Why Netflix Should Acquire Warner Bros. ($NFLX & $WBD)

12 Days of Pitch-Mas Day 1

While Hollywood loves to talk in hyperbole, Netflix & Warner Bros. would be the rare deal that truly reshapes the industry. The media landscape is still too fragmented, with too many streaming services leaving consumers to question how the status quo is better than cable. By combining one of the industry’s top distributors with one of its premier content libraries, Netflix can solve this fragmentation while securing its next phase of growth for its ad supported tier. Netflix is uniquely positioned as the “best buyer” for these assets. Unlike Comcast or Paramount, Netflix does not already own a major studio, minimizing redundant layoffs compared to other potential mergers. For the 1st Day of Pitch-Mas, I am pitching Netflix as an Outperform.

Here are 5 reasons why Netflix + Warner Bros. makes strategic sense.

1. Unmatched Content Monetization via the “Netflix Effect”

Netflix , NFLX 0.00%↑ possesses the most powerful distribution platform in the world, capable of generating higher viewership for content than any competitor.

The “Netflix Effect” has been proven to revitalize linear TV hits like Suits and The Office and turn films like KPop: Demon Hunters into global phenomena. WBD’s library has been underexploited due to recent corporate difficulties and would see an immediate valuation increase under the “Netflix machine”.

Superior Audience Discovery: Netflix can monetize WBD’s film and TV assets better than any other company on the planet through its world-class recommendation engine and the marketing power of its homepage.

Revitalizing Legacy IP: Shows that were originally on linear TV often only become massive pop-culture phenomena once they hit Netflix (e.g., Suits, The Office, Friends).

Amplifying Movies: Films often become much bigger hits on the platform than they would have in theaters, such as Sony’s KPop: Demon Hunters.

2. Immediate Global Infrastructure for WBD Franchises

WBD is currently years away from full global distribution, with HBO Max not scheduled to launch in much of Western Europe until 2026. This deal allows WBD 0.00%↑ content—including the upcoming Harry Potter series—to instantly “plug in” to Netflix’s existing infrastructure, which is already broadcast in over 190 countries.

Global Reach: Unlike HBO Max, which is not yet available in many territories such as much of Europe, Netflix already broadcasts in hundreds of countries, second only to YouTube.

Efficiency: Netflix would not need to spend time or marketing dollars introducing the HBO brand as a standalone service.

Franchise Launches: The platform allows for instant global launches for major upcoming IP, such as the Harry Potter television series currently in development at HBO and current tentpole hits such as House of the Dragon.

3. Fueling the Ad-Supported Growth Engine

With the introduction of an advertising tier in 2022, Netflix’s strategic goal has shifted from pure subscriber acquisition to maximizing time spent on the service.

Watch Time: WBD’s massive content library helps increase overall watch time.

Consumer Preference: Growth in ad-supported streaming proves that consumers prefer free content and are willing to tolerate ads, making a deep library essential.

