AppLovin ($APP) Q4-25 Earnings Review: The "Cash Machine" vs. The Market Fear

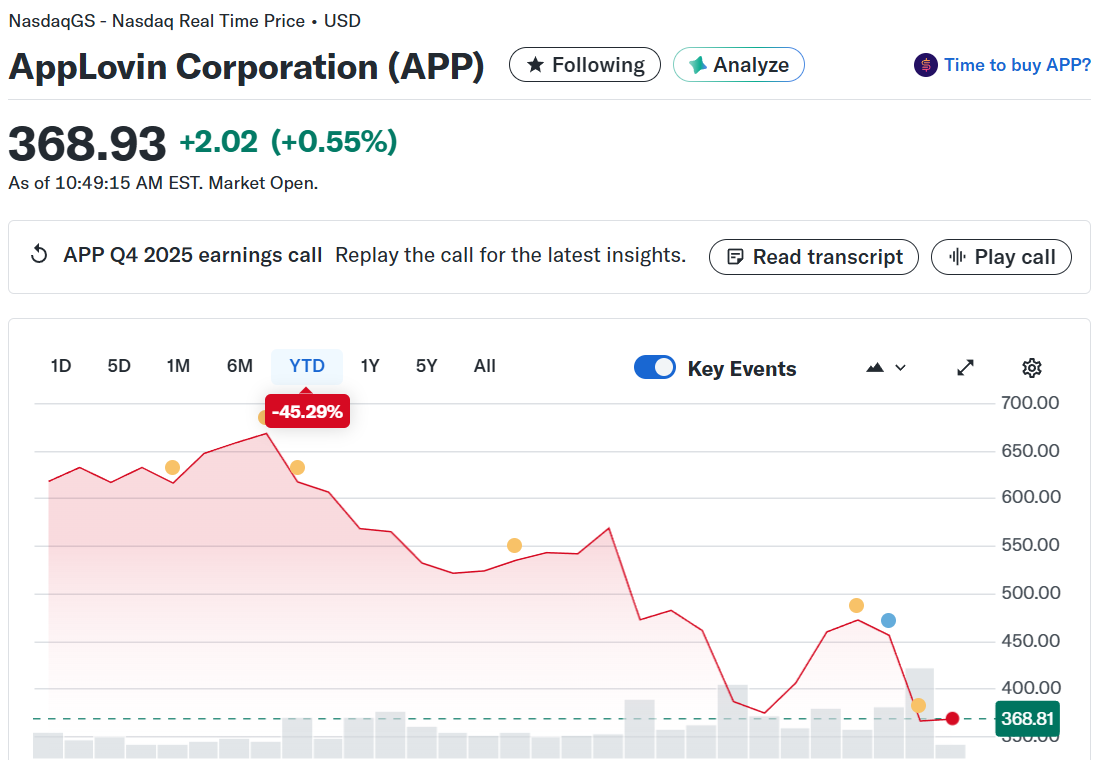

Why the -40% sell-off is a gift for value investors, and what the "Big Tech Capital Intensity" spread tells us about the future.

Accrued Interest TL/DR: AppLovin delivered a textbook “beat and raise” quarter, yet the stock is being punished due to broader ad-tech sentiment and fears over the “Meta Ceiling.” The disconnect between reality and price has rarely been wider.

While the market obsesses over “AI disruption” narratives, the financials tell a different story: AppLovin is printing cash with ~80% Free Cash Flow margins and 0.3% CapEx intensity—a stark contrast to the massive capital burdens of its Big Tech peers. Management is capitalizing on this volatility, having repurchased stock as high as $602/share in Q4, signaling immense conviction in intrinsic value. With the stock now trading at a ~40% discount to recent highs and ~25x 2026 earnings, investors are getting a “growth at a reasonable price” (GARP) opportunity in an asset-light compounder. The e-commerce rollout is deliberate, the AI tools are scaling, and the buyback engine is likely firing aggressively right now.

I recommend pairing this article with my pre-earnings write-up from Feb 5th – “AppLovin ($APP) Down -44% YTD: Fear vs. Fundamentals”.

