Is Versant (VSNT) Worth More Dead Than Alive?

How to unlock the hidden value of GolfNow and CNBC by dismantling the "melting ice cube."

Accrued Interest TL/DR:

The Thesis: In Parts 1 and 2, I argued why Versant (VSNT) is a value trap at $33.50. The public markets are correctly discounting a “melting ice cube” facing a 2028 sports rights cliff. However, the sum of the parts creates a fascinating theoretical arbitrage that only a private owner can unlock.

The “Hidden” Tech Platform: My analysis of 2025 disclosures suggests the Golf Vertical is no longer just a cable channel—it is a 50/50 split between linear TV and a massive B2B SaaS oligopoly (GolfNow) that controls ~75% of online aggregator inventory.

The Strategic Breakup: I map out why assets like CNBC and GolfNow are structurally more valuable to strategic buyers (like LSEG, Thomson Reuters, or DraftKings) than they are trapped inside a cable conglomerate.

The “Project Turn the TV Off” Scenario: A take-private is unlikely at today’s premium. I believe the stock must languish or fall further to create the necessary margin of safety. I run the math on a “2028 Doomsday” scenario where a PE buyer could take it private, run the cable networks for yield, and execute a dividend recap based on $1.47B in pro-forma EBITDA.

The Bottom Line: This isn’t a buy recommendation; it’s a roadmap for what should happen. Until management stops empire-building and starts dismantling, the equity remains dead money.

Introduction: The Art of the Dismantle

In Part 1 (“Decoding the Versant Investor Deck“), I looked under the hood at capital allocation. I found a management team that seems intent on spending its Free Cash Flow on “growth” initiatives and empire-building rather than returning capital to shareholders. The “E” in the P/E ratio is shrinking, and the “P” is likely to follow.

In Part 2 of this series (“Is Versant Cheap or Just Cheaply Valued? The Case for $27“), I laid out the bear case: Versant ($VSNT) is trading at a “value” multiple because it faces an existential cliff in 2028. The loss of the NBCUniversal “halo” and the expiration of key sports rights will likely re-rate the business permanently lower.

Today, in Part 3, I want to shift gears.

If I am so bearish, why spend this much time analyzing the company? Because Versant is a classic case of an asset-liability mismatch.

The public markets are designed to value growth and continuity. They are terrible at valuing a stock undergoing a liquidation and / or managed decline. Currently, the market looks at Versant and sees a messy, shrinking cable bundle. It assigns a blanket 5.0x EBITDA multiple to the whole entity.

But if I were advising the Board—or, more likely, a Private Equity firm circling the carcass a few years from now—I would not see a media company, but rather a breakup candidate.

For purposes of this thought exercise - let’s view Versant as three distinct businesses stapled together:

The Trophy Media Asset (CNBC): A global financial media asset with high margins that does not require much capital to run.

The Software as a Service Play (GolfNow): A vertical SaaS oligopoly on golf course booking times, currently shackled to a legacy sports cable channel.

The Bad Bundle (USA, E!, MS NOW): A declining portfolio of cable networks that generates massive cash flow today but has a terminal value of zero.

The strategy I am laying out today—“Project Turn the TV Off”—is a thought exercise. It is the blueprint for how to dismantle this company to unlock its latent value.

Note: I do not expect this to happen tomorrow. At the current price of $33.50, the equity is likely too expensive for a financial buyer to make the math work. For this scenario to become actionable, the stock needs to languish or drift lower toward my $27 target (or below) as the 2028 cliff approaches.

Here is how the dismantle should work.

Part 1: The “Hidden Gem” – Carving Out the Tech Platform

The first step in my breakup analysis is to isolate the assets that are being mispriced by the “Cable TV” label. The most egregious example is the Golf Vertical.

Investors look at the “Golf” line in the 10-K and assume it is just the Golf Channel—a niche linear network fighting the same cord-cutting gravity as everyone else.

They are missing the story. Based on my forensic review of the 2024-2025 data, the Golf vertical has quietly crossed the rubicon. It is no longer a majority media business; it is a technology business.

