Meta Q4 2025 Recap

The $META AI Engine is Roaring

Accrued Interest TL/DR: Meta, META 0.00%↑ posted a massive Q4 beat with revenue growing +24% year-over-year, yet the stock remains effectively flat YTD as the market fixates on the staggering $135B Capex guide. This is a classic valuation disconnect. In this article, I argue that Meta is a growth stock trading at a value multiple (22x 2026 EPS) and that the “Capex shock” ignores the clear ROI already showing up in the data. My thesis rests on three pillars: 1) AI is driving a +18% acceleration in ad impressions (the cleanest signal of ROI); 2) Meta has multiple ways to grow organically beyond just Facebook and Instagram, specifically through the monetization of WhatsApp (via agentic commerce), the adoption of Meta Verified, and new AI-native tools that lower the barrier for advertisers; and 3) Reality Labs losses are peaking while core operating margins remain distinctively robust at 49%. I am maintaining my OUTPERFORM rating.

Introduction

If you read my Day 5 of Pitch-Mas article back in December, you know I pounded the table on Meta. My argument was simple: ignore the noise about spending and focus on the ROI.

On January 28, Mark Zuckerberg delivered Q4 2025 earnings that did not just prove the thesis—it smashed it.

Meta reported $59.9 billion in revenue (+24% YoY) and $8.88 in EPS, beating estimates across the board. But the real story is not the beat; it’s the valuation disconnect.

A Growth Stock Trading Like Value

Meta is a growth stock trading like a value stock that the market has been underestimating. While other tech names have seen their stock prices rally in the past week, Meta’s stock has been left behind.

With the current price of $670, the stock is basically flat YTD and it is down mid-single digits over the past year.

Let’s look at the multiples:

Meta is trading at 22x 2026 consensus EPS of $30.

It is trading at 19x 2027 EPS of $35.

A company as dominant as Meta should not be trading at a discount to the market.

Meta’s valuation makes no sense right now because the discount screams “uncertainty,” yet we have mounting evidence that the company’s AI investments are clearly paying off in the form of improved ad impression growth.

Here is my deep-dive recap of why Meta’s Q4 indicates it will outperform in 2026.

