Decoding the Versant (VSNT) Investor Deck: A Warning Sign

Why the 160-page presentation is a marketing mirage masking a melting ice cube.

Versant management spent their inaugural Investor Day trying to convince you that VSNT is a diversified digital growth engine. My ten years building these exact same investor decks for media companies tells me a different story.

This deep dive isn’t just a summary; it’s a forensic audit of a 160-page presentation designed to mask a “melting ice cube” with big logos and broken axes. If you are looking at the headline EBITDA and thinking this stock is “cheap,” you are missing the structural gravity pulling this company down.

Key Takeaways:

The 2028 Cliff: Versant is currently hiding behind NBCUniversal’s scale. What happens when that safety net vanishes in 2028, with 55% of its carriage deals up for renewal?

The Math of Decay: Single-digit revenue declines can lead to -13% to -27% Free Cash Flow erosion for 2026. What if things get worse?

Renters vs. Owners: I distinguish between owned assets such as CNBC and GolfNow—from the expensive sports rights (WWE, NASCAR) that VSNT must constantly rebuy.

The Breakup Alpha: The public market is valuing Versant as a dying cable business. But the real value lies in a Private Equity “arbitrage and dismantle” play.

Now let us dive in and see exactly what VSNT 0.00%↑ management wants you to ignore.

The “Grandeur Without Context” Trap - Pg. 12

Big Numbers, Zero Context: Management loves using massive, context-free numbers to create a false sense of scale. For VSNT, a “large, highly engaged customer base” is table stakes, not a growth story.

Logo Soup: Page 12 is a wall of logos, mixing owned networks with rented sports leagues. Remember: Versant does not own these sports rights; they must win them in competitive auctions every renewal cycle.

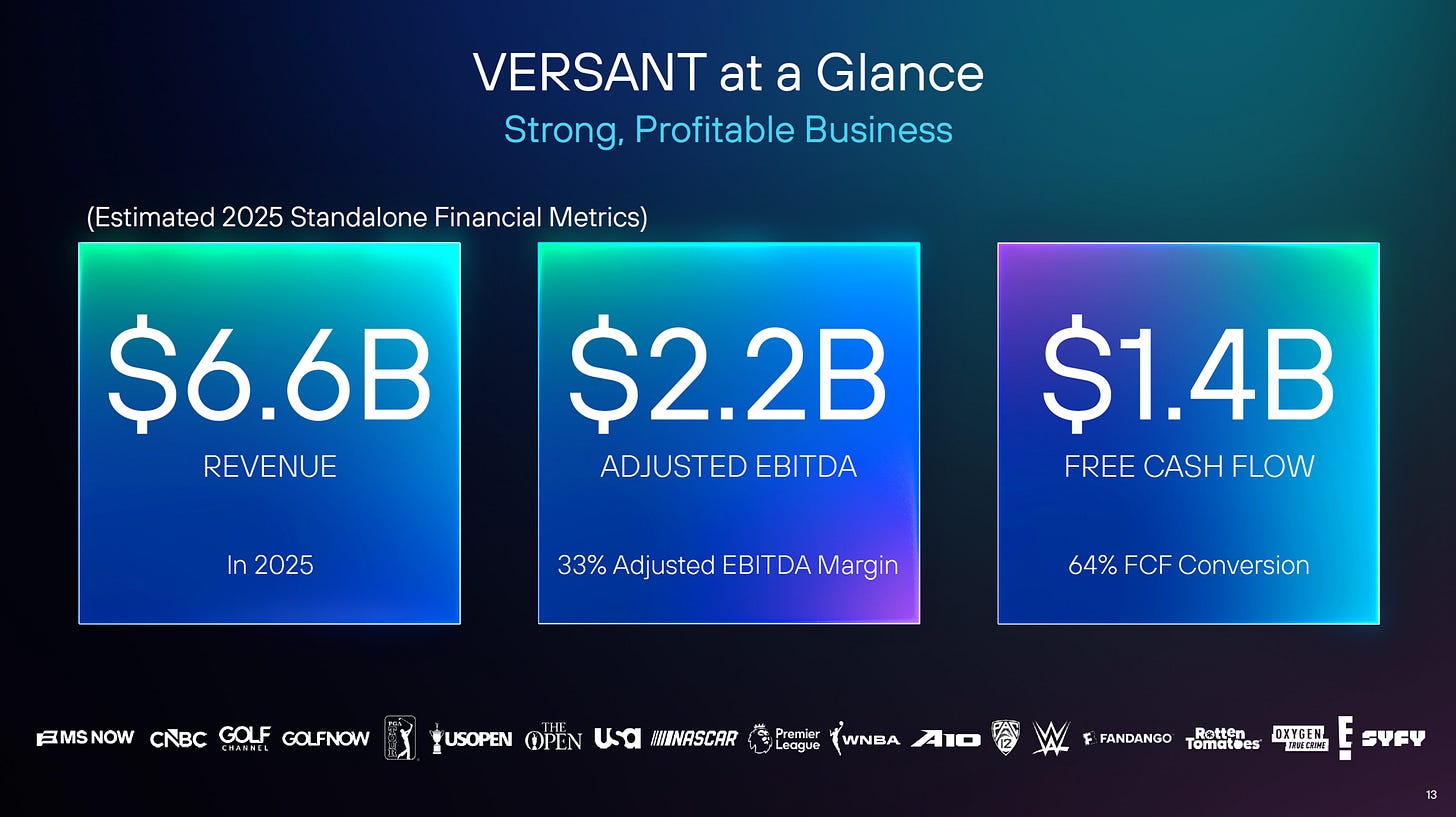

The Reality of Being Subscale - Pg. 13

Peak Optimism: Management leads with 2025 actuals because they look strong. But the real story is the declining estimates for 2026 and beyond.

Comparative Disadvantage: Scale is relative. With <$7B revenue and <$1.5B free cash flow, Versant is a subscale minnow swimming with whales like YouTube and Netflix (GOOG 0.00%↑ GOOGL 0.00%↑ NFLX 0.00%↑ ).

A Hint at the “Sum of the Parts” - Pg. 16

Strategic Segmentation: The four verticals on this page were not picked at random - but hint at what I imagine to be the inevitable endgame: a private equity breakup.

Distinct Buyers: Separating CNBC (business/finance) from MS NOW (politics) and “Genre Entertainment” confirms these assets appeal to completely different buyer pools and will be marketed accordingly.

CNBC: The CEO’s Network - Pg. 18

“CEO Media Outlet”: This label signals high non-sports affiliate fees. CNBC is not a volume play; it is a pricing play.

Valuation vs. Revenue: Omission of revenue figures is intentional. Management argues CNBC’s value lies in its influence and “trophy asset” status, not just its P&L.

MS NOW: “If You Ain’t First, You’re Last” - Pg. 20

Being the “#2 cable network” is meaningless when the entire medium is shrinking.

The Addressable Market Fallacy: Americans aren’t just switching news channels; they are leaving traditional news entirely for podcasts and TikTok.

Fox News is the Only “Must-Have”: Let’s get one thing straight. Throughout the deck, VSNT management cites Fox News as a competitor for MSN Now. While that is factually true, the companies could not be more different.

Fox operates (and monetizes) like a broadcast network with loyal die-hard fans.

MS NOW is just a cable news channel fighting for scraps.

