Why Meta Will Outperform in 2026 ($META)

12 Days of Pitch-Mas Day 5

For the 5th Day of Pitch-Mas, I am pitching Meta to outperform, and here is why I am ignoring the current market anxiety. While the stock has recently sold off—dropping from nearly $800 to around $650 due to fears over Zuckerberg’s aggressive capital spending—I believe investors are missing the tangible ROI already happening under the hood.

My bullish thesis comes down to three main drivers:

AI is Fueling Core Growth: Meta is currently defying typical auction dynamics by growing ad impressions (+14%) and ad prices (+10%) simultaneously. AI advancements are also increasing the time users spend on FB and Instagram.

Fiscal Discipline: Management is proving they are disciplined by planning deep cuts to the loss-making Metaverse division to redirect toward AI infrastructure.

New Moats: The company is expanding beyond its traditional apps, with Threads hitting 150 million daily active users and Instagram Reels launching on connected TVs to capture video ad market share.

With the stock currently trading at ~20x its 2027 earnings—a valuation cheaper than Google’s—I see this as a prime opportunity to buy the dip.

Here are 6 reasons why I expect META to outperform the S&P500 in 2026.

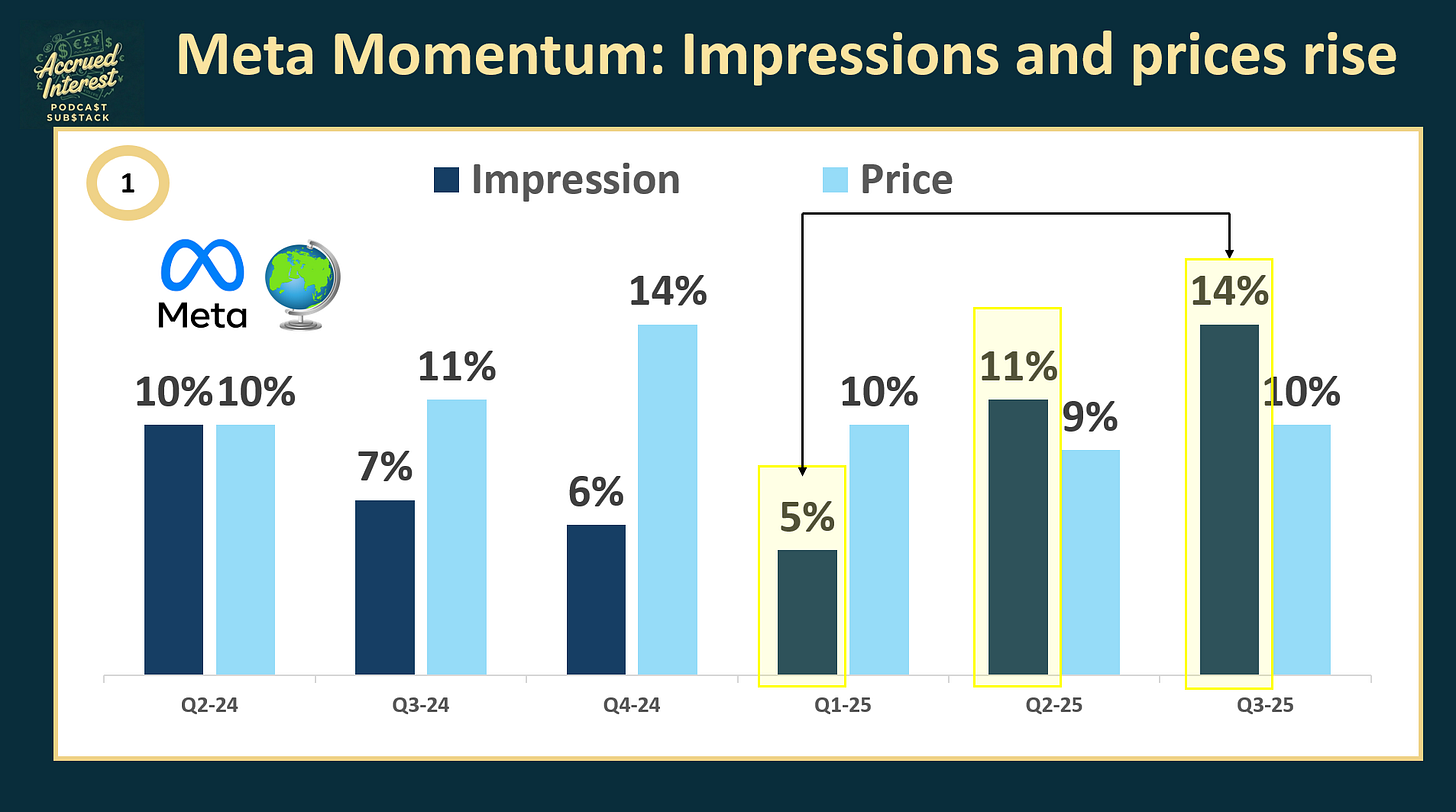

1. Meta Momentum: Impressions and Prices Both Rise

I am most bullish about Meta because AI is directly boosting user time spent, translating into accelerating ad impression volume across Facebook and Instagram. AI is increasing ad efficiency and advertiser return on investment (ROI), allowing Meta to raise prices even as ad supply grows.

AI engine is accelerating, more users, more impressions. In Q3 2025, Meta impressively expanded ad supply (+14% impressions) while simultaneously increasing ad prices (+10%), overcoming the typical inverse relationship in auction markets.

As I mentioned in my Meta Q2 recap article, “usually, a good time to

purchase Meta stock is when ad impression growth outpaces pricing increases”.

“Improved impression growth is beneficial for Meta’s long-term health. A larger user base provides more opportunities to sell advertisements, reducing the need to over-saturate screens with ads.”