The “Matt Hong” Signal

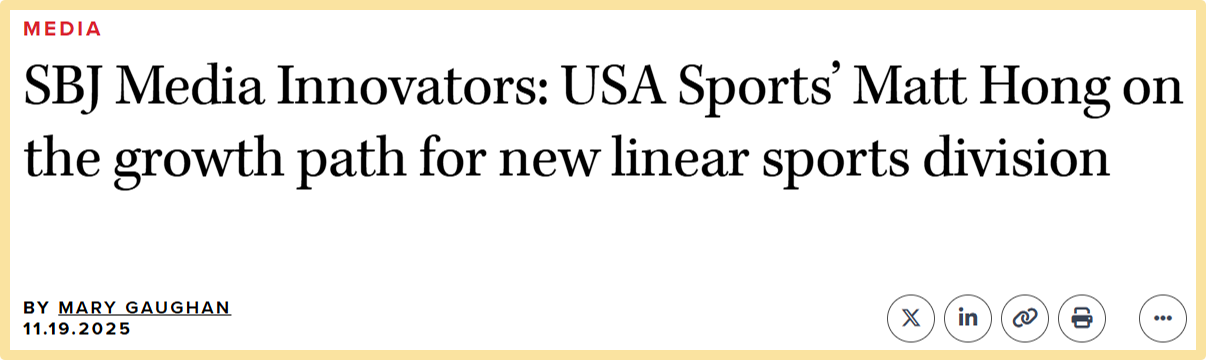

Management doesn’t break out the Golf financials explicitly. However, in November 2025, Matt Hong (President of USA Sports) offered a rare glimpse under the hood at the Sports Business Journal Media Innovators Summit.

Hong revealed that the Golf vertical’s revenue is now split roughly 50/50 between the Linear TV side (Golf Channel) and the Digital side (GolfNow/GolfPass).

This disclosure is our Rosetta Stone for understanding the asset.

We know that the Linear side (Golf Channel) likely generates roughly $600 Million in revenue (based on ~70M households × standard carriage fees + advertising).

If the split is 50/50, that implies GolfNow/GolfPass is also generating ~$600 Million in revenue.

This means Versant owns a digital marketplace with half a billion dollars in revenue—likely with SaaS-like margins—that is being valued at a distressed cable multiple.

Why the Golf Vertical is Worth More to a Buyer

We don’t need to put a specific dollar tag on this to know it is mispriced. We just need to look at the strategic moat.

