Is Versant (VSNT) Cheap or Just Cheaply Valued? The Case for $27

Why investors should avoid the “value trap" until the company faces the 2028 cliff.

If you have been reading Accrued Interest for a while, you know I love a good spin-off. There is something intellectually satisfying about finding a misunderstood stock the market kicked to the curb.

So naturally, when Comcast announced they were spinning off Versant VSNT 0.00%↑ – a collection of cable networks including USA, CNBC, and MS NOW – my ears perked up. The stock has been hammered since its debut, down roughly -25% since it began trading. At first glance, it looks like a value investor’s dream: a company printing over $1 billion in Free Cash Flow, trading at a low single-digit EBITDA multiple, with a clean balance sheet.

But after spending the last week tearing apart the Form 10 and the 160-page investor deck, I have come to a different conclusion.

Versant isn’t just misunderstood; it’s a “melting ice cube” that is melting faster than the market realizes.

I am initiating coverage on Versant a with an Underperform rating. My price target is $22 - $27 per share, implying another -20-35% downside from today’s price of ~$33.50.

Now let me explain...

1. Versant is your classic “value trap”

The most frequent “Bull Case” I am seeing is simple: “The stock is too cheap.”

Bulls will point to the fact that the stock trades at ~5.1x 2025 estimated Enterprise Value to Free Cash Flow (EV/FCF). They will argue that even if the business declines, the earnings yield is so high (>20%) that you could make your money back in buybacks (or dividends) before the lights go out.

I disagree. The problem with “melting ice cube” stocks is that they always look cheap on trailing or current year numbers. But the market is a discounting mechanism, and right now, the market is failing to properly discount the structural cliff coming in ‘28.

The “Ghost of Future Past”: Why AMC Networks is the True Comp

To understand where Versant is going, we don’t need a crystal ball. We just need to look at AMC Networks ($AMCX).

Like Versant, AMC Networks is a collection of cable channels (AMC, WE tv, IFC) with some formerly “must-have” content (Walking Dead universe) but no broadcast network to protect it. (Sidenote: AMC Networks in 2025 expanded their deal to put even MORE of their newest shows on Netflix, if you want some foreshadowing on where the TV game is headed).

Today, AMC Networks trades at a distressed valuation because the market knows its leverage is high relative to its shrinking earnings power.

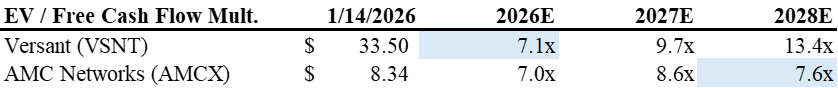

AMCX Current Valuation: ~7.6x 2028 Estimated EV/FCF

VSNT Current Valuation: ~7.1x 2026 Estimated EV/FCF.

My argument is simple: Versant is just AMC Networks with a 2 to 3 year delay.

Right now, Versant benefits from the “NBC Halo.” It still has 2 years of ad sales representation from NBCUniversal. It still has carriage deals that were negotiated when it was part of the Comcast bundle.

But in 2028, those protections vanish. Versant will be a standalone cable company negotiating against giants like YouTube TV and Charter without the leverage of Sunday Night Football or Peacock.

I do not think Mr. Market will reward Versant stock with multiple expansion until its post-2028 Ad sales situation is resolved.

2. Valuation not low enough given the earnings decline

Let’s do the math.

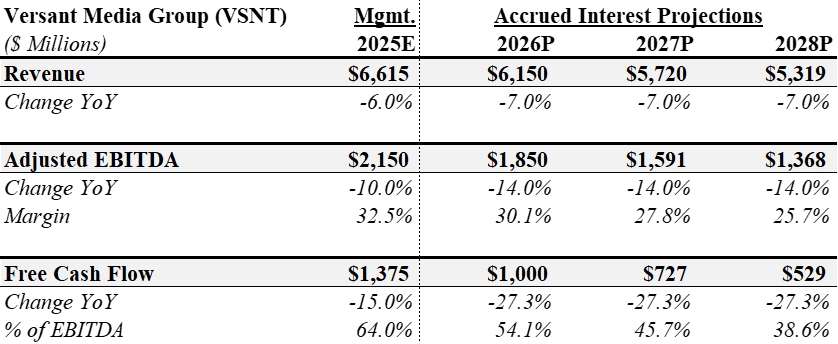

In my previous article (”Decoding the Versant Investor Deck“), I broke down the company’s guidance. Management is forecasting:

Revenue: -3% to -7% decline in 2026.

