO and Warner Bros. television and film library—the only content catalog in history that rivals their own for prestige. Feeding HBO content into the Netflix recommendation algorithm is like pouring jet fuel on a bonfire.

Furthermore, consider the recent licensing deal Amazon MGM Studios struck to bring the entire James Bond catalogue to Netflix this January.

Amazon originally acquired MGM for $8.45 billion in 2022 to bolster Prime Video. But recently, it was revealed that Amazon paid an additional ~$1 billion just to secure full “creative control“ of the James Bond franchise from the Broccoli family. That brings their total investment in the studio to nearly $9.5 billion, largely to own one of cinema’s most iconic characters.

Think about the implications of that. Prime Video, which already has one of the largest digital video distribution footprints on the planet, was forced to bend the knee to Netflix’s distribution power. If Amazon can’t survive without the “Netflix Effect,” no legacy media company can.

CEO Ted Sarandos also made a pointed “throw-away” comment on the call that investors should not ignore:

“The Oscars and the NFL are on YouTube... Amazon owns MGM... and Instagram is coming next.”

While seemingly a casual remark about competition, it was a reminder that digital behemoths like Meta are aggressively moving into the video space to capture television ad budgets. I touched on this in my 12 Days of Pitch-Mas article - Why Meta Will Outperform in 2026 ($META).

Netflix knows it isn’t just fighting any one competitor: it’s fighting the entire internet for your attention.

4. NFLX Has Operating Leverage Upside

Let’s talk about that “expense hike” that scared the market.

Netflix is forecasting programming spend to grow ~10% in 2026. However, revenue is growing at 14-16%. That is positive operating leverage.

The company is choosing to reinvest in content now—specifically live sports (NFL, WWE)—to lock in the next leg of growth. This is not “wasteful spending”; it is defensive moat-widening.

A prime example of this is the renewed deal with Sony Pictures. Netflix recently secured a massive extension to keep Sony’s films (like Spider-Man and Venom) exclusively in the Pay-1 window.

The new deal is reportedly valued at over $7 billion (neither company provided specific terms). That is a staggering sum just to rent movies. For context, the previous domestic deal was valued in 2022 at roughly $2.5 billion over 5 years, meaning the price to access this content has nearly tripled as the rights expanded globally.

Think about the economics here: Netflix is paying $7 billion just to rent Sony’s slate for a few years. Now compare that to the total enterprise value of the Warner Bros. deal. For $82.7 billion, Netflix is acquiring the entire WB studio, the DC Universe, Harry Potter, and HBO forever.

If the Sony rental fee is the “market rate” for premium content, the purchase price for the Warner Bros. library—at roughly 12x—is arguably the value trade of the century. These are the types of insights that value investors miss when they forget to take their heads out of the spreadsheet and remember these are real businesses and not just tickers on a screen.

Lastly, the pause in buybacks is temporary. Once the WBD deal closes and the integration stabilizes, Netflix will be a cash flow monster generating $15B-$20B in Free Cash Flow (FCF) annually.

CONCLUSION

The market is punishing Netflix for being ambitious. They wanted a quiet quarter of margin expansion and buybacks. Instead, they got a transformational merger and an accelerated pivot to live sports, video podcasts, and other global content.

But this short-term fear is your friend. It is de-risking the investment entry point.

To bet against Netflix now is to bet that consolidation will fail, that the ad tier will hit a wall, and that the world’s best content engine (Warner Bros. Studios) will suddenly lose its value inside the world’s best distribution machine (Netflix). That is a bet I am not willing to make.

Being contrarian means buying when the narrative is messy but the fundamentals are strengthening. With the stock now trading roughly ~22x 2027 earnings excluding WB, the valuation has compressed to levels we have not seen since the early streaming wars.

The “melting ice cube” of linear TV is flooding the market with fear. Use that fear to buy the only life raft that matters (that is not owned by Google).

-Accrued Interest

Relevant Tickers: NFLX 0.00%↑ , GOOG 0.00%↑, GOOGL 0.00%↑ , WBD 0.00%↑ PSKY 0.00%↑ , DIS 0.00%↑ , AMZN 0.00%↑ , META 0.00%↑

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

You can always reach me at simeon@accruedint.com.

Another great deep dive into Netflix earnings.

The Sony rental vs WBD ownership comparison really crystallizes why the market is mispricing this deal. Seven billion to borrow content temporarily vs buying the enire library forever is a calculation most spreadsheet analysts miss. Ive been watching the ad tier fill rate data too and 45% leaves so much room to run before they need to worry about inventory limits. Kinda feels like the market is punishing them for being bold instead of safe.