Digital Misnomers:

“Top Digital Site”: Just low-value display advertising.

“Top YouTube Brand”: YouTube keeps the economics, not Versant.

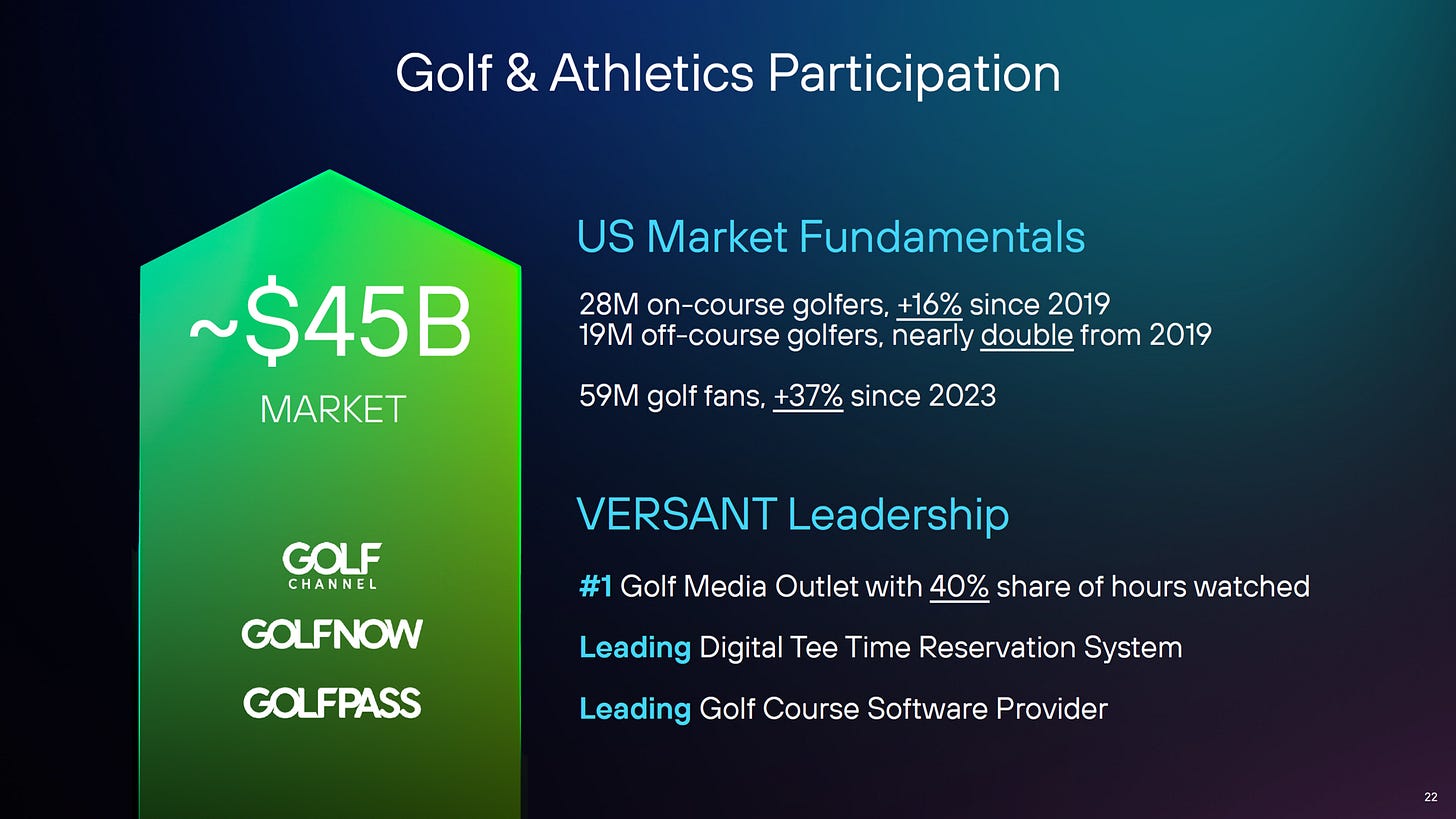

Potential Divestiture with Golf Assets - Pg. 22

Demographics Over Volume: Like CNBC, Golf’s value is its wealthy audience, not the raw number of players.

Software is the Real Asset: As it stands today, GolfNow’s digital tee-time system is a tech asset trapped inside a legacy media company. This screams “divestiture.”

The “Borrowed” Content Problem - Pg. 24

Rental vs. Ownership: Labeling this group of Versant cable channels “Sports & Entertainment” is a misnomer. These sports properties are rented rights.

The “Exclusive” Myth:

Technically True, Strategically False: Versant has “exclusive” rights to specific games, but the leagues slice their packages across multiple networks (Netflix, ESPN, etc.) to drive up auction prices of their respective leagues.

No Moat: Fans follow the sport, not the channel.