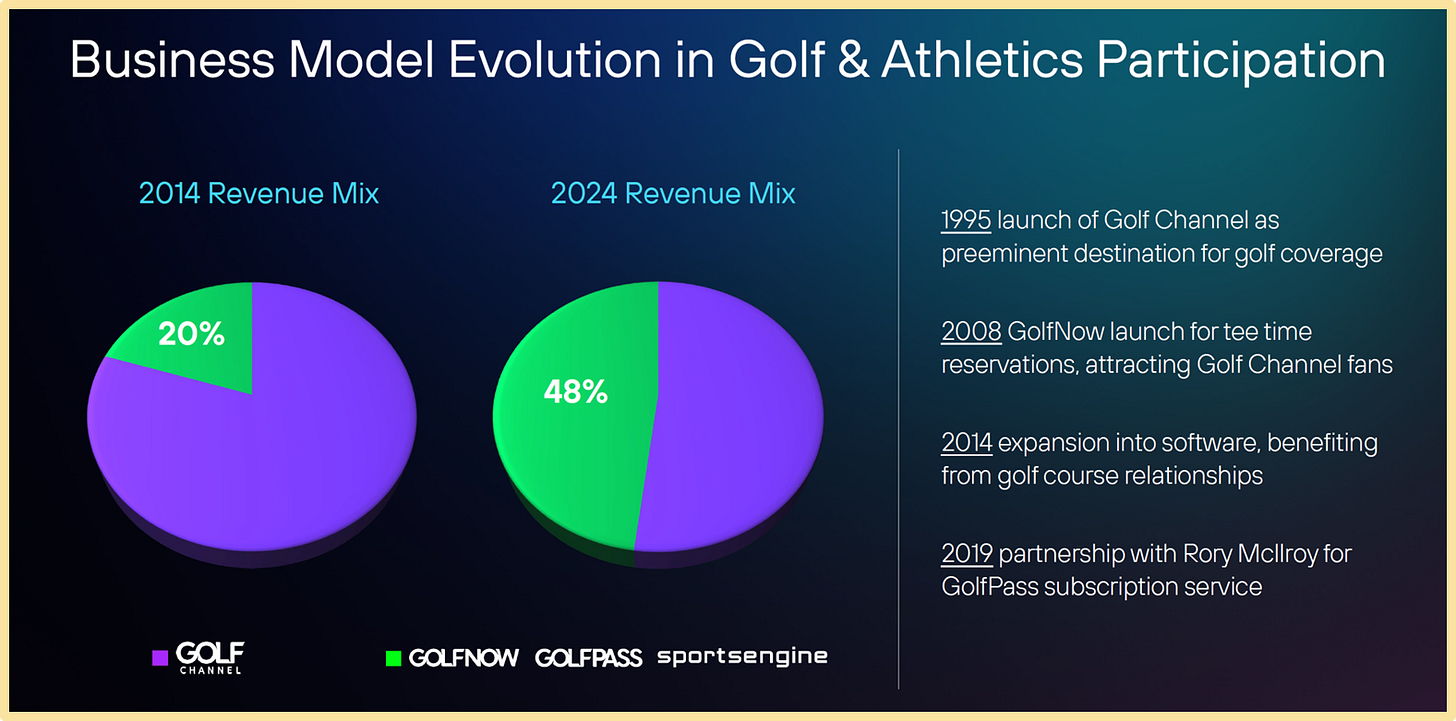

The Oligopoly: Versant owns both GolfNow (#1) and TeeOff (#2). My research suggests they control 75-80% of the third-party aggregator market. There is no “Expedia vs. Booking.com” war in golf. There is just Versant.

The “Inflation Hedge” (Barter Model): GolfNow typically uses a barter model, trading software for tee time inventory. As golf courses raise prices (inflation), the value of VSNT’s inventory rises automatically. They hold a call option on the price of greens fees.

The Potential Strategic Buyer List: To a public market investor, this is just a segment of a cable company. But to the right buyer, it is a crown jewel. In no order - here are some potential suitors for the golf assets:

DraftKings / Flutter (FanDuel): Golf is data-rich and perfect for live micro-betting. Owning the booking engine (GolfNow) gives a sportsbook direct access to the digital wallets of 4 million active, affluent golfers. This could be a customer acquisition tool.

Software-Focused Private Equity: This is ultimately a software play. We are talking about a vertical market software business with high recurring revenue, embedded payments, and high switching costs. A tech-focused PE firm would look at the retention rates and see a classic SaaS rollup opportunity that is currently being mismanaged as a media asset.

Sports Private Equity: Private investment firms that specialize in sports assets understand the intersection of media rights and technology. They would strip the booking engine away from the cable channel immediately, unshackling the tech multiple from the media drag.