Introduction

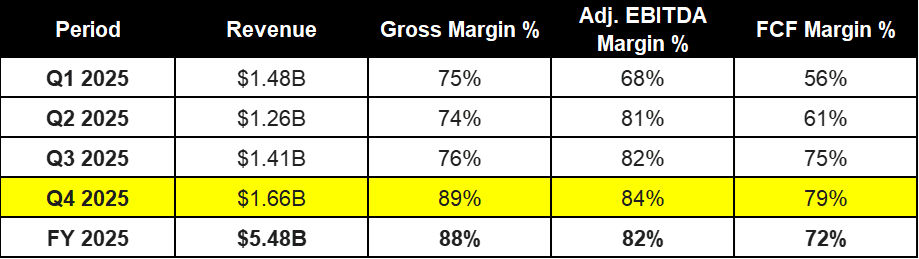

AppLovin reported Q4 earnings on Feb 11, 2026. The headline numbers were a “beat and raise” across the board:

● Revenue: $1.66B (Beat $1.61B consensus)

● EPS: $3.24 (Beat $2.96 consensus)

● Guidance: Strong, forecasting sequential growth in a seasonally weak Q1.

So why is the stock getting hammered? As I wrote last week in “AppLovin ($APP) Down -44% YTD: Fear vs. Fundamentals,” this stock is a “hedge fund hotel.” It is prone to wild momentum swings in both directions. We saw it rip from $370 to $470 on short-covering news, and now we are seeing it flush on valuation fears.

But there is a specific mechanical issue weighing on the stock right now: The “Meta Ceiling.”

The market is currently collapsing multiples across the entire ad-tech/software landscape. As I noted in my Meta Q4 2025 Recap earlier this week, when investors cut Meta’s multiple, they take AppLovin down with it.

Let us look at the math:

● Meta: Trading at ~22x 2026 earnings.

● AppLovin (~$370): Trading at ~25x 2026 earnings.

Right now, the market is telling us it is only willing to pay a tiny premium (+3x) for AppLovin over $META.

My Take: This is an overreaction. Paying 25x current year’s earnings for this level of growth and execution is a fantastic price. The market is skittish because the “e-commerce payoff” is a 2026/2027 story. Investors trying to model earnings 2 years out are seeing variability and choosing to compress the multiple today.

What’s Next? Management gave a TON of strategic detail on the call regarding the e-commerce rollout, AXON 2.0, and the competitive landscape with Big Tech. We are going to get into that, but I just wanted to remind everyone we are focused on the financials first.

After going through the Q4 earnings release and the transcript—here are the biggest takeaways I have following the quarter.

1. The “Capital Light” Miracle: Why AppLovin is Different from Big Tech

AppLovin’s financial metrics are fantastic. This company is such a unique combination of efficiency, high growth, profitability, and cash generation. Investors simply do not appreciate this when it trades at a market multiple.

On the call, CFO Matt Stumpf reminded everyone just how incredible their operating metrics are:

“AppLovin represents a combination that is exceedingly rare: sustained hyper-growth, exceptional margins, massive free cash flow generation, and disciplined capital returns. We believe this puts us in a category of our own and positions us to continue delivering outsized value for shareholders over the long term.”

$APP is getting thrown out with the Big Tech bathwater, but the market is missing a massive structural difference: Capital Intensity.

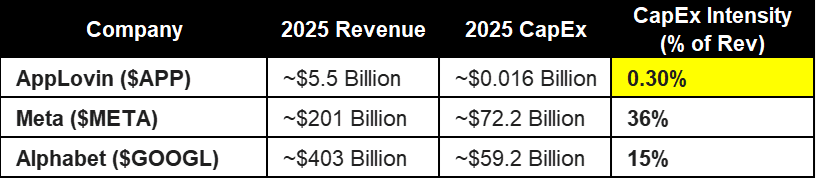

2025 Capital Intensity Comparison

While Big Tech is incinerating cash to build the AI infrastructure, AppLovin is simply riding the rails. I did the math on 2025 CapEx Intensity (CapEx / Revenue) to illustrate just how different these business models are:

● Meta: 36% (Building the tracks)

● Google: 15% (Playing catch up)

● AppLovin: 0.3% (Riding the train)

AppLovin is the asset-light way to play the AI supercycle. They get the growth without the bill.

Here is a double click on the detail for AppLovin—now that we have all four quarters. You can see the capital efficiency scaling in real-time. By Q4, CapEx was effectively a rounding error (<0.1%) against $1.66B in revenue.