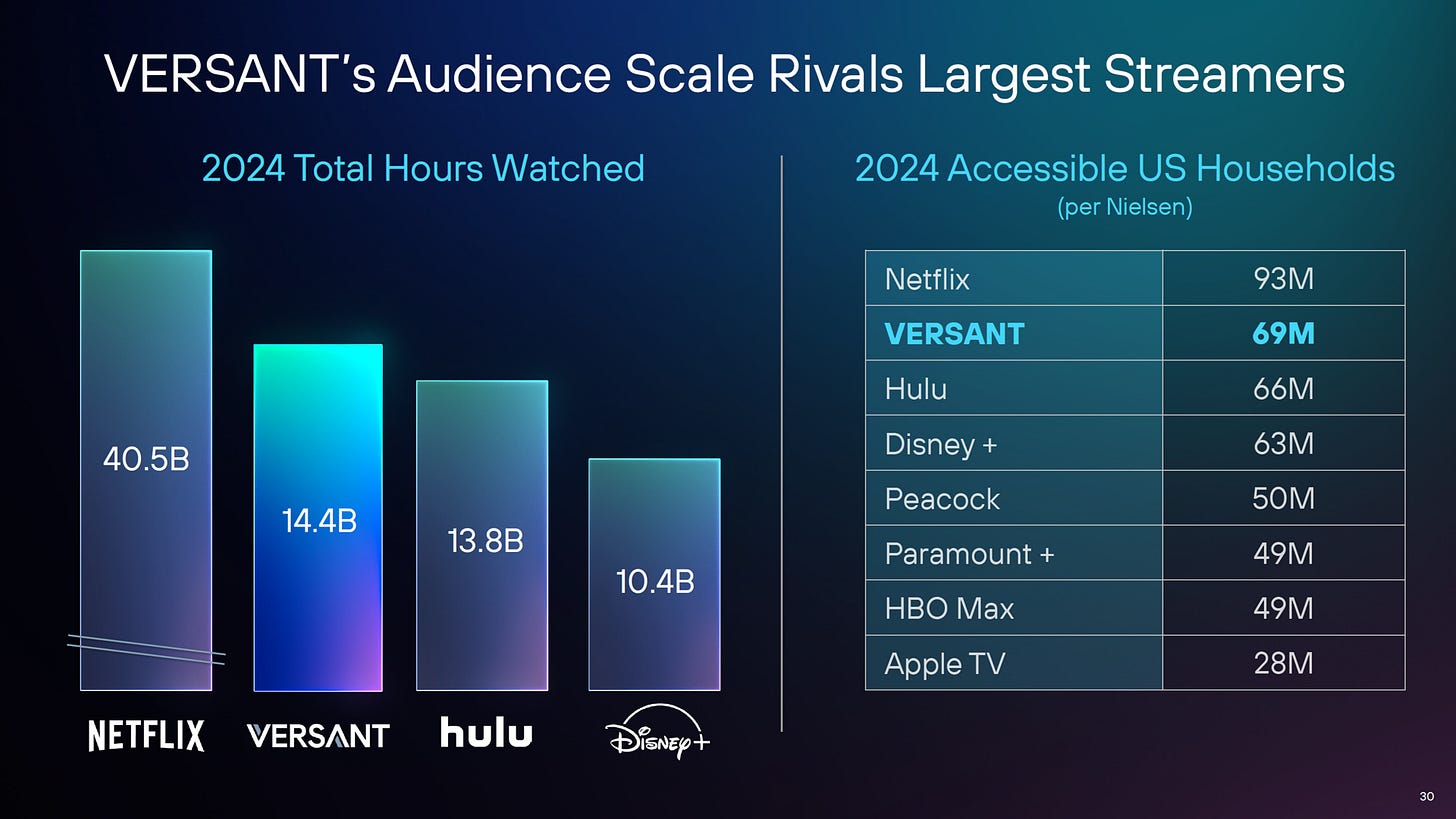

Breaking the Axis: The Netflix Reality Check - Pg. 30

This is one of those slides that unintentionally undermines the bull case.

Chart Crimes: Slide 30 literally breaks the Y-axis to fit Netflix on the same chart as Versant. If drawn to scale, Versant’s position would look far more tenuous.

Distribution Inflation: “69 million households” just means they are in the basic cable bundle. That is a legacy feature, not a growth metric.

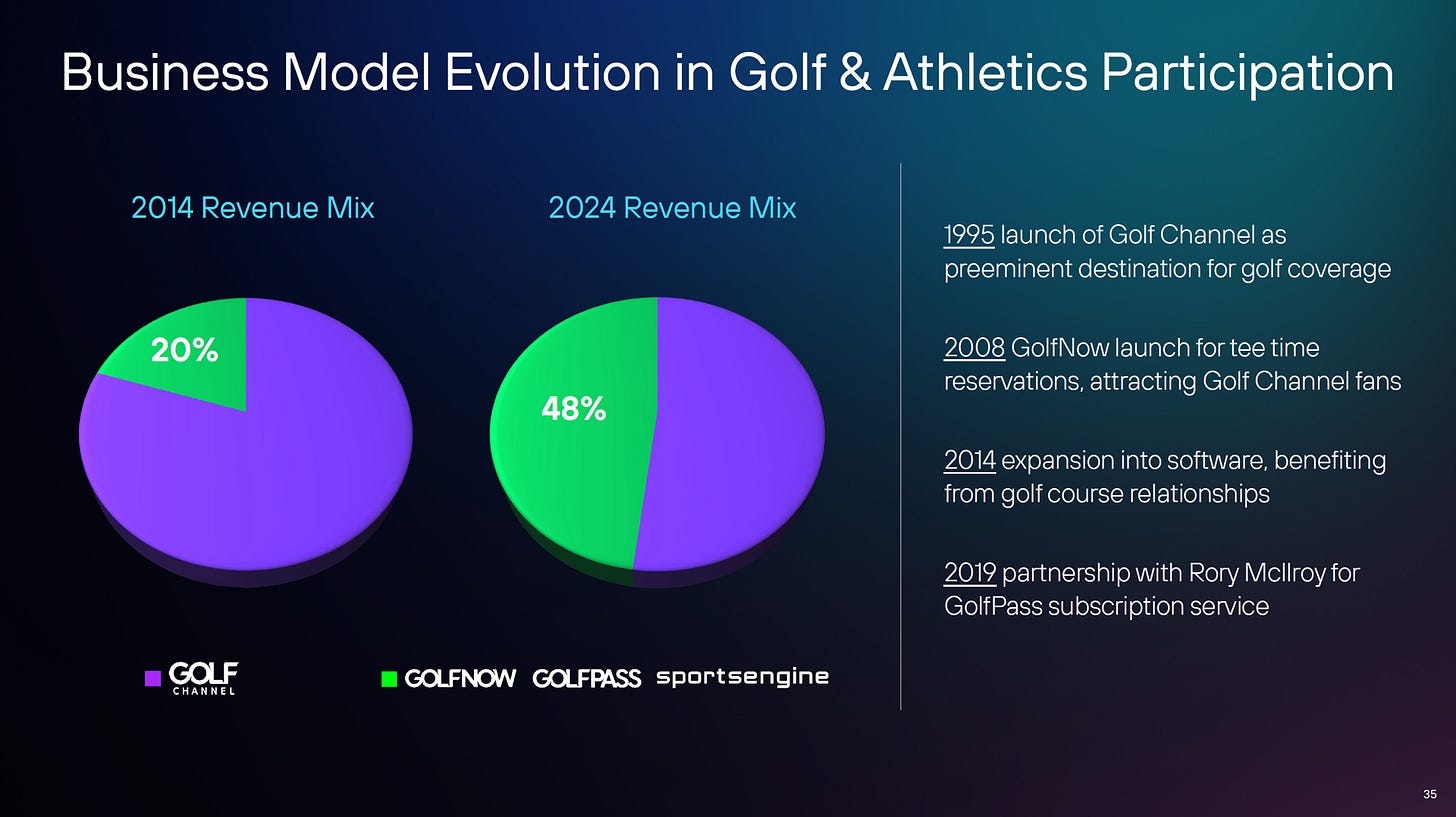

Golf’s Revenue Mix Mystery - Pg. 36

Organic vs. Acquired: We don’t know if “GolfNow” and “GolfPass” grew because the businesses were good or because they bought competitors.

Undefined mix shift: Showing the mix growth of non-TV golf assets (20% to 48%) without dollar amounts hides the reality.

The Legacy of NBC Support - Pg. 48

The NBC Halo Effect: Versant airs Premier League and Olympics coverage solely because of its former parent, NBCUniversal. Those are some of the most expensive sports rights packages on earth that VSNT will not be able to afford without a deep-pocketed owner.

The 2028 Cliff: Once the separation agreement ends, Versant loses the bidding power of the NBC bundle. Expect zero Olympic games post-2028.

The Over-the-Air “Growth” Mirage - Pg. 53

Slide 53 overstates the potential of Versant’s digital multicast networks, which target over-the-air viewers. This is not a significant growth sector.

Low Quality Revenue: Digital multicast networks survive on bottom-tier Direct Response advertising.

Tiny Market: Only 16% of U.S. homes are Over-the-Air only. Growing this share by 3% YoY points vs. 2024 is statistically insignificant and not a trend to get excited about.

FAST > OTA: If you want to invest in growth, buy FAST (free ad supported) channels such as Tubi - don’t bet on Americans all installing digital broadcast antennas.