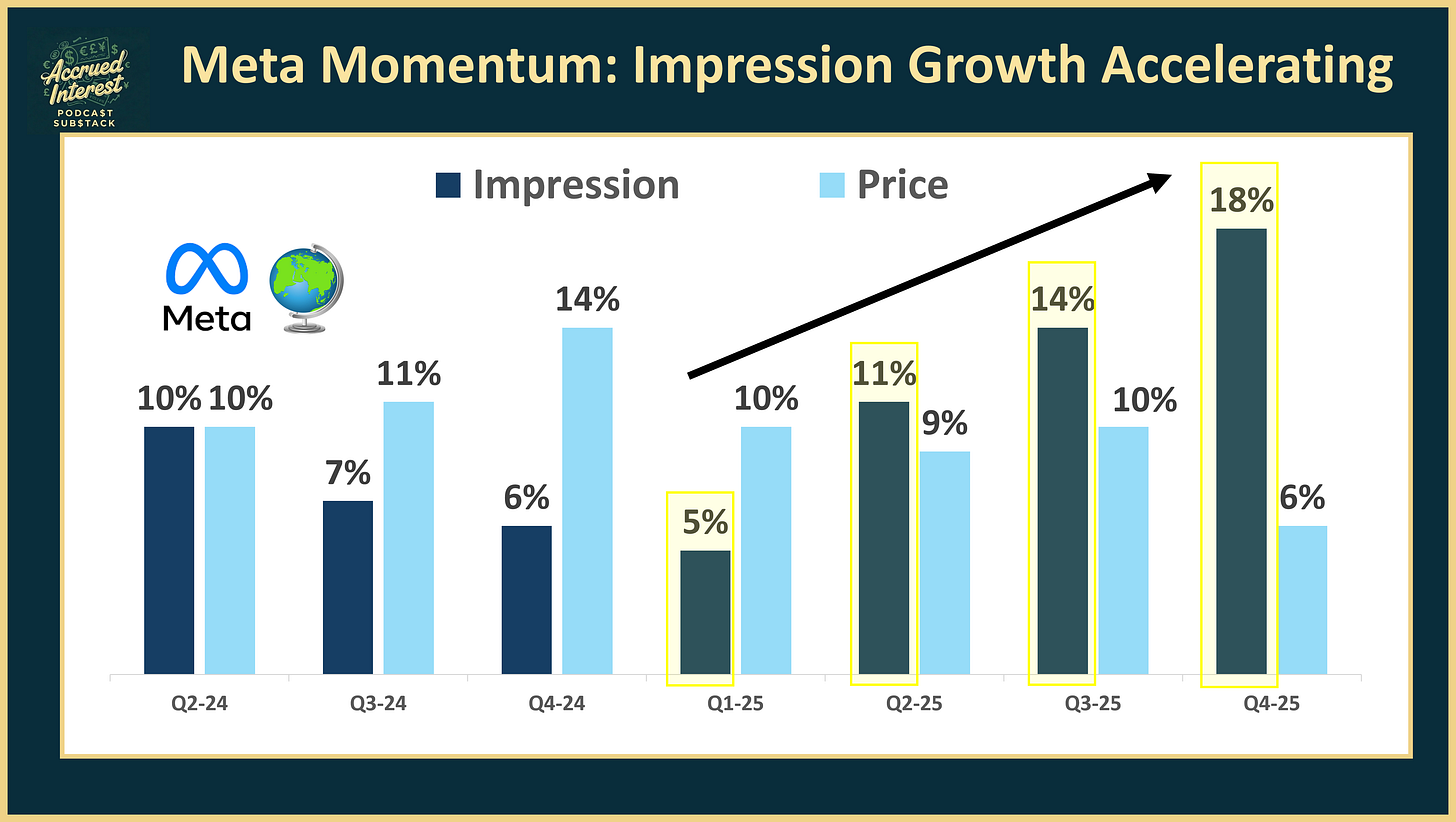

1. The Cleanest Signal in Tech: Ad Impressions +18% YoY

The most critical metric in this entire report was ad impression growth of +18% year-over-year.

For quarters, skeptics have asked, “Where is the return on all this AI spending?” Here it is. The trendline shows a clear acceleration as Meta successfully merges Large Language Models (LLMs) with its recommendation engines:

● Q1 2025: +5% YoY

● Q2 2025: +11% YoY

● Q3 2025: +14% YoY

● Q4 2025: +18% YoY

Why does this matter? Because this is the “AI ROI” in action. AI is turbocharging the core business by creating an algorithmic feed that is smarter, stickier, and serves you exactly what you want to see. This increases the surface area for ads, totally separate from Zuckerberg’s sci-fi “superintelligence” goals.

Even if you strip away the futuristic hype, the core ad machine is accelerating because AI is making the product better right now.

2. Meta Continues to Grow Revenue at Scale

It is incredibly impressive that a company of this size is still growing revenue at 24% year-over-year.

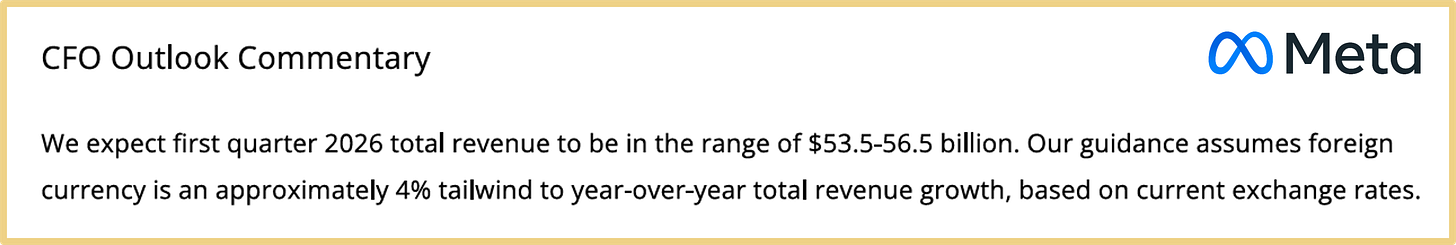

Based on the Q4 2025 earnings release and conference call, management provided robust guidance for the first quarter of 2026. Meta expects Q1 2026 total revenue to be in the range of $53.5 billion to $56.5 billion, which includes an expected foreign exchange tailwind of 4%.

When you compare this to Q1 2025, the implied growth rate is staggering for a company of this scale:

● Low End: +26% YoY

● High End: +34% YoY

● Midpoint: +30% YoY

This guidance reinforces that the revenue acceleration we saw in late 2025 is not a fluke—it is the new baseline.

