Pinterest ($PINS) Q4 Earnings: The "Value Trap" Trap Door Opens

Why 41% impression growth resulted in a revenue miss, and why the "OpenAI Buyout" theory is your only (risky) hope.

Accrued Interest TL/DR: Pinterest ($PINS) stock is currently down ~40% YTD and trading under $16 following a disastrous Q4 earnings report on February 12, 2026, which validated my bearish “Value Trap” thesis from December. The quarter revealed a company suffering from a “pricing death spiral”: Ad impressions grew +41%, yet pricing collapsed -19%, proving they are flooding the zone with low-quality inventory to mask weak demand. Management blamed macro factors like tariffs, but a comparison to Meta’s results proves this is a Pinterest-specific structural failure. While cash flow looked strong, a deeper dive reveals it was inflated by non-recurring items. The only remaining bull case is a potential acquisition by an AI major like OpenAI, but relying on a white knight to save a broken fundamental story is speculation, not investing. I reiterate my Underperform rating.

In December, I published a piece titled “Why Pinterest Will Underperform in 2026,” arguing that the stock was a classic value trap—optically cheap but structurally broken.

On February 12, 2026, Pinterest reported Q4 2025 earnings, and the stock dropped -15% to -19% in the aftermarket, validating that skepticism in brutal fashion.

Investors are currently sifting through the wreckage, trying to determine if this dip is a buying opportunity. My answer is no.

This report did not just miss numbers; it confirmed that the “turnaround” story is a stagnation story. We are seeing record user growth that the company simply cannot figure out how to monetize.

Here is why the bear case has gone from “theory” to “reality.”

1. The “Empty Calorie” Growth Problem

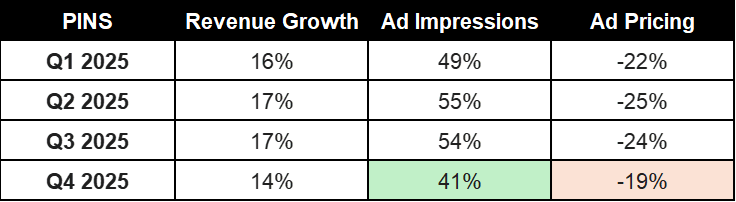

The most alarming metric in the entire print was the divergence between volume and price. Bulls will point to the fact that Pinterest grew ad impressions by +41%. On the surface, that sounds like a platform on fire. But in the ad world, if you increase supply by +41% and your revenue only grows +14%, you have a massive deflation problem.

Ad pricing collapsed by 19% year-over-year.

Management explicitly admitted this was driven by a mix shift toward “under-monetized international markets” and “lower-monetizing surfaces.” In plain English: They are flooding the zone with cheap inventory to chase top-line growth metrics.

Look at the trend:

Pinterest (PINS) 2025 Quarterly Ad Metrics (Year-Over-Year Change)

This is a pricing deflation loop. They are running faster (growing impressions) just to stay at the same revenue growth rate.

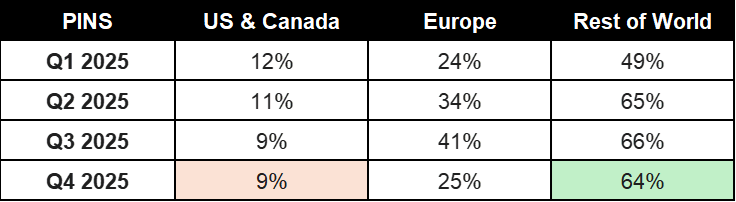

But where is this impression growth coming from? It is not from the high-value US consumer. It is coming from regions where Pinterest has almost no pricing power. Look at the revenue growth by region over the last year. The deceleration in the US & Canada (the only region that matters for profits right now) is stark.

Pinterest (PINS) 2025 Revenue Growth by Region (Year-Over-Year)

While “Rest of World” is growing at +60%, it is growing off a tiny base. Meanwhile, the core US business has slowed to single digits.

This becomes even more concerning when you look at where the new users are located. Pinterest boasted about reaching 619 million Monthly Active Users (MAUs). But look at the absolute numbers:

Rest of World MAUs: Added +49 million users YoY (Total: 356M)

Europe MAUs: Added +13 million users YoY (Total: 158M)

US & Canada MAUs: Added +4 million users YoY (Total: 105M)

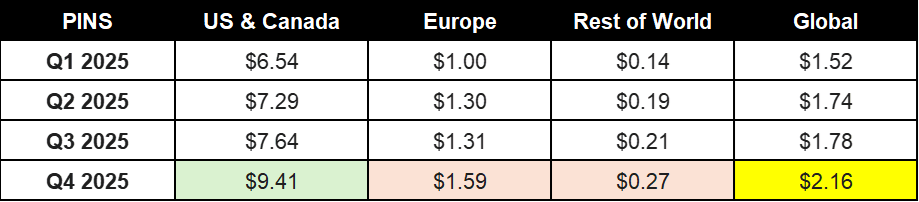

Almost 80% of their new user growth is coming from the “Rest of World” bucket. Why is this a problem? Because of the ARPU (Average Revenue Per User) gap.