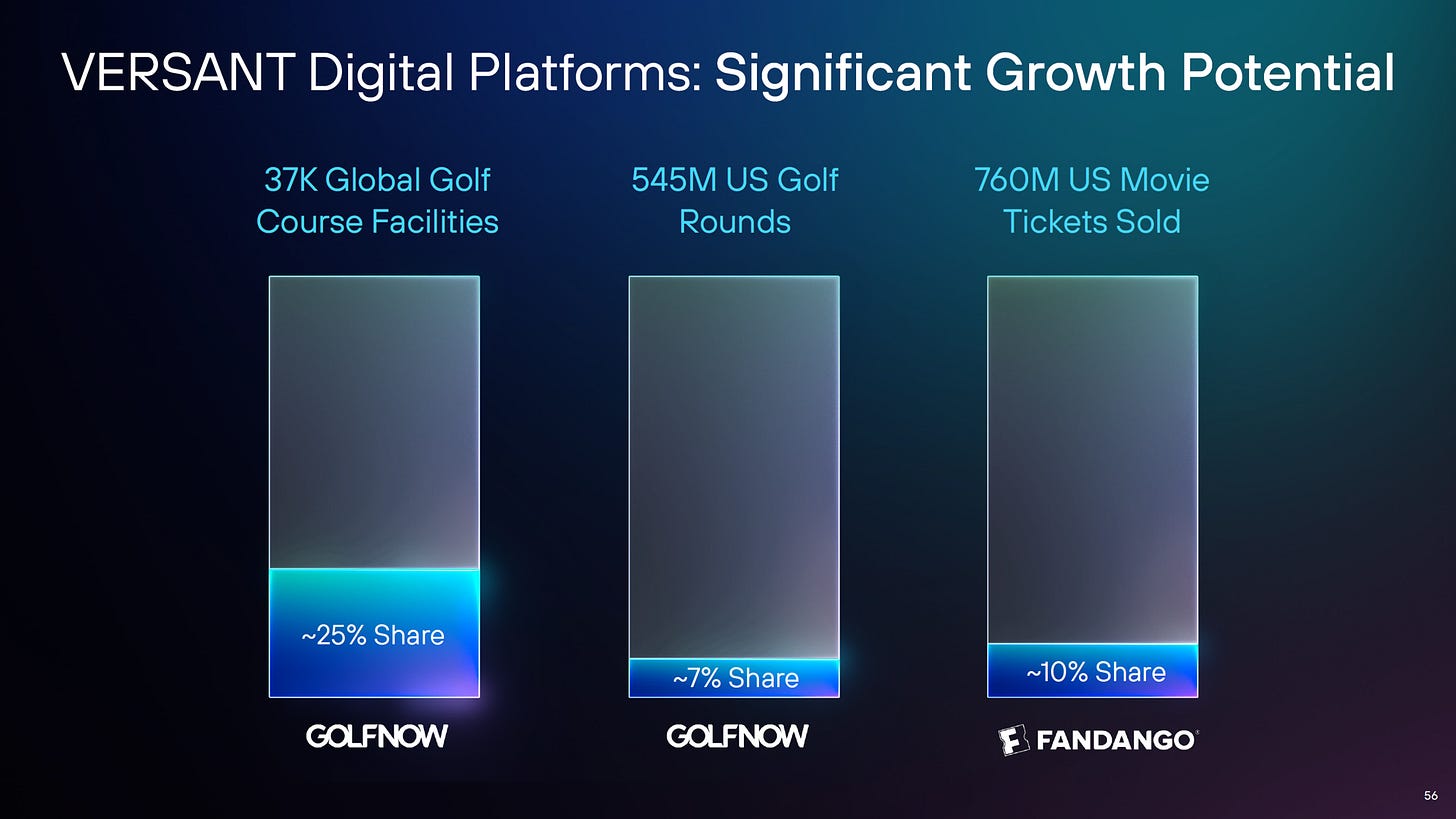

The “White Space” Fallacy - Pg. 56

Misleading TAM: Slide 56 paints all non-Versant market share as “white space.”

Entrenched Competitors: That share is owned by competitors who won’t give it up easily. Not every dollar is up for grabs.

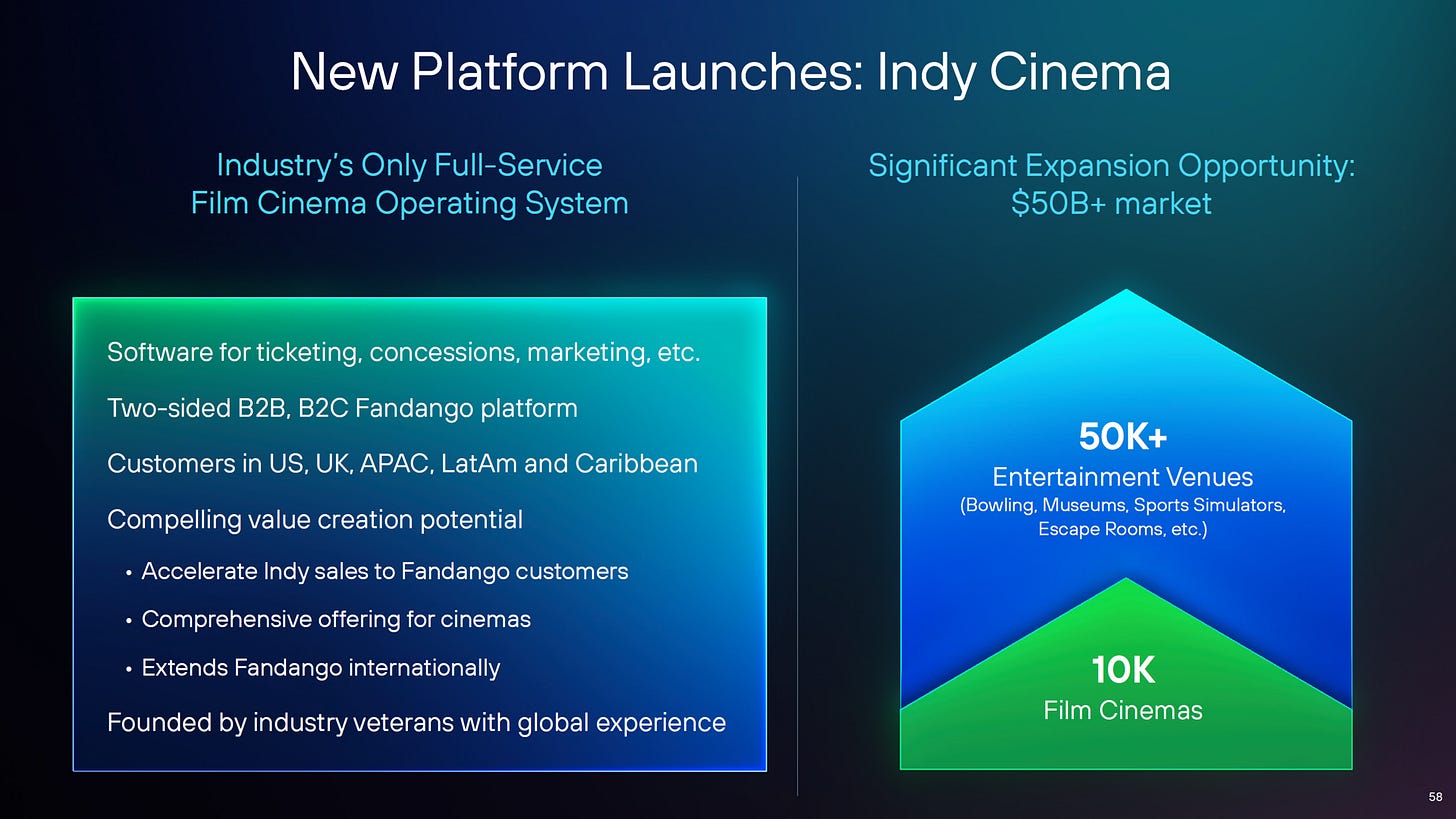

Indy Cinema & The Bowling Alley Pivot - Pg. 58

Slide 58 is trying to make a bullish case for their most recent acquisition, Indy Cinema.