4. Regulatory Viability and Market Concentration

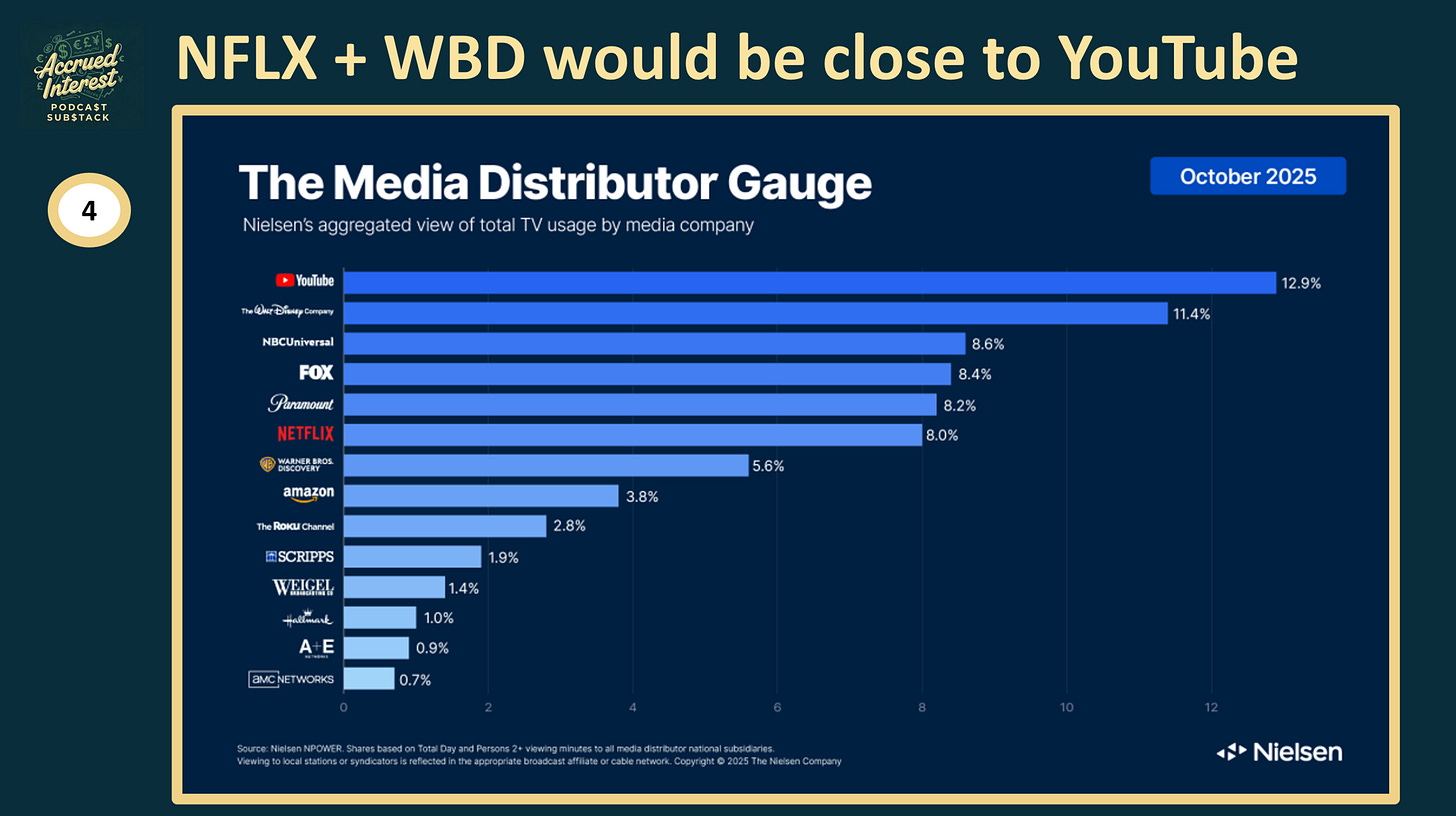

Concerns regarding a monopoly are based on outdated market definitions that exclude YouTube. When viewing the streaming market holistically, a combined Netflix/WBD (approx. 13.6% TV viewing share as of Oct-2025) would essentially equal YouTube’s standalone share (12.9%). Furthermore, because Netflix has 0% market share in movie theaters, this deal would not negatively impact theatrical competition.

YouTube: The combination would not be a monopoly because even combined (Netflix at 8% + WBD at 5.6%), their TV viewing share (13.6%) is comparable to YouTube (12.9%).

No Theatrical Monopoly: This may be counterintuitive to some people, but NFLX buying WBD would NOT impact theatrical market share. Unlike PSKY, Netflix does not release movies in theaters. NFLX said they would continue to release WB movies in theatres, but only in a way that makes economic sense.

Labor Advantages: Unlike a potential merger with Comcast, CMCSA 0.00%↑ or Paramount PSKY 0.00%↑ , Netflix does not already own a major studio, meaning there would be less redundancy and fewer people fired.

5. Solving Consumer “Subscription Fatigue”

Over the weekend I saw many movie fans on the internet lamenting how NFLX was going to hammer the final coffin into the shrinking theatrical industry. However, data confirms that consumers prefer watching general entertainment on demand at home, reserving theatrical visits for “event” films and major franchises. This acquisition aligns with that habit, offering a centralized location for premium content while allowing them to optimize theatrical windows in ways consumers have requested for decades.

Simplification: Consumers have complained for years about “too many streaming services” and the hassle of signing into multiple apps. This deal reshapes the industry according to what consumers are asking for—centralized content.

Evolving Theatrical Windows: Netflix can adjust theatrical release windows to match consumer desires.

Consumer Choice: Subscribers to Accrued Interest would note I have been covering the fact that YouTube is the true giant in the streaming space all year. Please see my archives where I have been sharing each month YT has been taking more watch-time away from linear TV networks.

CONCLUSION

This M&A opportunity represents an opportunistic purchase for Netflix, securing a legendary studio while avoiding the liabilities of struggling cable networks.

The deal achieves three main goals: stabilizing the industry, creating a formidable rival to YouTube, and delivering the streamlined consumer experience that market demand supports.

Like any good Hollywood blockbuster, this M&A saga will have some unexpected twists along the way! On the morning of December 8th, Paramount launched a hostile bid to acquire Warner Bros. Discovery. I expect all parties to fully exhaust their legal options - which means I would not expect a winner to be announced until 2027 at the earliest.

To kick off Pitch-Mas, I want to emphasize that Netflix is not only the BEST owner for WBD, but also the MOST likely company to win final approval. I plan to provide more extensive coverage on this deal and the major players throughout 2026.

If you found this interesting, don’t forget to subscribe. And please come back tomorrow, for Day 2 of Accrued Interest’s 12 Days of Pitch-Mas!

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

Really solid anaylsis on the regulatory angle here. The point about Netflix having zero theatrical market share is pretty clever when thinking about antitrust scrutiny compared to other potential buyers. What's intresting is how this also sidesteps the whole vertical integration concerns that killed ATT/Time Warner initially, since Netflix doesn't have the ISP distribution layer like Comcast does. Kinda makes the path to approval way smoother than most folks realize.

@theaiarchitects - Thank you for reading and subscribing! Agree on all your points. And extra credit to you for throwing in a throwback reference to the AT&T / Time Warner merger saga. I think investors are too myopically focused on the WANTS of the current U.S. administration that they are forgetting the lessons of history. In my post for Pitch-Mas Day #2 I will talk more about the regulatory risks here. Thanks for the comment.