Free Cash Flow: -13% to -27% decline in 2026.

This is negative operating leverage in action. Because sports rights costs are fixed (and rising), small drops in revenue lead to massive drops in cash flow.

If we extrapolate this trend to 2027 and 2028—assuming the “NBC Halo” wears off and the decline stabilizes at -7% revenue / -27% FCF—here is what we get:

Now, let’s apply the AMC Networks EV/ FCF multiple (7.5x - 8.5x) to those future cash flows to find the fair value.

2027 Valuation Case: If Versant trades at 8.5x its 2027 FCF of $727M, the implied stock price is ~$27 per share.

2028 Valuation Case: If we look out to 2028, when FCF falls to ~$529M, an 8.5x multiple implies a stock price of ~$15 per share.

Even using the more generous 2027 numbers, the stock is worth roughly $27, which is ~20% lower than where it trades today.

This is why the stock screams “value trap.” You are buying a stock for $34 that is structurally destined to be worth $27 (or less) as its earnings power erodes. And VSNT cannot get a takeover offer until at least 2 years post-spin (2028), or else it would risk the tax-free status of the transaction to Comcast.

3. Three Reasons to Avoid Versant

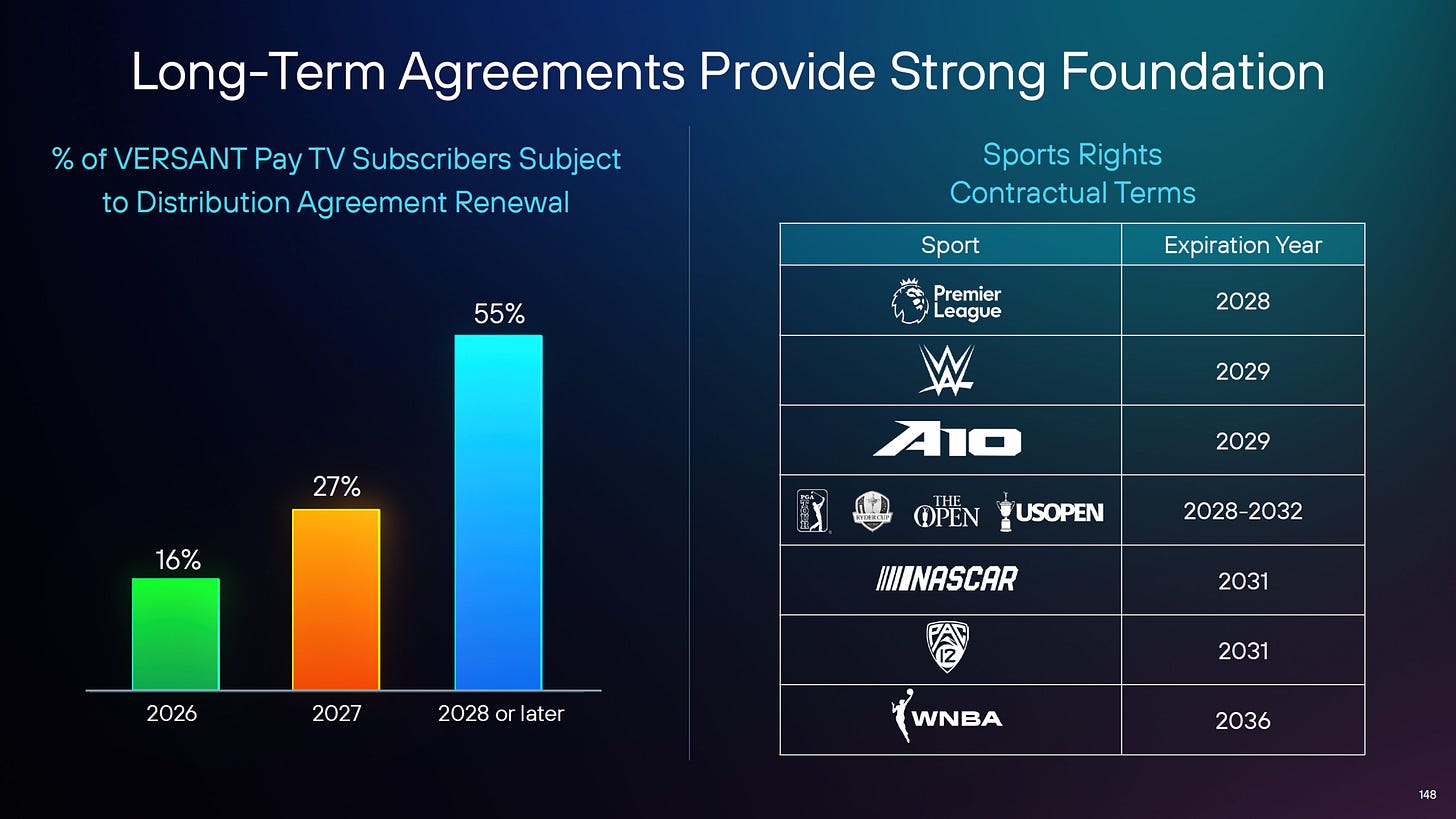

3A. The “2028 Cliff” is Real

The single biggest risk to this stock is the expiration of the NBCUniversal commercial agreements. Right now, Versant’s ad inventory is sold by NBCU. This allows them to package lower-tier networks (like Syfy or E!) with premium NBC broadcast inventory. In 2028, Versant’s sales team goes it alone.

Simultaneously, 55% of their carriage agreements expire in 2028 and beyond. Distributors like YouTube TV, Charter and DirecTV have been ruthless in dropping smaller cable networks. Without NBC to protect them, Versant will likely face a choice: accept massive fee cuts or get dropped from many cable bundle packages entirely.

As a rebuttal – the bulls would argue that Versant would have more strategic flexibility to pursue new digital distribution partnerships now they are not tied to NBC and Peacock. For example – VSNT could strike new deals to get expanded distribution through Roku or through Prime Video Channels. Or maybe some of the Discovery Global networks (the former Warner Bros. cable networks that Netflix is not buying) could partner with Versant to make new bundles/packages.

But by the time VSNT finally has strategic flexibility in 2 years, it will be too late to make a difference. I think YouTube TV, Netflix and social media more broadly will continue to steal away watch time from “traditional” television networks. The issue here is not distribution –audience tastes have changed and are not going back.

3B. Dividends and buybacks can’t save you

Value investors love a good dividend or free cash flow yield! Raymond James recently argued that a dividend is “sustainable at only about 20% of free cash flow.” But “sustainable” is a relative term when your denominator is shrinking by -27% a year.