Bad Timing: Investing in theatrical operating systems during a box office collapse is questionable.

Desperate Pivots: Targeting bowling alleys and escape rooms is not a growth strategy; it’s a sign of a limited TAM.

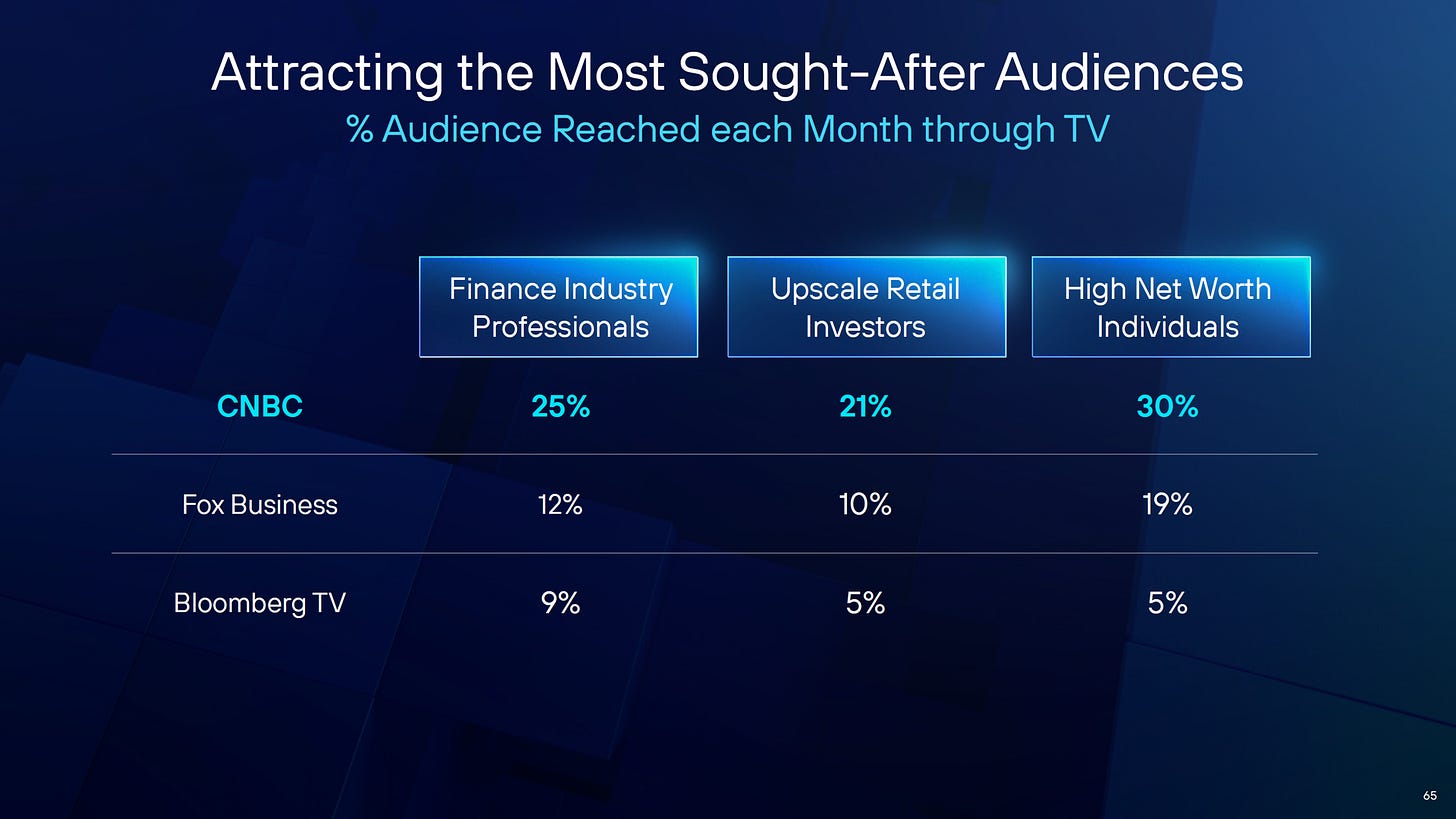

CNBC’s True Moat - Pg. 65

CNBC’s true value is that it commands the attention of high-net-worth individuals that marketers would love to target.

The CPM Story: This is the only valid bull case. CNBC commands premium ad rates because it reaches the C-Suite.

Trophy Asset: A buyer will pay for the audience, not the cash flow. This is the best rebuttal I can come up with, as to why bulls should push for a sum-of-the-parts valuation for VSNT.