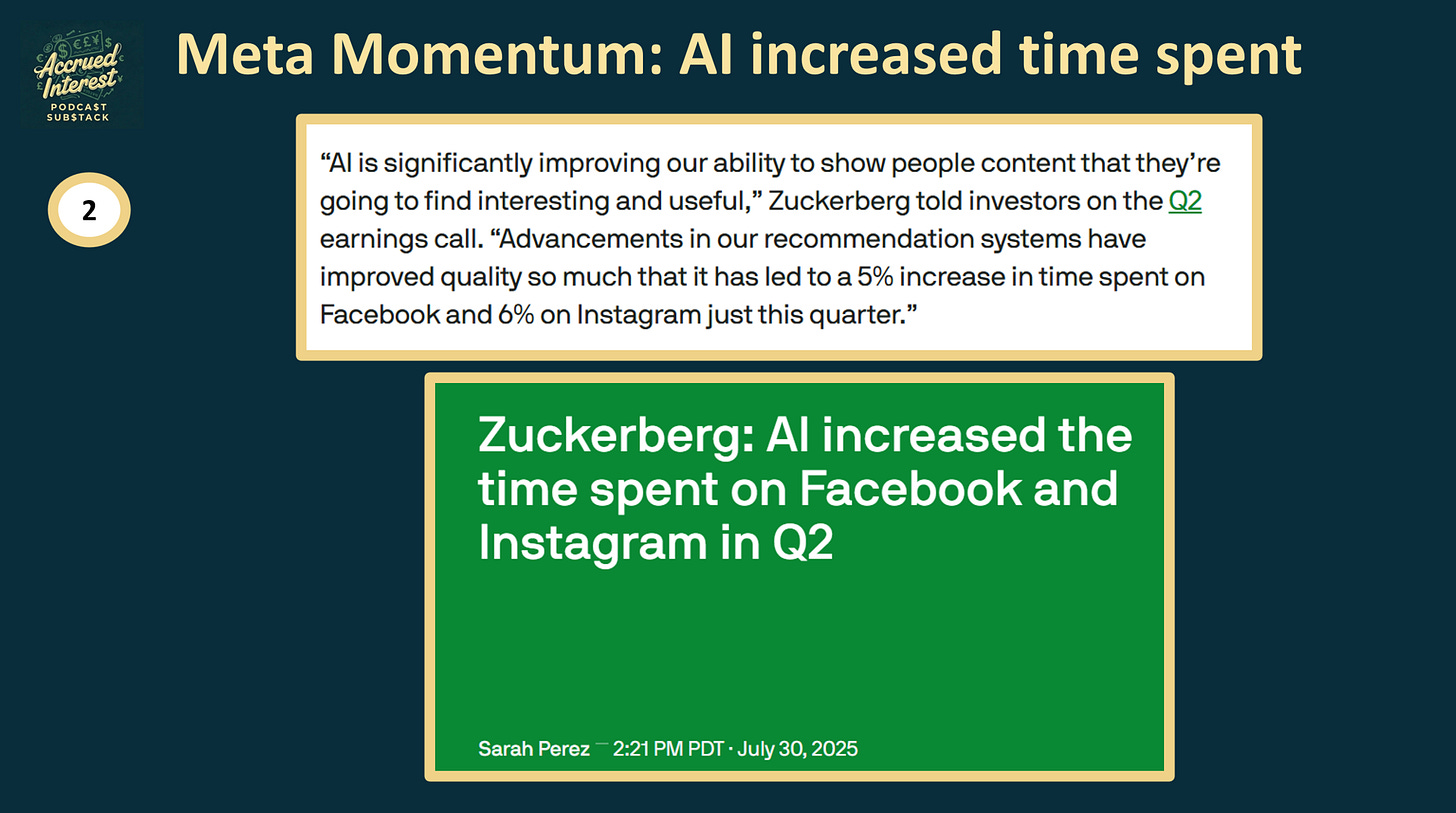

2. AI Increased Time Spent on Meta Platforms

Improved relevance is boosting engagement and volume: AI systems are making content more relevant, driving increased time spent, up +5% on Facebook and 6% on Instagram in Q2 2025.

Automated tools like Advantage+ already generate over $60 billion in annual revenue, proving that many advertisers are already recognizing the quantifiable performance benefits of these AI tools.

AI is tangibly boosting ad performance: internal enhancements drove nearly 4% higher conversions on Facebook mobile Feed and Reels in Q2 2025.

3. Go Big or Go Home: Management Commits Massive Capital to Proven ROI

Initially, investors were worried about Zuckerberg doubling down on AI infrastructure. I am not concerned, because I can tell META 0.00%↑ knows that these investments are translating directly into core profitability today.

Management is aggressively hiking the 2025 CapEx guidance to $70-$72 billion. It is all about infrastructure for their AI and compute needs.

My variant perception of Meta stems from the fact Meta can see, better than almost anyone else, the massive, positive AI impact within the Family of Apps.

4. Management Demonstrating Fiscal Discipline

Management is demonstrating fiscal discipline by reportedly eyeing up to

-30% operational expense cuts in the massively loss-making Reality Labs segment. For context, the division has lost over $70 billion since 2021, so these cuts are long overdue.This smart, disciplined approach pulls resources out of speculative metaverse bets and redirects them to other hardware initiatives, such as AI glasses and wearables, where they’ve got real momentum.