Pinterest Q4 2025 ARPU by Region

Pinterest is adding millions of users who are worth $0.27 each, while failing to grow the user base that is worth $9.41 each. This is the definition of “Empty Calorie” growth.

2. The “Exogenous Shock” Excuse (vs. The Meta Reality)

Management spent a significant portion of the call blaming the revenue miss on “tariff-related ad budget pressure” from large retailers. They claimed that because Pinterest is over-indexed on Retail and CPG (Consumer Packaged Goods), they were hit harder than peers.

This confirms my long-standing view that Pinterest is a “nice-to-have” rather than a “must-have” platform. When budgets get tight—whether due to tariffs, inflation, or recession—advertisers cut the experimental spend (Pinterest) and retreat to the fortress balance sheets (Google and Meta).

As value investors, we often get seduced by a “cheap” stock price, but true value investing requires focusing on business quality first. A cheap business that loses pricing power every quarter is not a bargain; it is a melting ice cube.

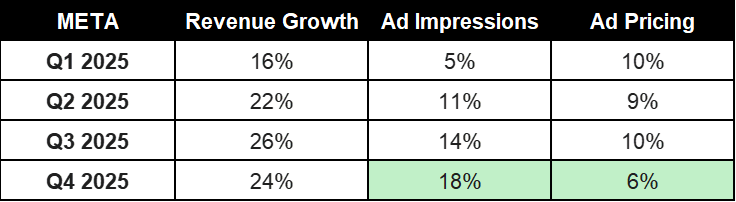

If you want proof that this is a Pinterest problem and not a “market” problem, just look at Meta ($META). I am long Meta, and I use it as a benchmark for what a healthy ad ecosystem looks like.

Meta (META) 2025 Quarterly Ad Metrics (Year-Over-Year Change)

Do you see the difference?

Pinterest: Floods inventory (+41%) > Destroys pricing (-19%) > Misses Revenue.

Meta: Controls inventory (+18%) > Maintains pricing power (+6%) > Beats Revenue.

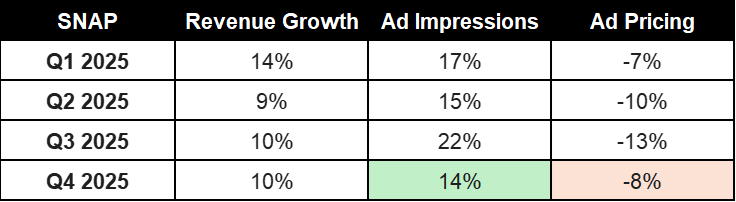

Now, let us look at another struggling peer: Snap (SNAP). Snap is often compared to Pinterest as a “second-tier” social platform. When we look at Snap’s 2025 metrics, we see the exact same pattern of deflationary growth.

Snap (SNAP) 2025 Quarterly Ad Metrics (Year-Over-Year Change)

Snap and Pinterest are in the same boat: fighting a losing battle against pricing deflation. Meta is on a different planet. Value investors need to take note: Low P/E multiples do not protect you from bad business models. Meta’s pricing power proves their moat; Pinterest’s pricing collapse proves their commoditization.

3. Sales Reorgs: The Oldest Trick in the Book

Whenever a company consistently misses revenue targets, the “Sales Reorganization” press release is never far behind.

Pinterest announced a significant “sales and go-to-market transformation” under new Chief Business Officer Lee Brown. Management even preemptively warned that this “may cause short-term disruption” in Q1. Recent reporting from The Information regarding internal friction paints a picture of a company searching for a silver bullet.

I have spent years working in corporate finance, partnering with CFOs and senior sales leadership on revenue benchmarking. In my experience, “Sales Reorgs” are almost always euphemisms for structural product failure.

It is much easier for a CEO to fire a Sales VP or “restructure the regions” than it is to admit that advertisers simply prefer the competitor’s product. If Pinterest’s ad product (Performance+) was delivering undeniable ROI, they would not need to reorganize the sales team to sell it. The product would sell itself.

Do not let the “transitional friction” narrative fool you. This is not a personnel problem; it is a product-market fit problem.