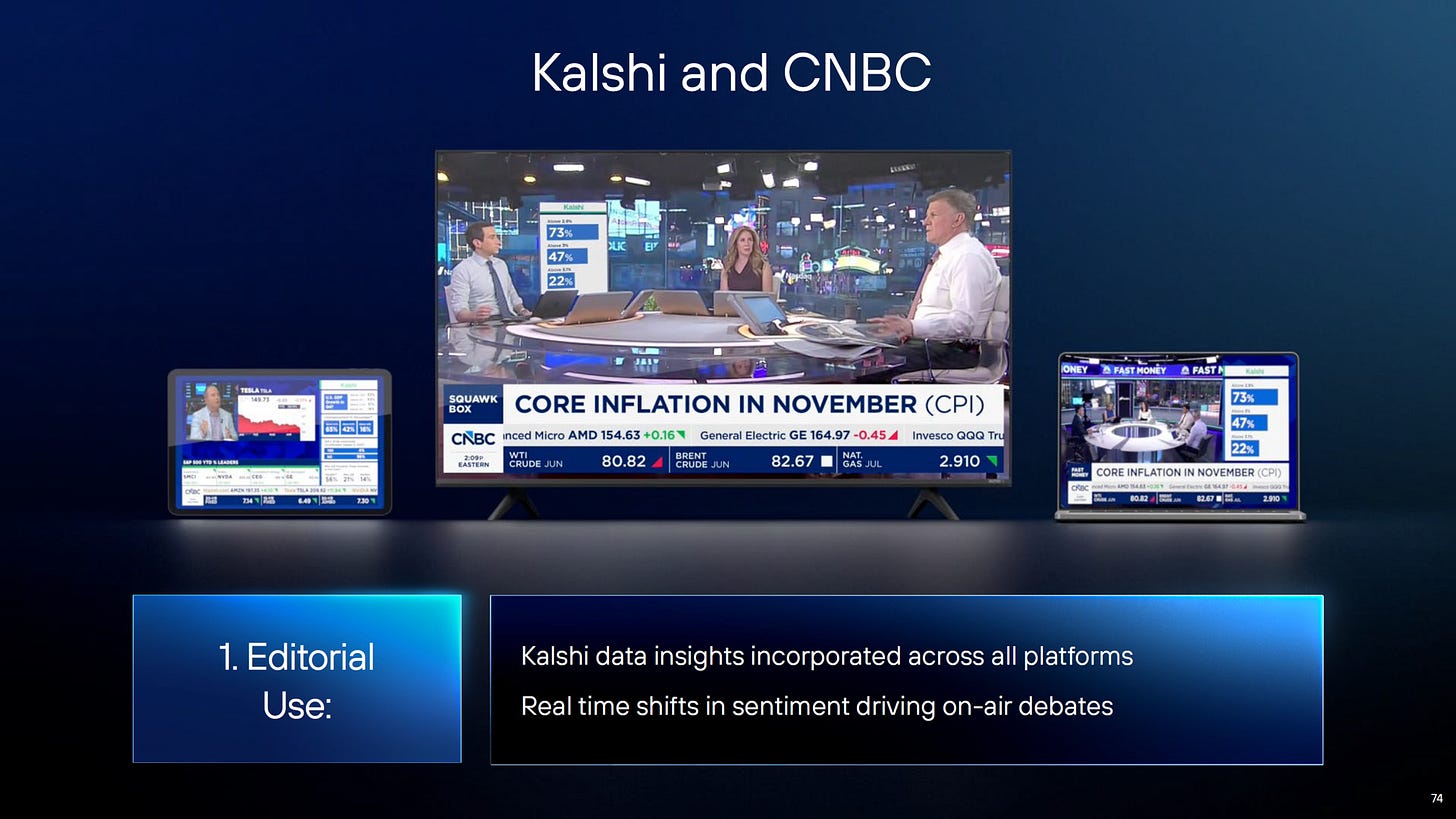

Prediction Markets Partnerships: Who Benefits? - Pg. 74

Versant management is trying to argue that CNBC’s partnerships with prediction markets, such as Kalshi, are a strategic benefit that is going to grow the business. I tend to disagree.

Legitimacy Transfer: CNBC legitimizes Kalshi; Kalshi does not drive viewers to CNBC.

Cannibalization: Showing odds on TV just reminds viewers they can get better data faster on their phones.

The Limits of DTC Subscriptions - Pg. 79

Versant is making the case that CNBC has the potential to sell a lot of DTC (direct-to-consumer) subscription products to their very affluent, highly educated audience base. Where I disagree is that I just do not think that CNBC is the brand that they are going to turn to make their investment decisions.

Brand Mismatch: Retail investors want stock picks, not editorial opinions.

Value Proposition: People watch for the CEO interviews, not the anchors. You can’t put guests behind a paywall.

MS NOW: Fighting for Attention - Pg. 92

Losing Relevance: Political discourse is increasingly moving to digital-first platform such as YouTube and social media, not cable news.

Subscale Branding: Comparing MS NOW to “The Joe Rogan Experience” backfires. It highlights that culture has moved to podcasts and areas outside of the cable bundle.

MS NOW touts more YouTube views than CBS, NBC, and ABC combined, suggesting advertisers would be better off simply advertising on YouTube. This reinforces my pick of Google as a top pick for 2026.

Podcasts Don’t Make Money - Pg. 99

Frankly, for anyone looking for multi-billion dollar advertising markets with scalable growth, let’s be clear: the podcast industry in 2026 is not a significant source of high-level revenue.

Video Killed the Audio Star: Audio podcasts are low-revenue. The money is in video (YouTube/Spotify).

News Credibility Does not Equal Profit: Highlighting podcasts proves news credibility but adds zero material value to the stock.

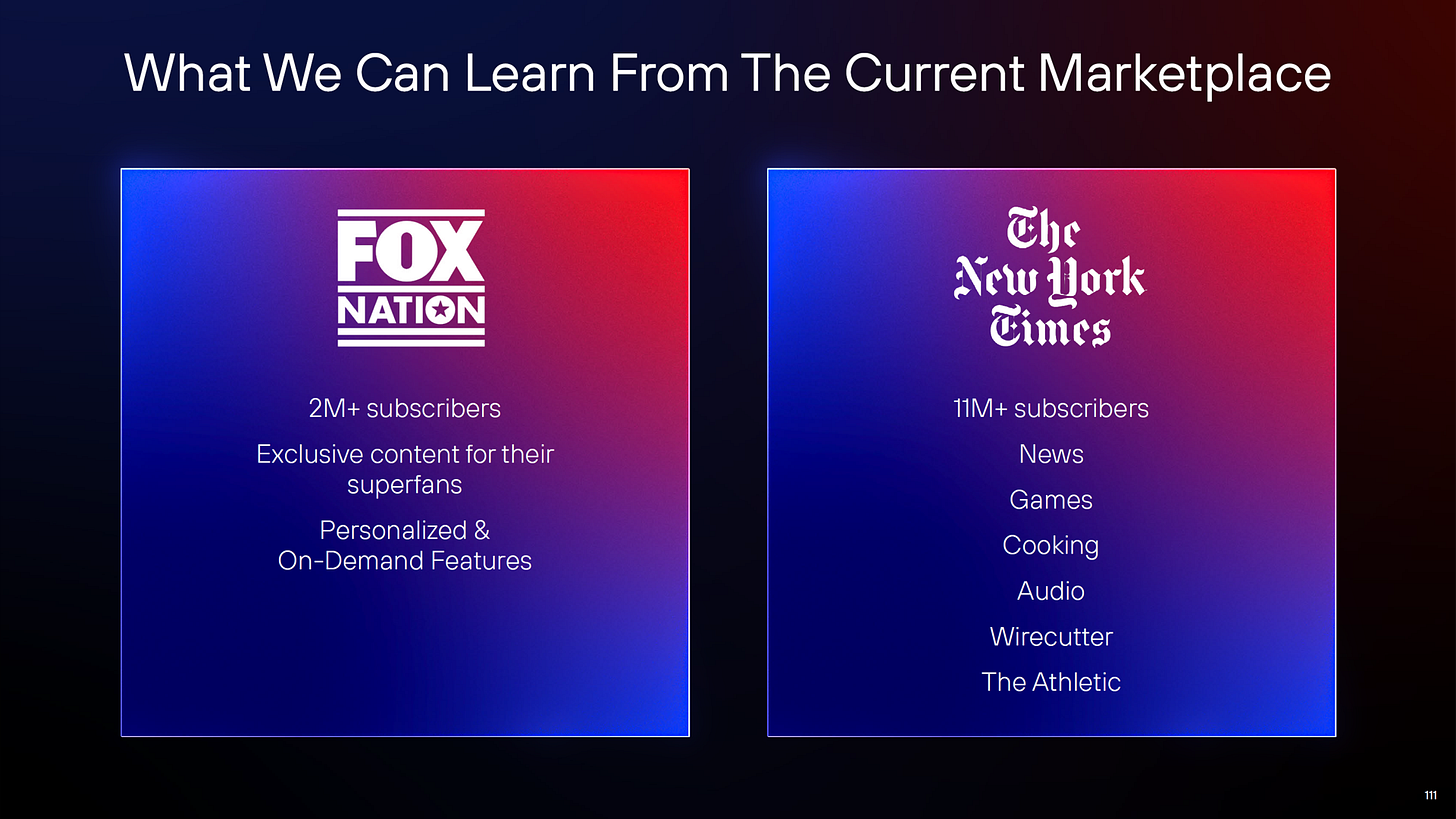

Wrong Comparisons - Pg. 111

Fox News is unique because it has a strong cultural relationship with its audience that is different from every other news network in the U.S.