AppLovin Quarterly CapEx Detail

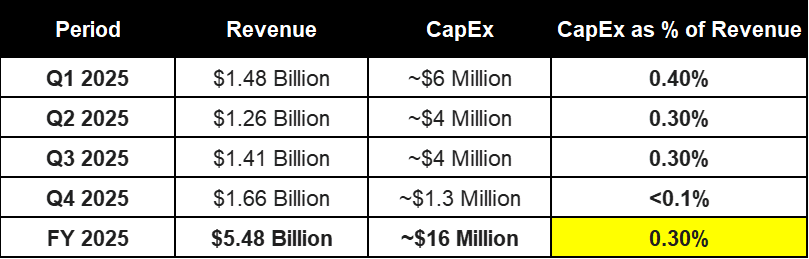

To further highlight the comparison—let us compare it to Meta (which I am also long).

I have seen a lot of sticker shock over $META’s 2025 capital expenditures. And looking at the chart below, I get it. Spending 36-38% of revenue on CapEx (and higher) is a staggeringly high number for a software/internet business.

Meta Quarterly CapEx Detail

So why am I still bullish on $META?

Because the receipts are in the revenue line. As I wrote in my Q4 recap, this is not “vanity spend.” This massive infrastructure build-out is directly accelerating revenue growth. The AI improvements in ad targeting and content recommendation (Reels) are converting at a higher rate than ever before.

The market is punishing Meta for the cost of the AI arms race while ignoring the payoff. At ~22x 2026 EPS, you are buying a company that is successfully pivoting to the next computing platform while still growing double-digits.

Now let me explain why I am using P/E for my argument here about how the market is treating Meta and AppLovin. I agree Free Cash Flow (FCF) matters the most, but FCF penalizes $META because they are in a heavy investment period (which I support!). I would rather use P/E multiples that look at normalized earnings because it is fairer and smooths out the massive capex spike.

Bottom line: I am long both $APP and $META. AppLovin has the stronger free cash flow profile and higher growth over the next two years, but it is hard to argue that $META is not the stronger business overall as the 800 lb. gorilla. $APP is too cheap, but investors are not going to bid it up while Meta is selling off.

But I am not going to complain—cheaper AppLovin shares make the buyback work harder.

2. The “Cash Machine”: Why AppLovin is a Free Cash Flow Monster

While the “Asset Light” argument is compelling, the real magic is in the conversion. It is not just that AppLovin spends less; it is that they keep more.

We can now paint a full picture of 2025 and drill into why AppLovin is converting nearly 80 cents of every dollar of revenue into free cash flow. This matters because when a stock is down and investors are skeptical of the strategy, very few do the real work to tear apart the financials and understand the money machine inside.

The “Money Machine” is Accelerating: Look at that FCF Margin expansion from 56% in Q1 to 79% in Q4. That is an absurd level of efficiency.

AppLovin (APP) 2025 Margin Analysis

Based on the financial reports, there are three primary drivers for this massive expansion:

1. Structural Shift: Divesting the Lower-Margin “Apps” Business

In Q2 2025, AppLovin completed the divestiture of its mobile gaming division. This segment historically had much lower margins compared to the Software Platform. By Q4, the company was operating as a “pure-play” ad-tech software platform. The revenue mix shifted entirely to high-margin software revenue (~90% gross margins). Without the heavy OPEX of game development studios, a significantly higher percentage of every revenue dollar flowed directly to the bottom line.

2. Timing of Interest Payments

There is a “hidden” driver here: bond payments. AppLovin’s debt structure requires semi-annual interest payments (Q2 and Q4).

● Q2: Dragged down to 61% by interest payments.

● Q3: Bounced to 75% with no interest payments.

● Q4: Despite having an interest payment, the sheer scale of revenue growth overpowered the cash outflow, keeping margins at an elite 79%.

3. Operating Leverage (The “Flow-Through” Effect)

Management highlighted that their AI models (AXON 2.0) are scaling revenue without requiring a linear increase in costs. They achieved a 95% flow-through rate in Q4. This means for every additional $100M in revenue they generated, ~$95M went straight to EBITDA.

The jump to 79% in Q4 proves the “pure-play” thesis is working.