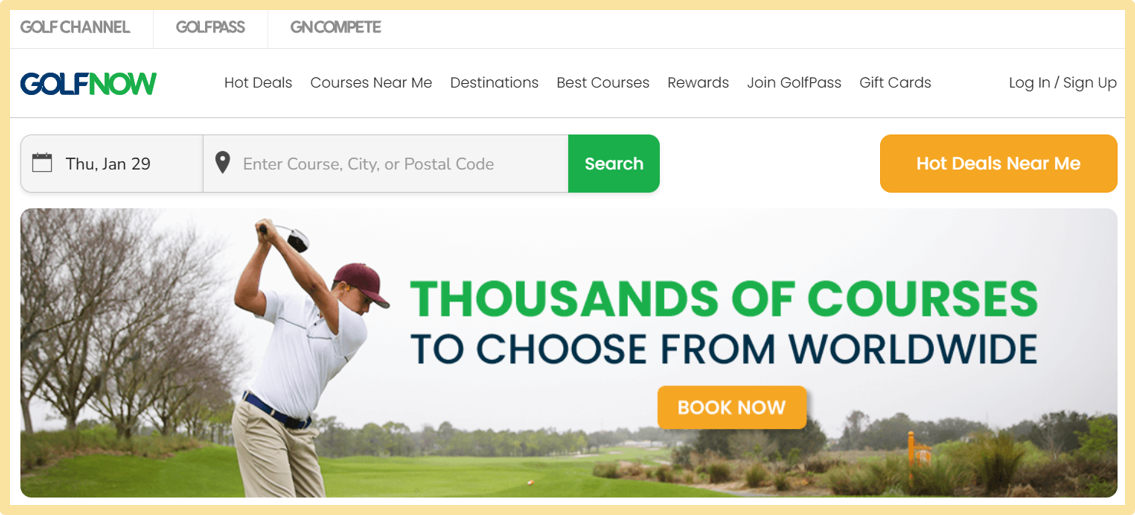

The “Rounding Error” Digital Assets Astute readers will notice I have not focused on Versant’s other digital holdings: the movie-tech basket that includes Fandango and Rotten Tomatoes. This is not an oversight; it is a question of scale. While these are legitimate digital platforms that are currently mismanaged inside a cable conglomerate, their financial contribution is a rounding error compared to the leviathan that is the Golf Vertical.

In a full "Project Turn the TV Off" breakup scenario, these assets absolutely should be divested. They belong in the hands of another digital media conglomerate or a middle-market software PE firm that can give them the attention they deserve. But for investors looking at the current $33.50 share price, let’s be clear: selling Fandango amd RT is mere housecleaning; unlocking GolfNow is company-altering.

Part 2: The Trophy Media Asset – Why CNBC Does Not Belong Here

The second asset that needs to be liberated is CNBC.

Inside Versant, CNBC is treated as just another cable network, bundled with USA and E!. This is a fundamental strategic error. CNBC is not an entertainment channel; it operates more like a B2B utility for the financial industry. It has high affiliate fees, and crucially, it has zero reliance on the expensive sports rights that threaten the rest of Versant’s portfolio.

Strategic Rationale for a Sale

In a breakup scenario, I believe CNBC could be monetized because it could spark a natural bidding war between three distinct types of buyers. Here are a few names (this list is by no means comprehensive).

1. The “Bloomberg Killer” Play: LSEG (London Stock Exchange Group)

The Logic: LSEG owns LSEG Workspace, a competitor to the Bloomberg Terminal. However, they lack the media influence that Mike Bloomberg wields.

The Value Unlock: Bloomberg LP is a money-printing machine because of the flywheel between the Terminal (Data) and Bloomberg TV (Marketing). By buying CNBC, LSEG could replicate some of that model, pairing the world’s most-watched business network with their data terminals.

2. The “News Oligopoly” Play: Thomson Reuters

The Logic: Thomson Reuters sold their terminal business but kept the news wire. They are a dominant text news organization in finance.

The Value Unlock: Buying CNBC gives them the broadcast distribution to complement their wire service. It would create a global leader in financial news—text and video—under one roof. With a $56B market cap, this is a digestible “bolt-on” for them.

3. The “Gamification” Play: Robinhood

The Logic: This is my wildcard pick. Robinhood wants to shed its “meme stock” image and capture the serious, high-net-worth investor.

The Value Unlock: Imagine integrating a live CNBC feed directly into the Robinhood app. You watch the CEO of Nvidia discuss earnings, and a “Buy NVDA” button pops up on the screen. It could turn news into order flow.

Part 3: The “Bad Bundle” – Managing for Decline

Once you strip out Golf and CNBC, what is left?

USA Network, SyFy, E!, Oxygen, and MS NOW.

I’m calling this the “Bad Bundle.” These assets are the reason I am bearish on the stock at $33.50. They are tethered to the linear cable ecosystem, which is eroding revenue by ~7-10% per year, and profits / free cash flow at an even faster rate.

In a “Project Turn the TV Off” breakup, we do not try to sell these. There are no buyers. Instead, we place them into runoff.

The Runoff Strategy:

Stop the Growth Spending: We cut all original scripted programming. No more expensive dramas. We fill the schedule with reruns of Law & Order and Real Housewives.

Squeeze the Distributors: We use the remaining leverage of the bundle to squeeze Comcast and Charter for every penny of carriage fees until the 2028 renewal cliff. After 2028, we try to strike as many distribution deals as possible with as many digital video players and other streaming services.