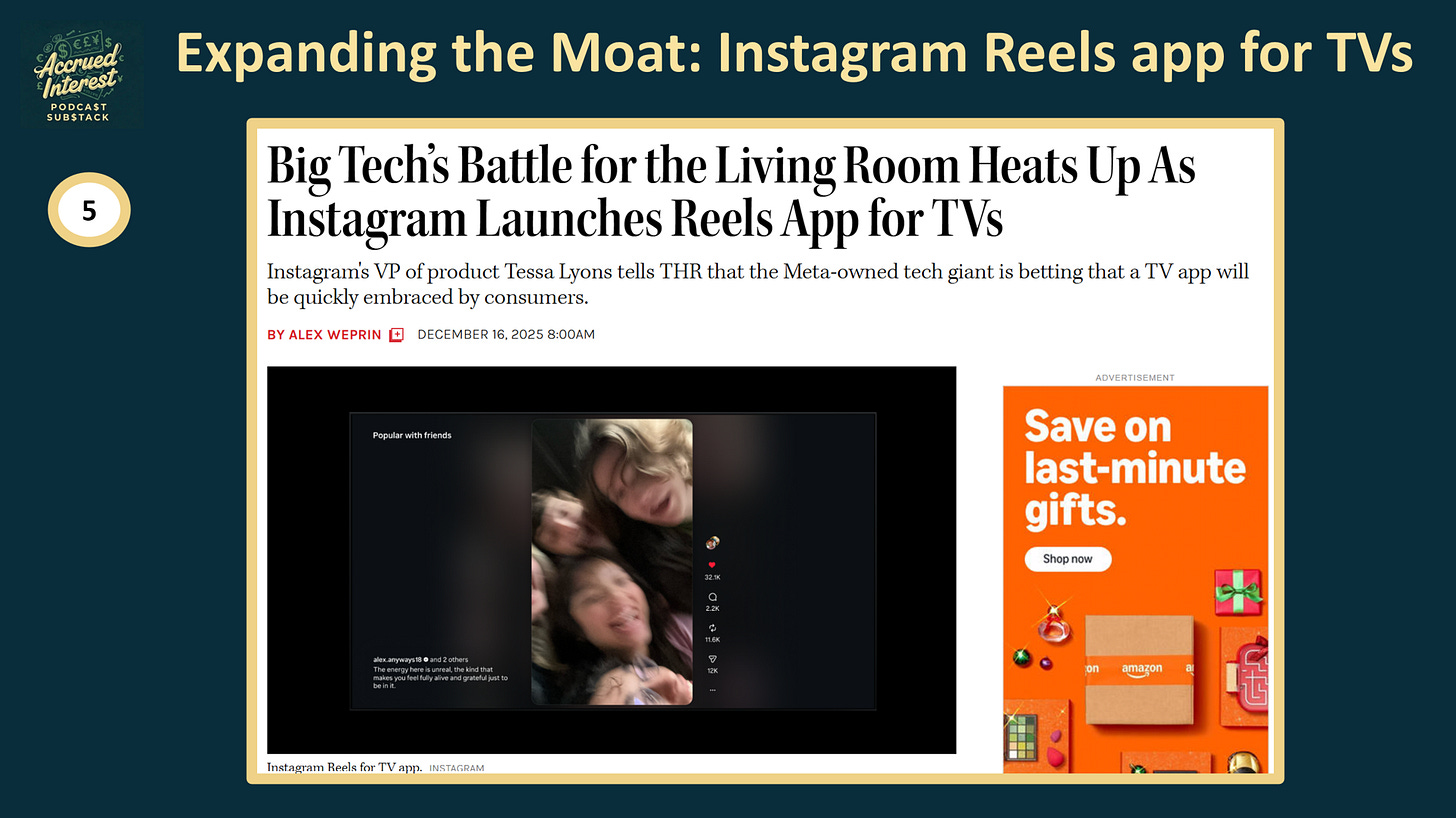

5. Expanding the Moat: Meta on Your TV

The launch of the Instagram Reels app for connected TVs (starting with Amazon Fire TV) demonstrates a strategy to aggressively enter the TV ad market.

This expansion aims to accelerate video monetization and convince advertisers to divert budgets from the declining linear television industry.