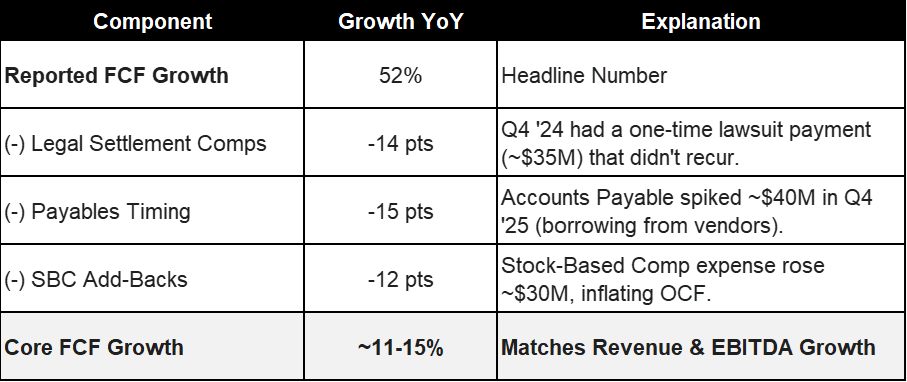

4. The “Optical” Free Cash Flow Growth

Bulls have been hanging their hats on one metric: Free Cash Flow (FCF). In Q4, reported FCF grew by a staggering +52% YoY, far outpacing revenue.

However, the “operating leverage” story is paused. Guidance for 2026 suggests Adjusted EBITDA margins will be flat at ~30%, weighed down by the tvScientific acquisition and GPU investments.

So why was FCF so high? I did a “Quality of Earnings” deep dive on the cash flow statement, and the growth is largely optical, driven by three non-fundamental factors. “Core” cash flow is much lower than the headline number.

Pinterest Q4 2025 Free Cash Flow Bridge (Estimated)

If you strip out these noise factors, “Core” FCF growth was roughly in line with EBITDA growth (~15%). There is no magical margin expansion happening here. The company is simply benefiting from easy comparisons and timing benefits that will reverse in Q1 2026.

5. The “Agentic” Threat to Pinterest

In the earnings Q&A, CEO Bill Ready was asked specifically about the rise of “agentic commerce”—the idea that AI agents will soon be able to execute purchases on behalf of users, bypassing traditional browsing.

His response was telling:

“Users come to Pinterest to be inspired... they want to be in the loop. We view our role as ‘assisted’ shopping, not replacing the user.”

Takeaway: This sounded incredibly defensive.

As I wrote in December, the biggest existential threat to Pinterest is an AI that moves from “search” to “action.” If the world moves toward “done-for-you” commerce—where I tell an AI to “buy me a modern outfit for a wedding”—Pinterest’s entire value proposition of “browsing for inspiration” becomes a relic.

The risk is that Pinterest becomes the “window shopping” engine in a world where everyone else is using a “personal shopper.” If users start relying on Gemini or OpenAI to find and buy the product in one conversational turn, Pinterest loses its position at the top of the funnel. While competitors race toward autonomous agents, Pinterest is betting that human behavior won’t change. That is a dangerous bet.