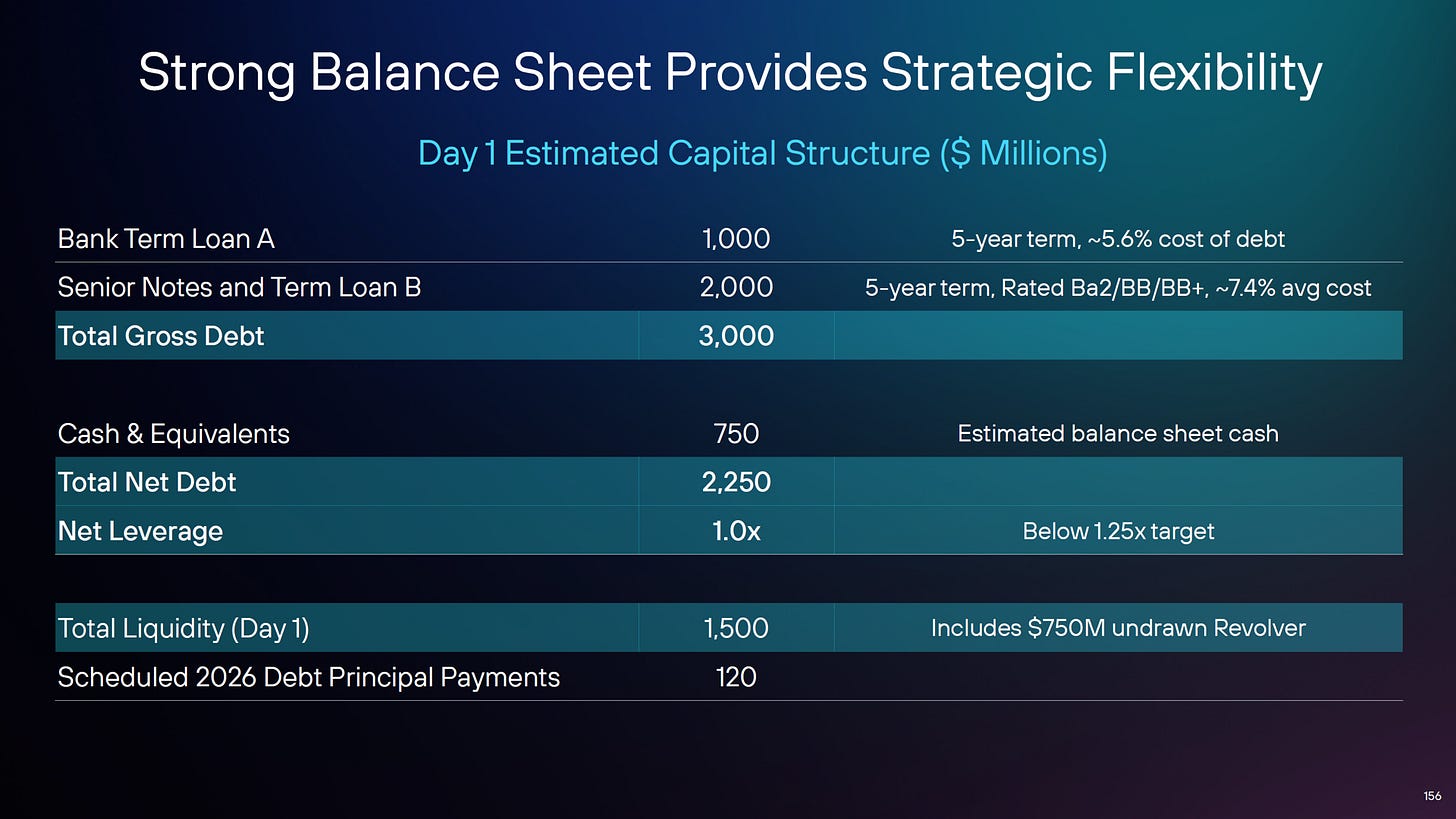

Also, Versant has ~$3.0 billion in total gross debt. While the maturities are pushed out to 2031, the interest expense is real (~$200M/year). As cash flow shrinks, that interest burden becomes a larger percentage of the pie, squeezing the cash available that could be returned to shareholders or reinvested in the business.

Management has been clear: their priority “disciplined organic and inorganic investments”, not just returning capital. Investors hoping for a massive buyback to prop up the stock are likely to be disappointed.

3C. “Rented” assets like sports rights are too expensive to maintain

Finally, we must look at the asset mix.

Versant owns some great assets: CNBC and GolfNow. These are niche, high-moat businesses that dominate their verticals.

But they are currently being used to subsidize a portfolio of “rented” viewership. The sports rights on USA Network (WWE, NASCAR, Premier League) are not assets Versant owns; they are leases they must renew every few years at higher prices.

In a world where Amazon, Netflix, and Apple are bidding up sports rights, Versant is bringing a knife to a gunfight. They will either lose the sports rights (killing their ratings) or overpay to keep them (killing their margins).

CONCLUSION

Don’t Catch the Knife!

I want to like Versant. There is a scenario where a Private Equity firm steps in, takes it private, and breaks it up—selling CNBC to another media company, the Golf assets to a sports company, and running the rest for cash. I will outline what I think is the best path to create value in Part 3 of this series on VSNT.

But as a public market investor today, you are not buying the breakup; you are buying the melting ice cube.

The market is currently pricing Versant as it can stabilize its cash flows in the next 1-2 years. My analysis suggests those cash flows are entering a period of structural decline that will re-rate the stock lower.

Recommendation – I expect VSNT to Underperform the S&P 500 in 2026. Let the stock find its floor. If it drifts down to into the $20s, the “breakup value” might become compelling enough to take a swing. But at $34? The risk is all to the downside.

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

You can always reach me at simeon@accruedint.com.

Solid write up. Agreed on this one. Maybe would take a pass if it gets into the teens.