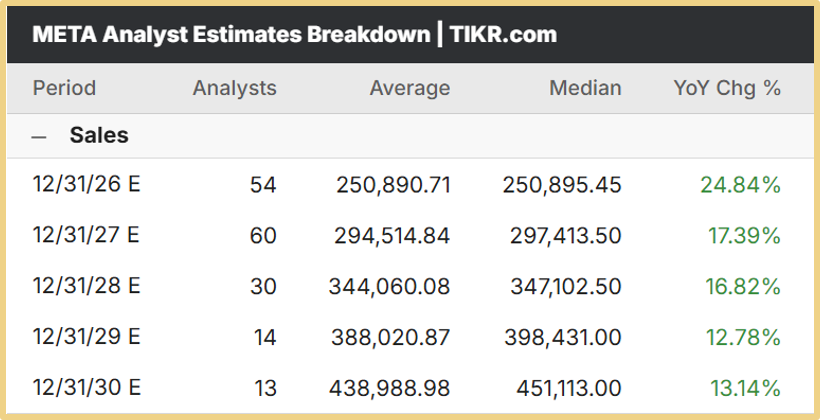

Interestingly, despite this clear guidance, the sell-side consensus seems to be playing catch-up. Current analyst estimates project revenue growth of +25% for 2026, but then a sharp deceleration to +17% in 2027.

Given the momentum we are seeing in ad impressions and the new monetization levers I will discuss below, the street is significantly underestimating the durability of this growth. If Meta is guiding to ~30% growth right now, assuming a drop to 17% next year feels overly conservative, especially as their AI tools mature.

See the table below for context on current analyst estimates as of Feb-10-2026:

While the ad engine is the main driver (with average price per ad up 6%), we are finally seeing the “Family of Apps Other” line item wake up. This segment hit roughly $801 million in Q4, growing significantly as they monetize messaging and subscriptions.

The WhatsApp Unlock

WhatsApp has been a sleeping giant for a decade, but 2026 looks like the year it fully wakes up. Meta is aggressively rolling out “Business AIs” and “agentic shopping tools“ that allow users to find products and transact directly within the app. With over 1 billion active threads between users and businesses, enabling automated AI agents to manage sales and customer support transforms WhatsApp from a messaging app into a global commerce engine.

Automated Ad Creation

Meta is also removing friction for advertisers. The company is deploying AI-native tooling to fully automate ad creative—generating video and static assets from simple text prompts. This lowers the barrier to entry, allowing millions of small businesses (and creators) to advertise without needing a design team.

Meta Verified

As a content creator, I have seen this shift firsthand. White-collar workers transitioning careers are flocking to Instagram to build personal brands, and paying for the “blue check” via Meta Verified is now a standard business expense to signal legitimacy.