6. The Only Upside: The M&A Wildcard

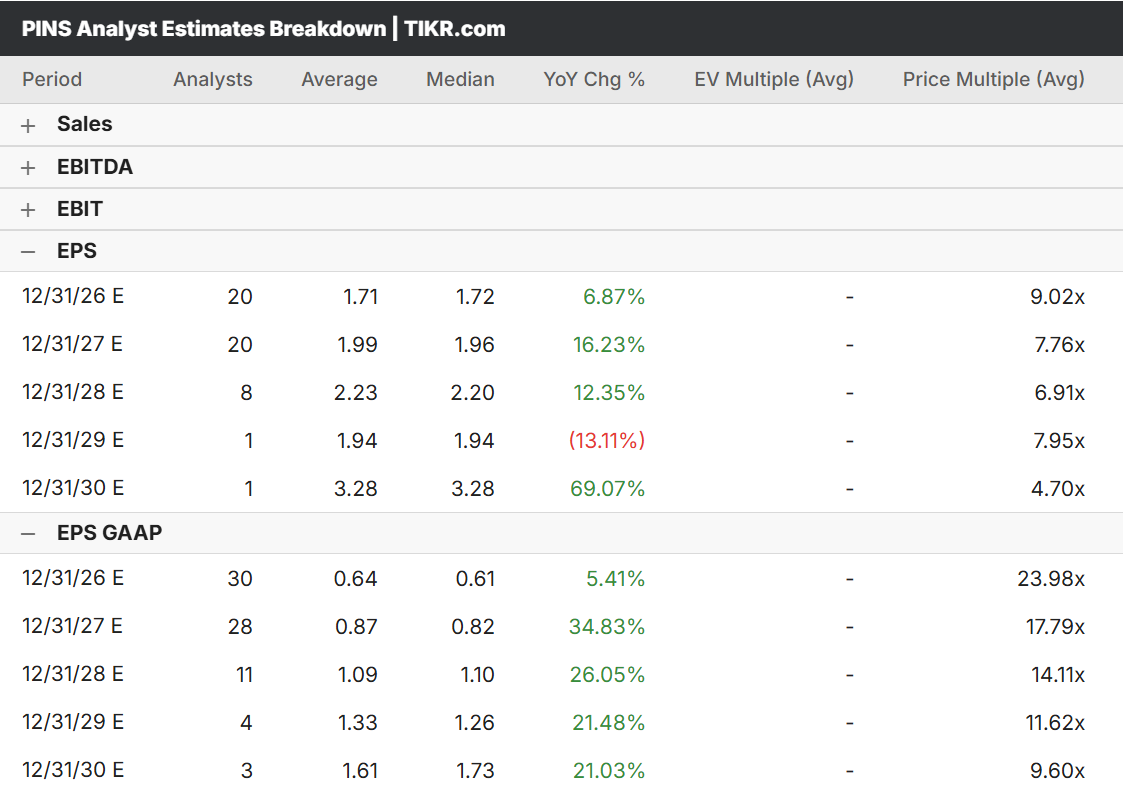

With the stock trading under $16 and the multiple is compressing, we must address the elephant in the room: Is Pinterest a takeover target?

I am sticking with my Underperform rating, and I want to be clear: I am not recommending you hold $PINS in hopes of a buyout. A buyer could strategically wait for the stock to fall further. However, we must recognize the “M&A Floor.”

At a current price of ~$15.50, the stock might look optically cheap but be careful.

● Non-GAAP: On consensus 2026 Non-GAAP EPS of $1.72, the multiple is 9x.

● GAAP (The Real Cost): Because Pinterest relies so heavily on Share-Based Compensation (SBC), the GAAP picture is much less forgiving.

○ 2026 Estimated GAAP P/E: ~24x, GAAP EPS of $0.61

○ 2027 Estimated GAAP P/E: ~18x GAAP EPS of $0.82

Source: Tikr

Trading at 24x GAAP earnings for a company growing revenue in the low teens is not deep value. It is fair value at best. A “cheap” stock can get much cheaper if that multiple compresses to 15x.

Why OpenAI (or a similar AI Major) might want it:

The “Blue Sky” bull case is that OpenAI acquires Pinterest to train its next-gen multimodal models. Pinterest possesses a unique “Intent Graph”— billions of images curated by humans into “boards” that link visual aesthetics with specific semantic concepts (e.g., “Boho Chic Living Room”). This data is incredibly valuable for training AI to understand style and nuance.

OpenAI plans to go public in 2026. When they do, they will suddenly have a liquid currency (stock) to use for acquisitions. Buying a “depressed” asset like Pinterest to bolt on a visual shopping engine to ChatGPT could be a strategic masterstroke.