Cult vs. Commodity: Fox News has a cult following; MS NOW does not.

NYT is a Game Company: The New York Times grows via Games and Cooking. MS NOW has neither.

Golf Metrics: More Context Needed - Pg. 129

Slide 129 highlights Versant’s golf assets, specifically GolfNow and GolfPass. However, this presentation lacks crucial context.

Lack of Trend Data is Bearish: Without golf trend data, we cannot ascertain if metrics such as total rounds or total golfers are experiencing growth—whether rapid, slow, or stagnant—or if they are declining like VSNT’s other businesses.

Evaluating Golf Now is hard because most Versant analysts specialize in covering media businesses. This is another reason I believe the asset will be sold to a more relevant buyer.

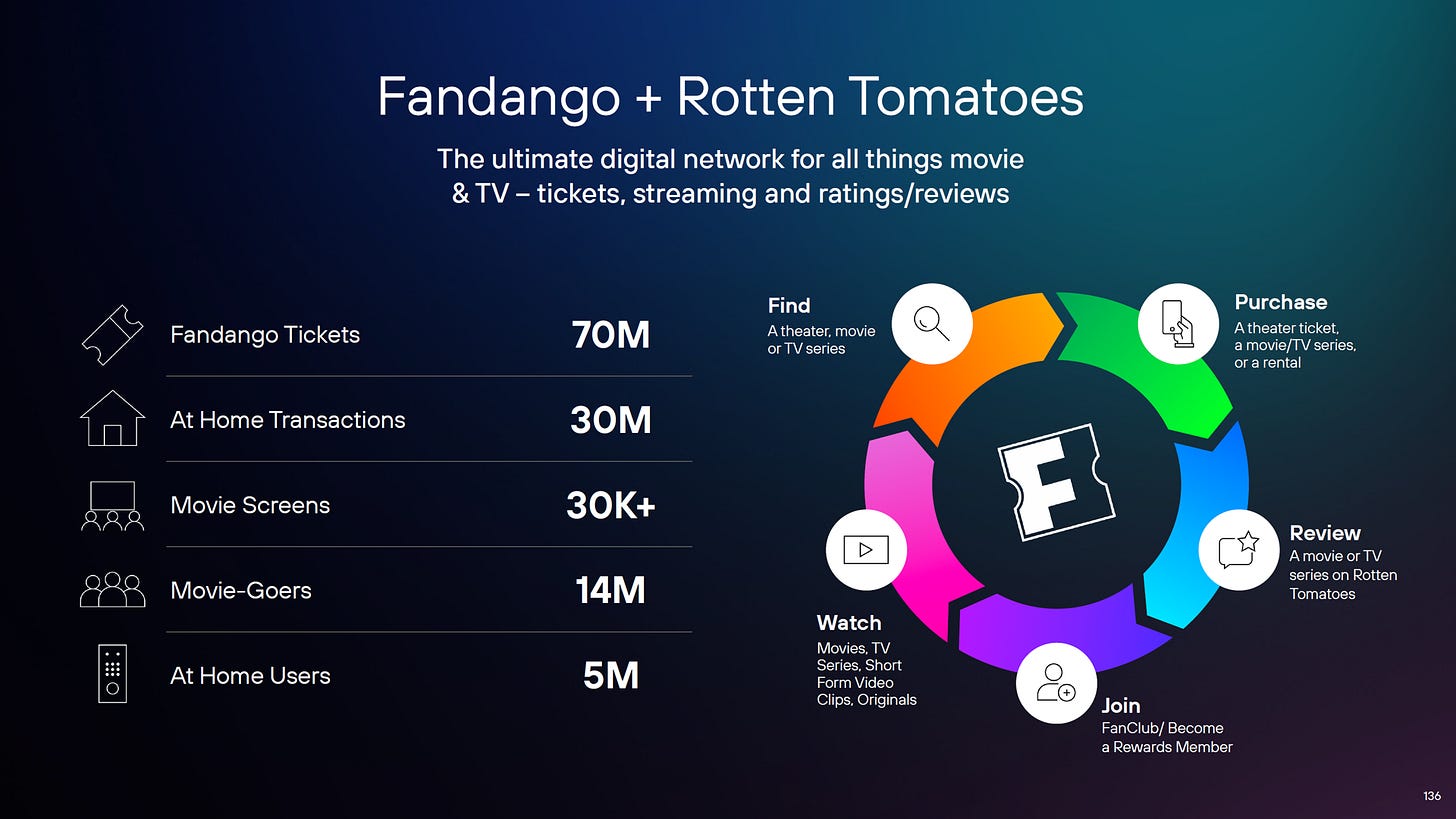

Fandango: Secular Decline Masked as Synergy - Pg. 136

No Synergy: Fandango (tickets) and Rotten Tomatoes (reviews) are not a flywheel.

Decline Everywhere: Ticket sales, screens, and moviegoers are all in secular decline.

Oligopoly Problem: AMC and Regal push their own apps. Fandango is squeezed. I am not sure how Versant overcomes this fundamental fact.

The AVOD Mirage - Pg. 141

It is comical to portray Versant as having an AVOD (advertising video on demand) opportunity through Fandango and Rotten Tomatoes.

Too Little, Too Late: You cannot build a streaming competitor on the back of Fandango this late in the streaming wars.

Better Alternatives: If investors want exposure to AVOD, they can easily buy stock in Roku, ROKU 0.00%↑ or Fox Corp (which owns Tubi), FOXA 0.00%↑.