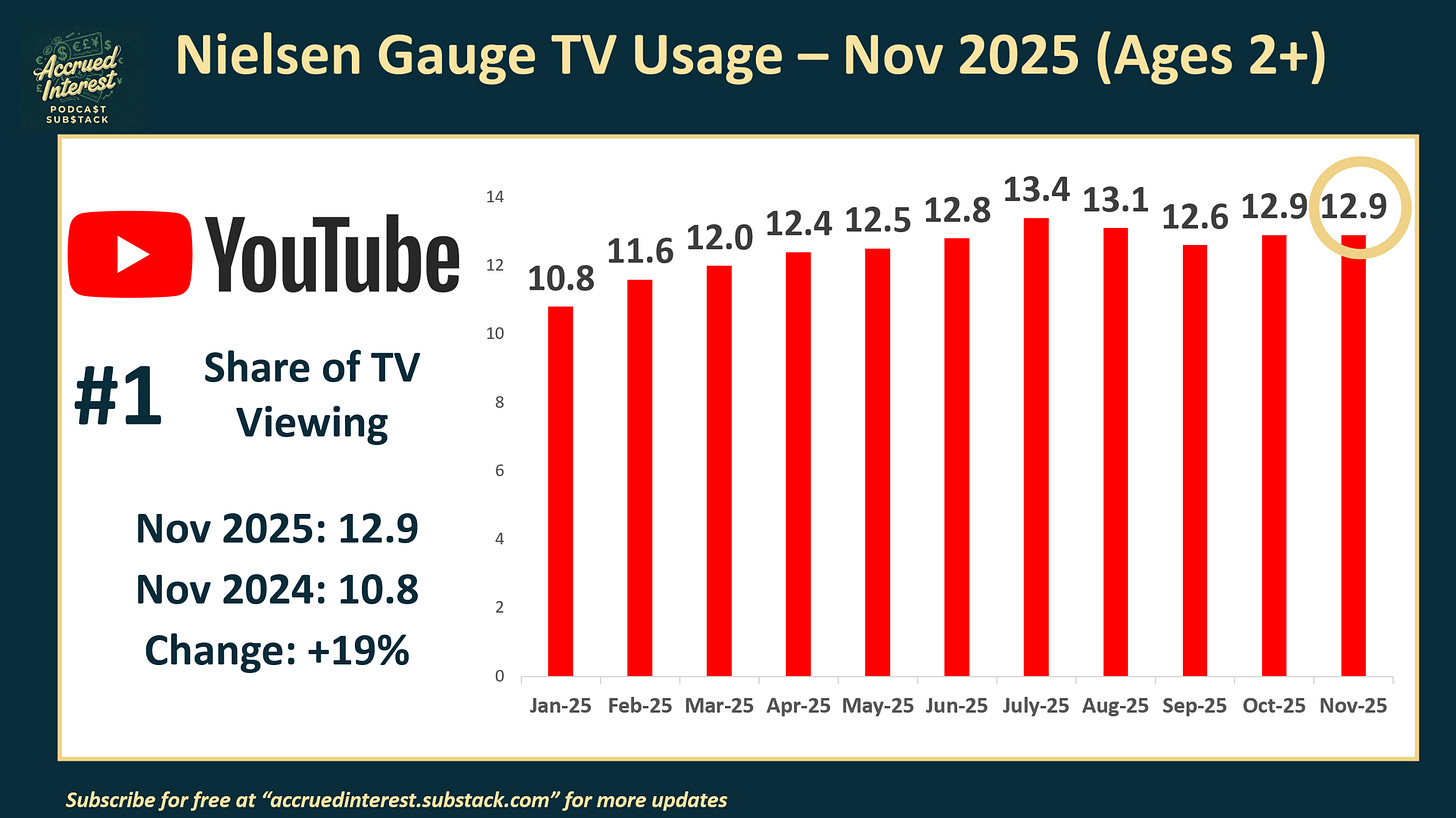

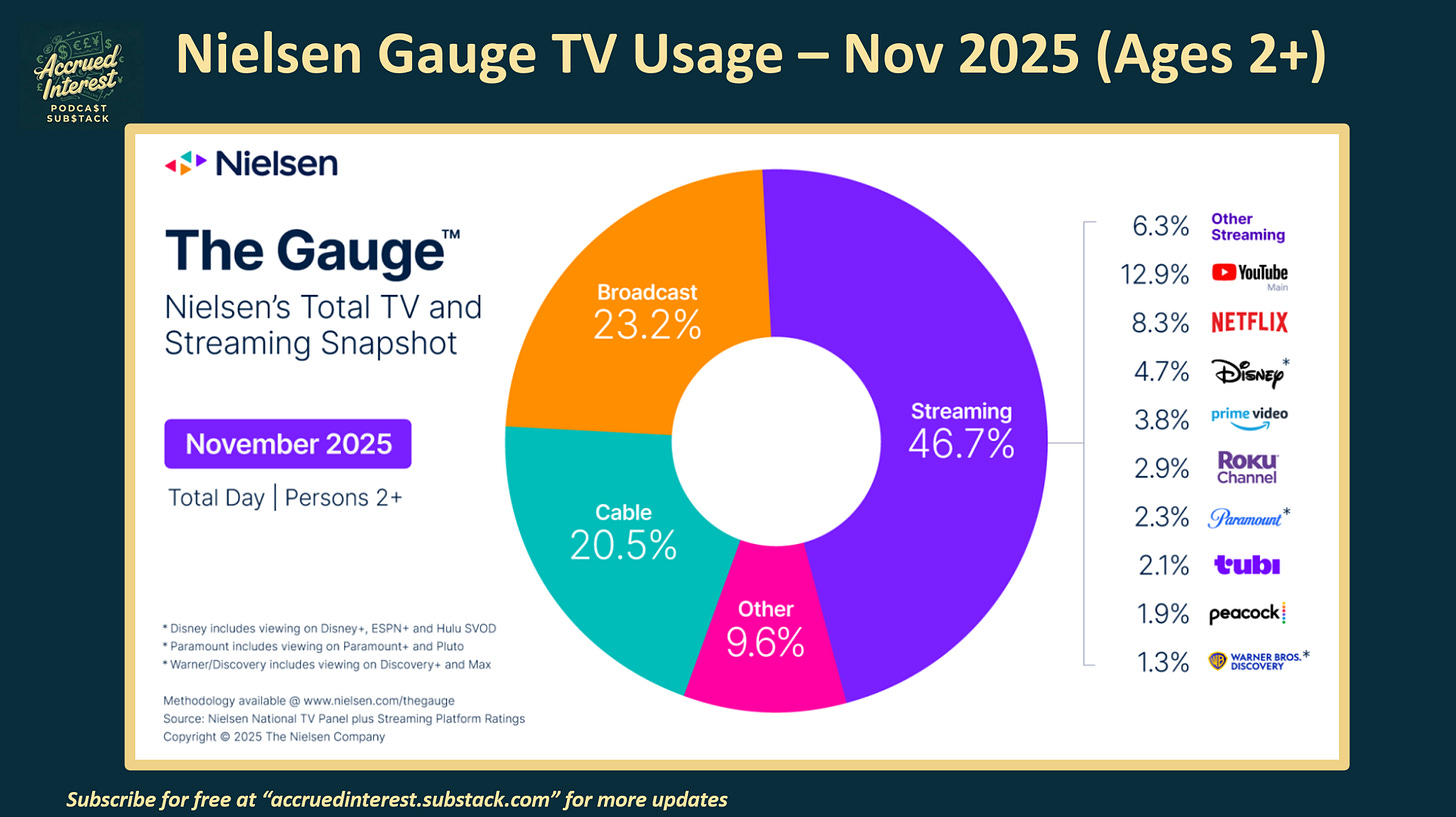

Subscribers would know that I have a monthly series where I have been chronicling YouTube’s takeover of big screen TV viewing all year. As of October, YouTube accounted for almost 13% of big screen viewing in the U.S.

YouTube’s second closest competitor is another streamer, NFLX 0.00%↑ , with approx. 8% of viewing.

According to Nielsen’s TV November 2025 Gauge report, streaming accounts for almost 50% of viewing today. It is reasonable that Meta believes it can win a piece of this market.

6. Meta Threads is Rapidly Scaling

Threads has rapidly scaled, hitting 150 million daily actives in Q3 2025, with ranking optimizations driving a 10% increase in time spent in the quarter.

Monetization on Threads has begun globally, providing a fresh, rapidly growing, albeit currently low-supply, impression inventory set for future revenue growth.

CONCLUSION

Meta is, without a doubt, a dominant company, but its stock has recently been sold off, dropping from all-time highs near $800 to around $650 today. This sell-off has contracted its forward earnings multiple while earnings forecasts have stayed strong.

What truly captured my attention, however, is the valuation. Based on analyst consensus estimates, Meta is currently trading at approximately 20x its 2027 GAAP EPS. This is notable when compared to Google, which trades at about 24x —a premium that is typically reversed between the two companies.

I anticipate Meta’s strengths in AI will become fully apparent by 2027. Therefore, I am ignoring the doubters and recommending Meta for 2026.

If you found this interesting, do not forget to subscribe. And please come back for Day 6 of Accrued Interest’s 12 Days of Pitch-Mas! You can find prior days here: Day 4 NXST 0.00%↑ , Day 3 GOOGL -3.52%↓ , Day 2 PSKY -1.96%↓ , and Day 1 NFLX -0.80%↓ .

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.