Cash Extraction: Since we aren’t spending on growth, Capex drops to close to zero - only maintenance. Every dollar of EBITDA becomes Free Cash Flow.

Even if these networks go to zero in 2030, they will generate billions in cash between now and then. We treat them as a “Zombie Yield Co”—an annuity stream that funds the debt service for the rest of the transaction.

Part 4: “Project Turn the TV Off” – The Financial Engineering

Now we come to the mechanics of the deal.

As I stated in the introduction, I do not believe a Private Equity firm can pay a premium on top of the current $33.50 share price to do this deal today. The math doesn’t work. The risk of the 2028 sports rights cliff is too high to lever up the company at a $7B+ valuation.

However, if the stock performs as I expect—languishing or dropping as the market wakes up to the “melting ice cube” reality—a window could open.

Here is the math on how a savvy financial engineer could structure a potential VSNT take-private in the future.

Phase 1: The Take-Private & Delisting

The first source of value is simply removing the company from the public markets.

Based on Versant’s Investor Day materials, the company is carrying roughly $200 Million in “Public Company Costs” (Board fees, IR, SEC compliance, D&O insurance, etc.).

In a take-private scenario, we gut this immediately. We fire the Board, scrap the earnings calls, and run the back office on a skeleton crew.

Conservative Savings: $100 Million in annual EBITDA.

Impact: This “found money” covers nearly half the interest on a LBO.

Phase 2: The “Doomsday” Dividend Recap

This is the only place where I will get specific on valuation because it illustrates the margin of safety required.

If I were the buyer, I would refinance the company’s debt immediately upon closing. But I wouldn’t lever it based on current EBITDA ($2.0B). That is a trap. I would lever it based on a 2028 “Doomsday” Estimate to ensure I can survive the sports rights cliff.

The “Safety” Math:

2028 Estimated EBITDA: ~$1.37 Billion (Post-Rights Cliff).

(+) Delisting Cost Savings: $0.10 Billion.

(=) Pro-Forma EBITDA: $1.47 Billion.

Using this lower, safer base, we apply standard private equity leverage:

Leverage Ratio: 4.5x.

Total New Debt Capacity: ~$6.6 Billion.

The Cash Extraction: With $6.6 billion in new debt capacity, the private owner can execute a capital return event:

New Debt: $6.60 Billion.

(-) Pay off Old Debt: ($2.25 Billion).

(-) Fees: ($0.10 Billion).

(=) Cash Available for Dividend: ~$4.25 Billion.

The Result: The private owner writes a check to buy the equity (likely at a lower valuation than today). They immediately pay themselves a special dividend of $4.25 Billion.

In this scenario, they have recovered 100% (or at the very least a large chunk) of their initial equity check immediately. They now own the upside of the CNBC sale, the Golf sale, and the “Bad Bundle” cash flow.

CONCLUSION

The “Project Turn the TV Off” blueprint proves that the assets inside Versant can be valuable to the right owners. A dominant news network, a SaaS golf platform, and a cash-gushing cable bundle are not worthless if managed the proper way.

But at $33.50, the public market is asking you to pay a full price for a structure that is fundamentally broken.

Management is not breaking the company up; they are trying to “grow” it.

The “Bad Bundle” is not being run for cash; it is being fed expensive sports rights.

The “Hidden Gems” (Golf/CNBC) are being suffocated inside a conglomerate structure.

The arbitrage exists, but it is theoretical. For this value to be unlocked, the status quo must fail. The stock price must disconnect from the “value” narrative and reflect the “distress” reality.

My advice remains the same: Stay on the sidelines.

The good news for Versant bulls is that the lower the stock price goes, the more actionable a take-private plan becomes. The value unlock is coming, but only after the pain.

-Accrued Interest

Relevant Tickers: CMCSA 0.00%↑ , TRI 0.00%↑, VSNT 0.00%↑, HOOD 0.00%↑

Read the Rest of the Series:

Part 1: Is Versant (VSNT) Cheap or Just Cheaply Valued? The Case for $27

Part 2: Decoding the Versant (VSNT) Investor Deck: A Warning Sign

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

You can always reach me at simeon@accruedint.com.