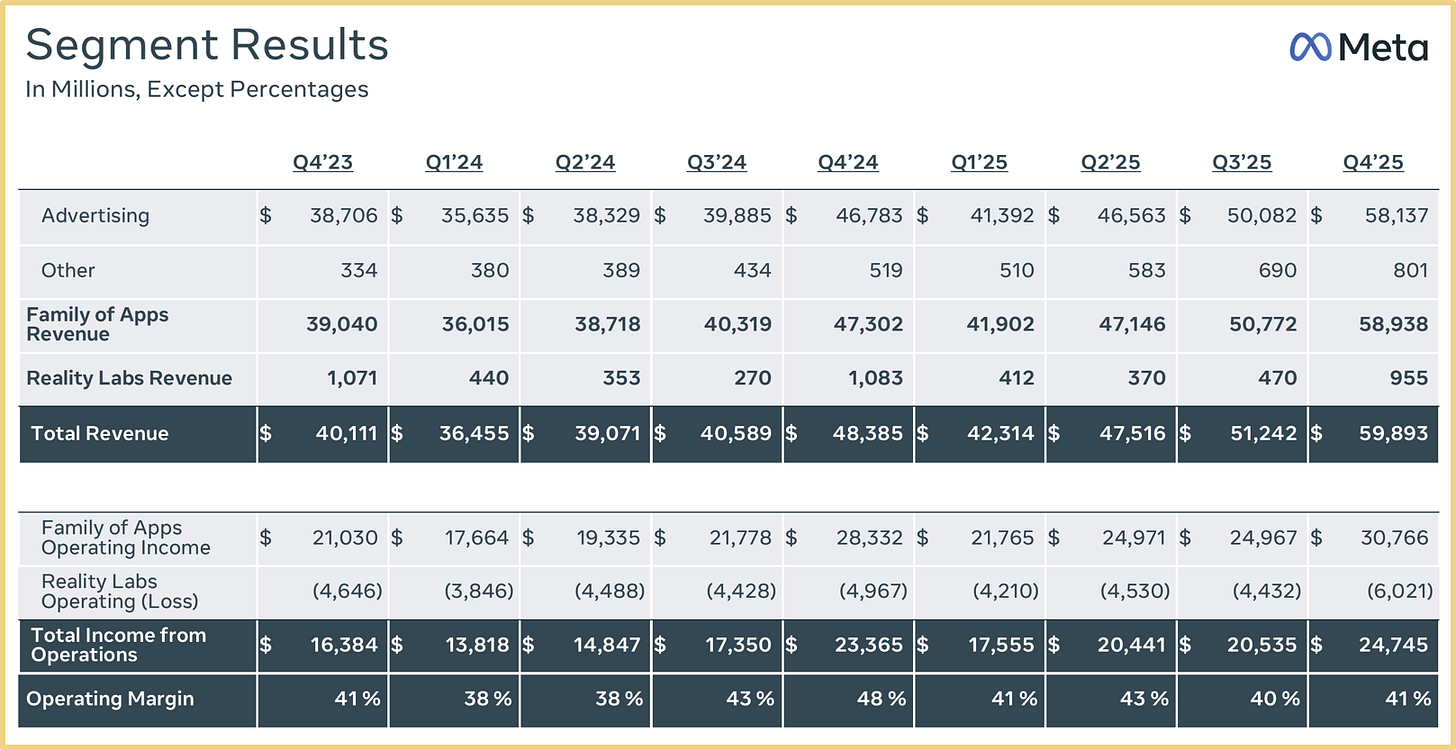

3. Operating Profits are Still Growing

Despite the fear-mongering about spending, Meta made it clear that operating income is expected to grow in 2026. This tells us that management is prioritizing profitable growth, not just growth at all costs.

Look at the profitability of the core business (Family of Apps) versus the total company:

Q4 2025 - Family of Apps Operating Income: $28.9 Billion (49% Margin)

Q4 2025 - Total Company Operating Income: $24.7 Billion (41% Margin)

Historically, these margins have remained robust even as Capex ramps up. In Q3 2025, Total Operating Income was $20.5 billion (40% margin). The jump to $24.7 billion in Q4 shows the immense leverage in this model.

The takeaway? Meta can fund its record-breaking AI investment while still maintaining operating margins in the 40s. That is a luxury almost no other company in the world possesses.