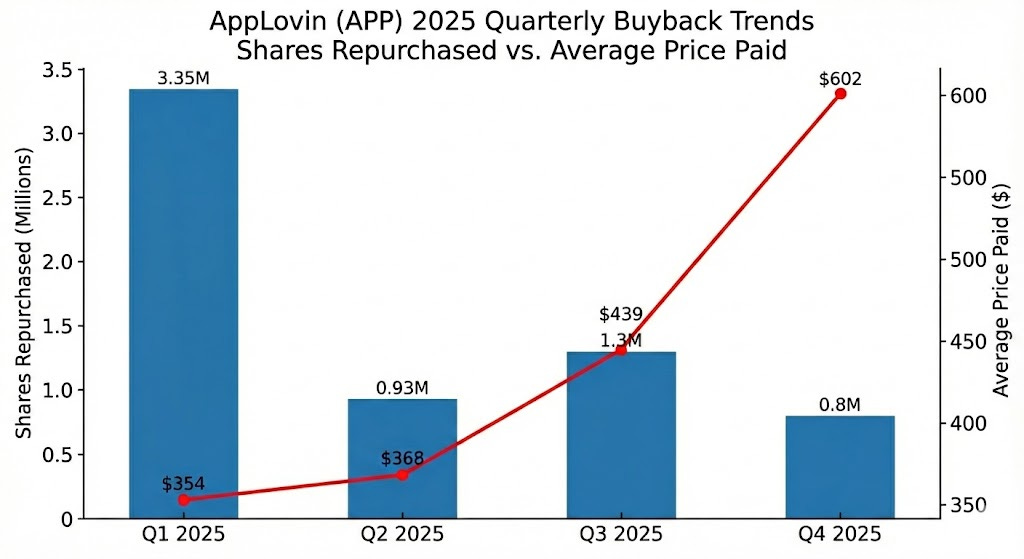

3. The Buyback Signal: Conviction at $602/Share

While the market obsesses over “AI disruption” fears and compresses the multiple, I have been updating my models to see what management is doing with their cash.

The chart below tells a story of both conviction and discipline.

Here is what we learned from the Q4 financials regarding the buyback machine:

The Conviction Signal ($602/share): In Q4, management repurchased ~800k shares at an average price of ~$602. Let that sink in. Just a few months ago, insiders were retiring shares at prices ~60% higher than where the stock trades today (mid-$300s). That is a massive vote of confidence in the intrinsic value of the business and the durability of the platform.

The Discipline (Smart Allocation): Notice the trend in volume vs. price.

Q1: When the stock was “cheap” (~$354), they aggressively retired 3.35 million shares.

Q4: When the stock ripped to all-time highs (~$602), they tapped the brakes, buying only 0.8 million shares.

This is exactly what you want to see. They are not blindly buying; they are price-sensitive capital allocators. They swing hard when the pitch is perfect and stay opportunistic when valuations stretch.

What This Means Now:

With the stock selling off post-earnings, we are trading at a massive discount to where management was just buying hand-over-fist. They have made it clear they intend to use their robust Free Cash Flow (which hit nearly 80% margin in Q4) to reduce share count.

With the earnings blackout over and the stock trading at a severe discount to their Q4 buyback price, I expect the buyback cannon to be firing aggressively right here. If they liked it at $602, they must love it here under $370 a share.

4. Key Quotes from the Call: Addressing the “Fear” Head-On

The CEO, Adam Foroughi, started off with one of the best introductions I have heard for a company whose stock price has been moving around as if they were in distress. We know many new investors are nervous about the share price, so he jumped right into it.

Adam Foroughi:

“I want to start by addressing what’s clearly on many people’s minds. While I prefer to ignore short-term fluctuations in the stock price and focus on maximizing value over the long term, the recent volatility warrants addressing. For the past few weeks, there’s been a lot of discussion about how AI and competition will challenge our business. But when I look at our internal dashboards, we are delivering the strongest operating performance in our history... There is a real disconnect between market sentiment and the reality of our business.”

The “Expanding Pie” vs. Zero-Sum Game

One of the key bearish arguments is that if Meta or Google get better, AppLovin loses. Foroughi dismantled this zero-sum thinking:

“Now in a typical zero-sum auction-based market, if one improves another loses. In our case, as bid density goes up, the pie expands. And while our share of the auction may shrink, our economics actually grow... When competition wins an impression, it’s very likely to be the one that we value less. This leads to the publisher making more. And in many cases, we do as well because instead of winning a low-value impression, we get to charge the winning bidder 5%.”

AI and the Content Explosion

Next, APP addressed the fear around AI Disruption when it comes to game creation. I mentioned this in my Q4-25 preview article “AppLovin ($APP) Down -44% YTD: Fear vs. Fundamentals”.

“The bearish view assumes that if AI makes games easier to build, the value of our ecosystem declines. Well, we believe the exact opposite. AI will dramatically lower the cost of creation, which means content will explode. And when content becomes abundant, discovery becomes a scarce resource... The winners will be the platforms that can efficiently match the right user to the right content at the right moment. That is exactly what our models are designed to do.”