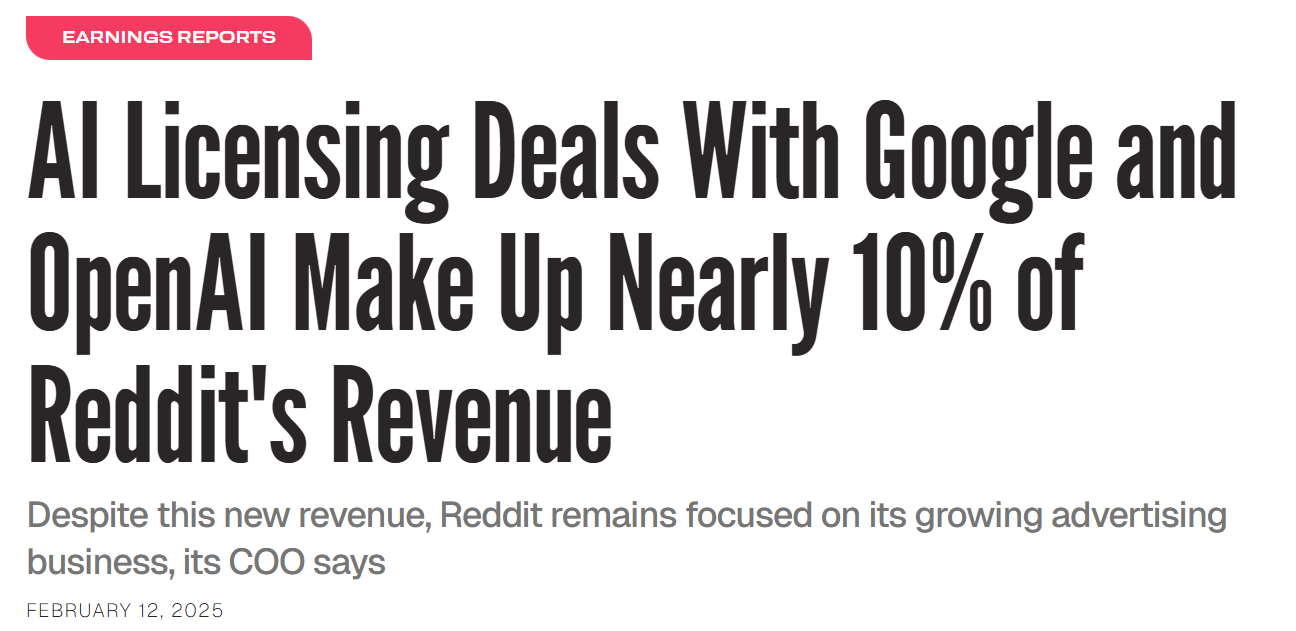

Why Licensing (The Reddit Model) Won’t Work:

Reddit was able to license its data for $60M/year because Reddit owns the text. Pinterest is different. Pinterest users curate images, but they usually do not own the copyright to them. This makes a pure data licensing deal legally toxic.

● The Solution: An acquisition is cleaner. By buying the whole company, an AI giant gets the “engine” of curation and the ad network, rather than just buying a static (and copyrighted) database.

● The “Strategic Data Lock”: Pinterest updated its Terms of Service in 2025 to allow them to train their own AI on user data. This makes the company more attractive as an asset, but less attractive as a partner.

Why it might not happen:

OpenAI and Google have likely already scraped the open web. They may have 80% of Pinterest’s images already, just without the board structure. Is the “board structure” worth a $12B premium? Maybe not.

CONCLUSION

I am sticking with my Underperform rating. The Q4 earnings confirmed that the structural rot in the pricing model is accelerating, and the “tariff” excuses do not hold water when compared to Meta’s performance.

However, when a company stumbles this badly, it becomes “financial engineering” bait. With OpenAI rumored to be looking at a public listing, they could soon have the public company currency to go shopping for “data assets” that are perceived as AI laggards.

But at Accrued Interest, we invest based on fundamentals, not lottery tickets. Unless Pinterest gets rescued by a white knight, the fundamentals suggest the path of least resistance is lower. Their best bet at this point is to exit the race and become a feature within a larger organization.

Avoid.

-Accrued Interest

Relevant Tickers: PINS 0.00%↑, META 0.00%↑, GOOG 0.00%↑ , GOOGL 0.00%↑ , SNAP 0.00%↑

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

You can always reach me at simeon@accruedint.com.

🤖 Is Reddit (RDDT) a Buy after the sell-off?

I have been getting this question a lot lately. With the stock pulling back, it is tempting to look at Reddit as the "picks and shovels" play for AI training data.

But while the price has come down, I am not convinced it is cheap enough yet to justify the long-term structural risks.

1. The Valuation is still demanding

Even after the drop, Reddit is trading at ~34x 2026 GAAP EPS.

For a platform growing quickly, that might seem reasonable—until you ask yourself what the "terminal value" of their data actually is.

2. The "Dead Internet" Risk

My biggest concern with the long-term bull case for Reddit is the quality of its signal. We are increasingly seeing the "Dead Internet Theory" play out in real-time.

Reddit is being flooded with bot accounts and AI-generated comments designed to farm karma or influence the algorithm. As LLMs begin to train on data produced by other LLMs (synthetic data loops), the quality of text-based training data degrades. If Reddit becomes an echo chamber of bots talking to bots, its value as a "human" data source collapses.

3. The Shift to Video

This is why I remain so bullish on Meta and Google.

The next frontier of AI models isn't just about reading text; it's about understanding the physical world. Video data is significantly harder to "fake" at scale than text.

-Google owns the world's largest library of video data (YouTube).

-Meta owns the world's largest library of social video and visual data (Instagram/Reels).

That video data is a much stronger, more defensible signal for training future models than a text forum that is increasingly vulnerable to spam.

Reddit is an interesting trade, but for a long-term hold, I prefer the companies that own the "hard-to-replicate" data. I’m sticking with Meta (which is cheaper) and Google (which is in the driver’s seat).

Nice post. Do you like Reddit here? Seems promising at this price.