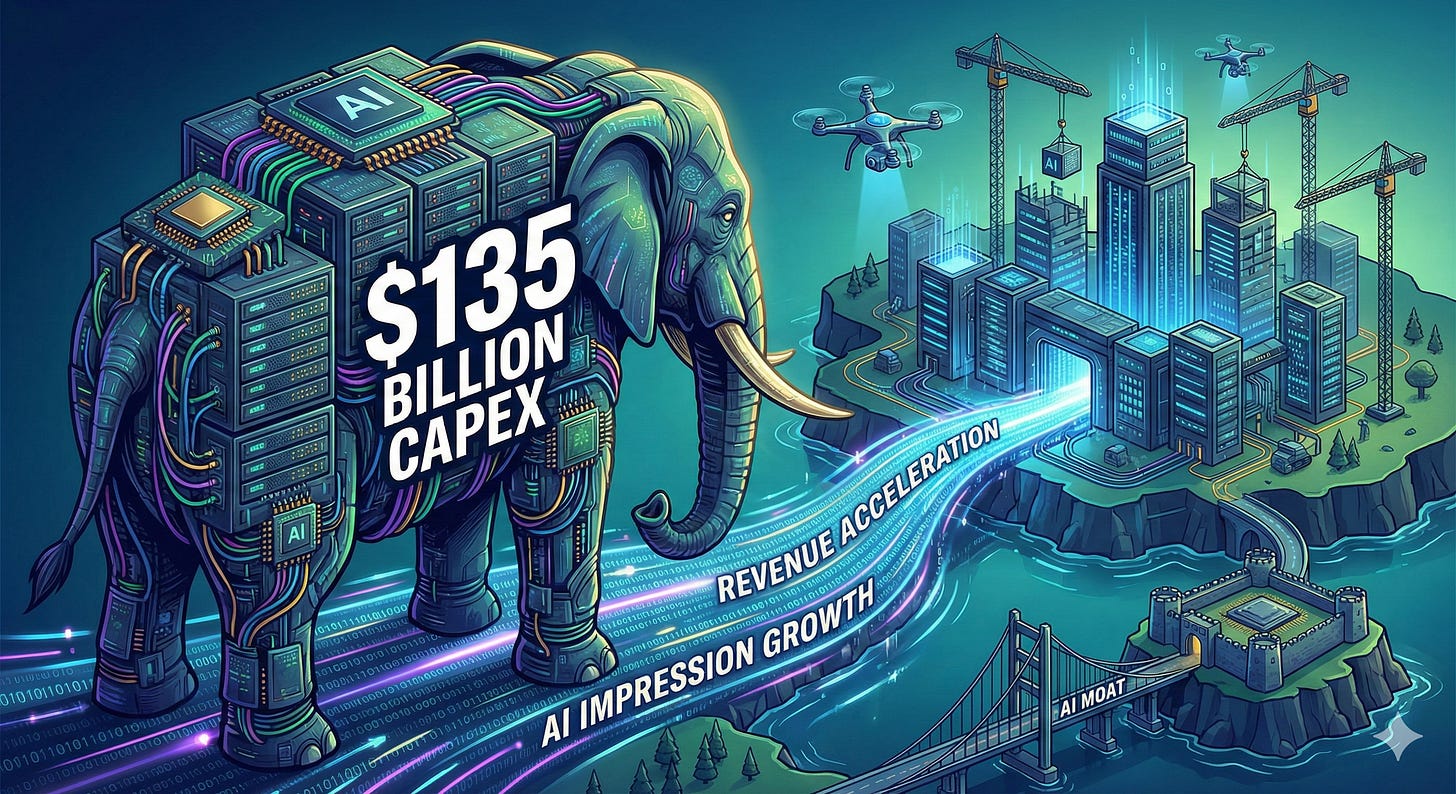

4. Address the Elephant: That $135 Billion Capex Guide

Let us address the number that freaked out the market: $115 billion to $135 billion in Capex for 2026.

Yes, it is a staggering amount of money—nearly double the ~$72 billion spent in 2025. The bearish argument is simple: if the economy slows, Meta is stuck with massive depreciation anchors.

But recall my argument from Dec: Meta is creating a moat that no one else can cross.

Zuckerberg was clear: this spend is to build out “Meta Superintelligence Labs” and to “front-load” capacity. More importantly, as we saw with the +18% impression growth, it is working. The revenue upside from these AI tools is already offsetting the costs.

5. Reality Labs: The “Black Hole” is Shrinking

For years, Reality Labs has been the stick bears use to beat this stock. The division posted another operating loss of ~$6 billion in Q4.

However, on the call, Zuckerberg threw investors a critical bone: 2025/2026 will likely be the peak of losses.

“I expect Reality Labs losses this year to be similar to last year, and this will likely be the peak as we start to gradually reduce our losses going forward.” — Mark Zuckerberg

This is the fiscal discipline we wanted to see. The fully immersive “Ready Player One” metaverse has not materialized, and pivoting resources away from that toward AI wearables (like Ray-Ban Meta glasses) is the right move. I still do not think smart glasses are material to the financials yet, but strategically, they feed the data flywheel of the core app.

CONCLUSION

If you liked Meta in December, you should love it today. We have a company growing revenue at +25% with 41% operating margins, trading at just 22x next year’s earnings.

The “Capex shock” is already baked into the stock. What is not baked in is the acceleration in ad impressions and the monetization of WhatsApp. The revenue acceleration is real, the AI investments are hitting the bottom line, and the “wasteful” spending in Reality Labs is finally being reined in.

If Meta can achieve 2027 consensus EPS of $35, at a 25x multiple - it would trade at $875 a share, up +30% from today’s price of $670. For all the above reasons I am keeping my Outperform rating on Meta. Don’t bet against the machine when the AI engines are just getting warmed up.

-Accrued Interest

Relevant Tickers: META 0.00%↑ , GOOG 0.00%↑ GOOGL 0.00%↑

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

You can always reach me at simeon@accruedint.com.