This is a critical insight. If AI creates 10 million new apps, finding the good ones becomes the hardest problem on the internet. AppLovin sells the solution to that problem.

Sequential Growth in Q1

I thought it was incredibly bullish when they explained that they are seeing quarterly, sequential growth from Q4 to Q1 2026. In the ad industry, Q1 is typically the seasonally weakest quarter (the “post-holiday hangover”).

“Despite typical seasonality where Q1 should be softer than Q4, we are guiding to meaningful sequential growth. That reflects both continued strength in gaming and the scaling of our e-commerce and our self-service customers.”

5. The E-Commerce Rollout: Deliberate, Not Delayed

Investors are impatient. I can imagine that bears and perhaps some new investors thought that on Jan 1, AppLovin was going to flip a switch, turn on e-commerce, and the rest would be history.

But APP is being deliberate to weed out fraudulent actors and to make sure everything is the best it can be. The e-commerce rollout is going carefully—it is still not a full “GA” (General Availability) type launch where just anyone can sign up.

Adam Foroughi:

“So the e-commerce business obviously has been live with us for 1.5 years. It’s doing really well. In Q4, we opened up the self-service platform, referral only. So we’re not at the point yet where we’re sort of a GA type launch. We’ll get there. We said first half of this year, that’s still on track... What gets us excited are a couple of things. One is the current customers that had lapped Q4 2024 into Q4 2025 saw material increases in spend as our models just keep getting better.”

They are being incredibly careful. As I mentioned in my last article, the true growth engines are still on track to kick in late 2026 and full year 2027.

6. Generative AI: The Hidden TAM Expander

Part of the bull case that I believe many are missing is that AppLovin is testing generative AI tools that basically help create ad creative for customers. This is a huge, underappreciated part of the bull case. Meta has talked about this as well.

This expands the Total Addressable Market (TAM) by lowering the friction for non-gaming advertisers (who might not have big creative teams) to spend on the platform.

Adam Foroughi:

“More importantly, though, generative AI tools to build creatives in a really low-cost way in an automated way is on the way. We already have in a pilot with over 100 customers, generative AI-based tools for one part of the ad unit... We’re now generating those automatically for over 100 customers. We’ll roll that out soon as it’s showing good performance to the broader set of customers.”

“But if we get to a place where the video model can help these customers create new video ads in bulk in cost of dollars versus cost of thousands of dollars, we expect the count of ads for these new customers on our platform is going to go up a lot.”

This is huge! This can get new advertisers spending even more on the platform because it cuts down on the friction and the cost of trial and error.

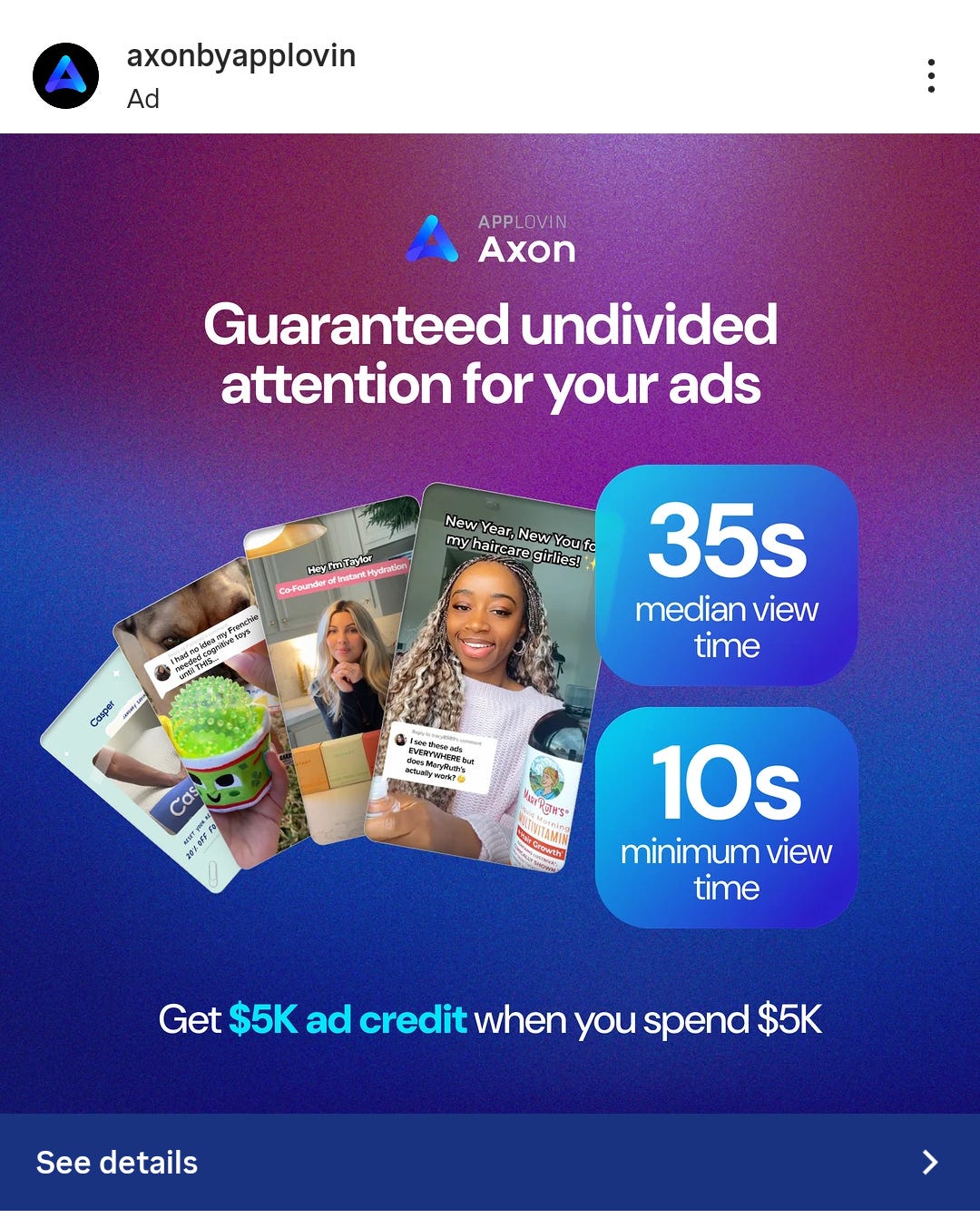

AppLovin Marketing Itself?

Another fascinating tidbit: AppLovin is finally spending money to market itself. They said before they never did marketing, and now that changes. I have seen their ads all over Instagram and Facebook, leading with the AXON branding (so they do not have to worry about scaring away customers with the “AppLovin” gaming name).

“But if we start actually being able to market our platform and get customers to convert through the funnel, that’s going to help us really catalyze faster growth to go get advertisers in the absence of a sales team.”

7. The “Frenemy” Dynamic: Meta and MAX

AppLovin did an excellent job explaining that they can still win and succeed even if Meta gets more involved in gaming.

Adam Foroughi:

“So the Meta thing, Meta was a launch partner of MAX. They’re a good partner. They’ve been in the MAX platform for a long time... They are a bidder on anything that has an ID today... They did not start bidding on no ID traffic, and they might very well bid on no ID traffic in the next couple of quarters.”

Essentially, if Meta bids more, bid density goes up, and yields go up for everyone (including AppLovin’s software tax).

However, we cannot ignore the 800lb gorilla in the room. While management’s comments are reassuring, Meta remains the most credible threat to AppLovin’s long-term success. Given Meta’s sheer size, scale, and almost unlimited resources, we have to remain vigilant. If Meta were to shift its strategy to become more adversarial, for example, aggressively bidding to commoditize the auctions or attempting to bypass mediators entirely—it could negatively impact AppLovin.

While the current relationship is symbiotic (a “frenemy” dynamic where both benefit from a larger pie), this is a risk factor that we cannot simply rule out. It requires constant monitoring in 2026. For now, they are co-existing profitably, but as AppLovin moves deeper into e-commerce, that collision course with Meta becomes more direct.

CONCLUSION

Sell-offs are difficult. Watching a stock drop 40% when the fundamentals are improving is a test of conviction. But I am going to stick to my value investing principles.

I will leave you with what might be one of my favorite quotes I have heard a CEO say after his stock has fallen.

Adam Foroughi:

“If the market chooses to price our stock based on fear, while we continue to compound revenue, cash flow and product capability, we’ll stay focused on execution and let our results speak over time.”

From where we sit, we are still in the early innings of what this platform can be.

-Accrued Interest

Relevant Tickers: APP 0.00%↑ , META 0.00%↑ , GOOGL 0.00%↑ GOOG 0.00%↑

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

You can always reach me at simeon@accruedint.com.