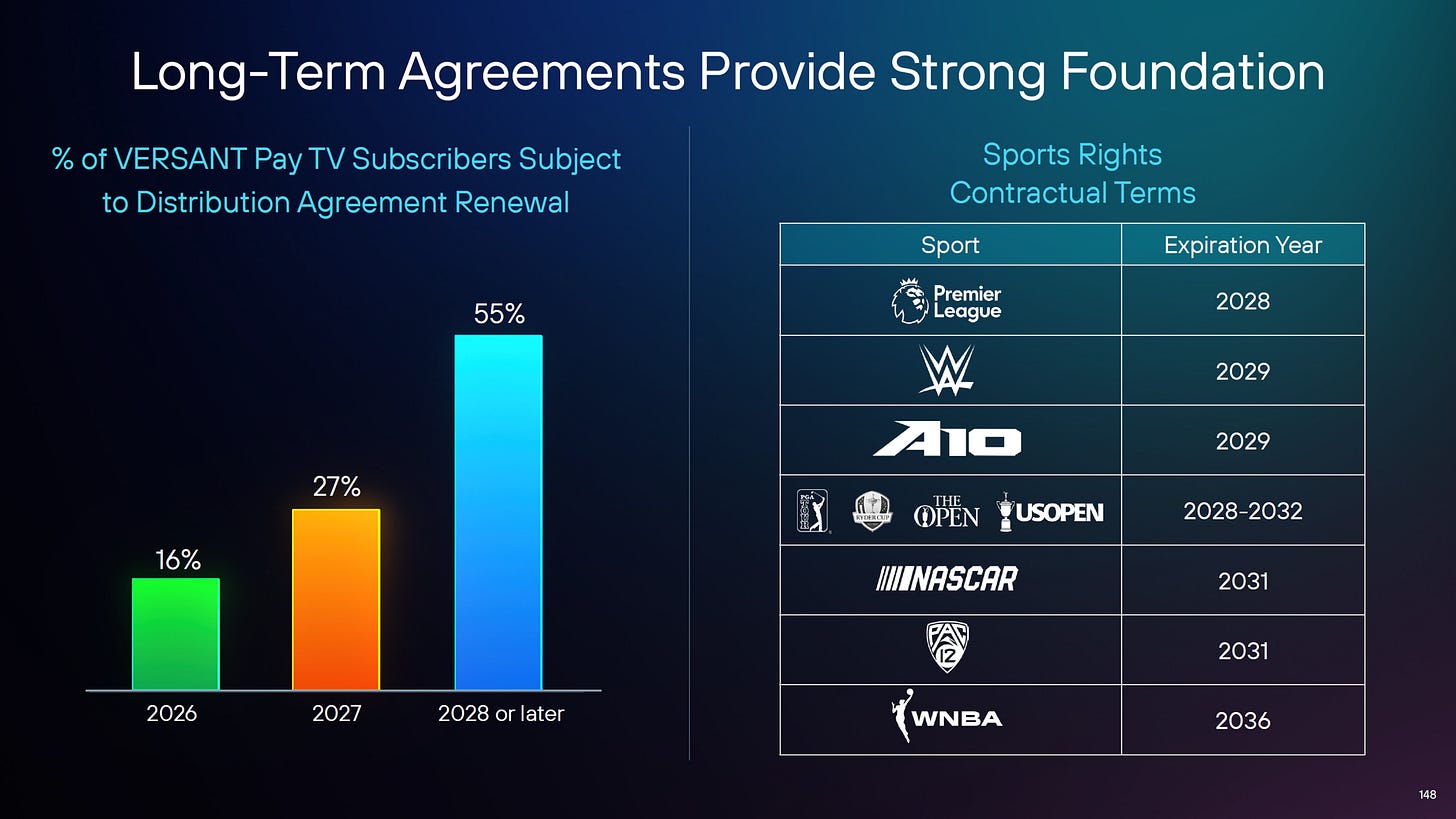

Biggest Red Flag - The 2028 Revenue Cliff - Pg. 148

Versant’s ad sales partnership with NBC Universal ends in 2028. Immediately thereafter, over 55% of its cable carriage agreements and major sports properties, including the Premier League (2028) and WWE (2029), are up for renewal.

Absent NBC’s protection, Versant’s distribution agreements will likely weaken, enabling cable operators to finally cut content costs they have long wanted to reduce.

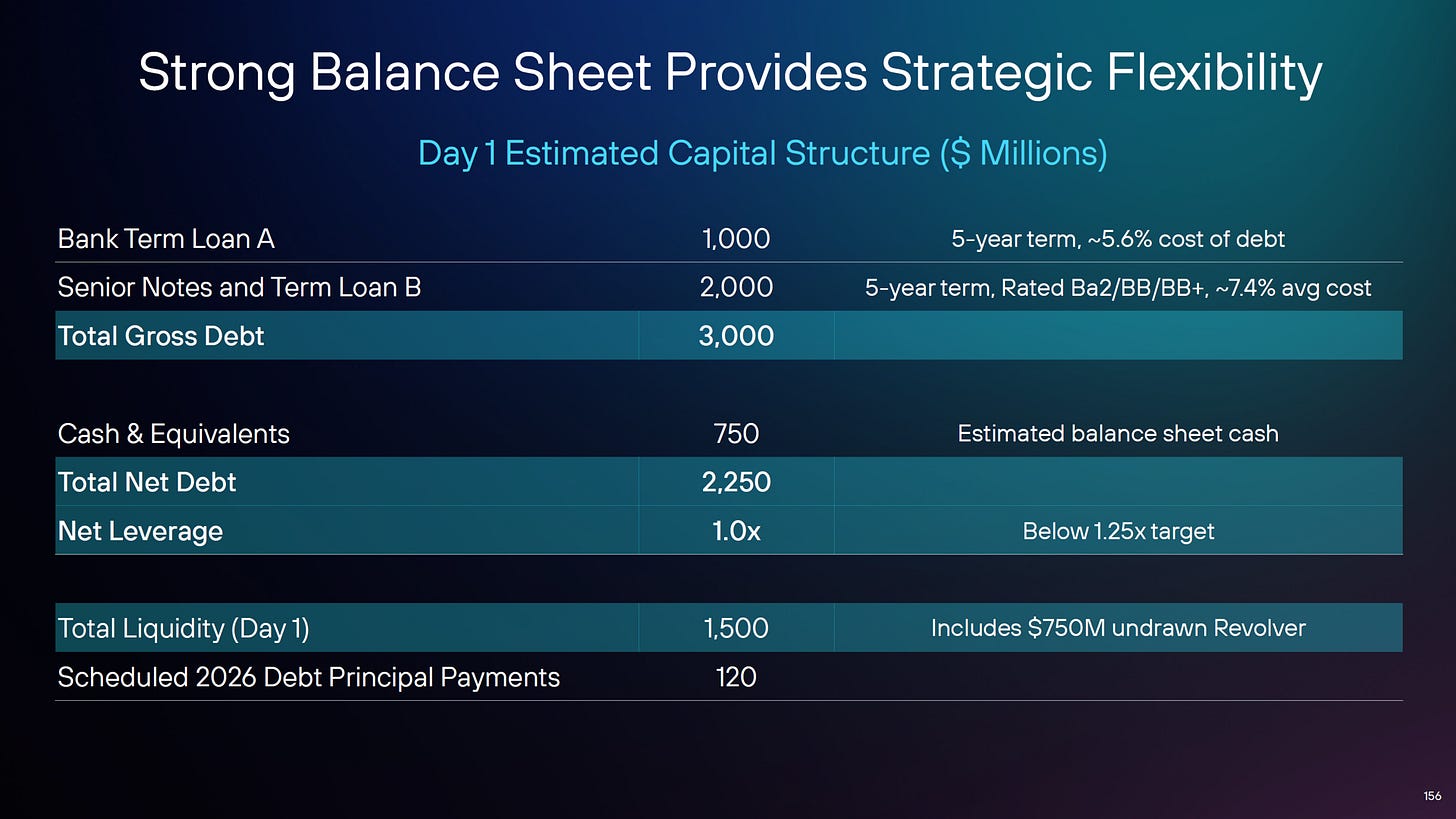

Low Leverage: A Necessity, not a Strength - Pg. 150

Survival Mode: 1.25x net leverage is not “flexibility”— it’s a requirement. They cannot service debt with shrinking revenue.

Negative Operating Leverage - Pg. 151

Versant bulls have been arguing the stock is cheap based on 2025 Adj. EBITDA and Free Cash Flow. However, how much lower could these figures go?

The downward spiral: Fixed costs (sports rights) stay high while revenue drops. Margins will collapse.

VSNT here shows revenue falling -6% in 2025 led to free cash flow falling -15%, more than 2x the top line rate of decline. I haven’t run the numbers yet but what do you imagine the downside to free cash flow will look like in 2026 and beyond?

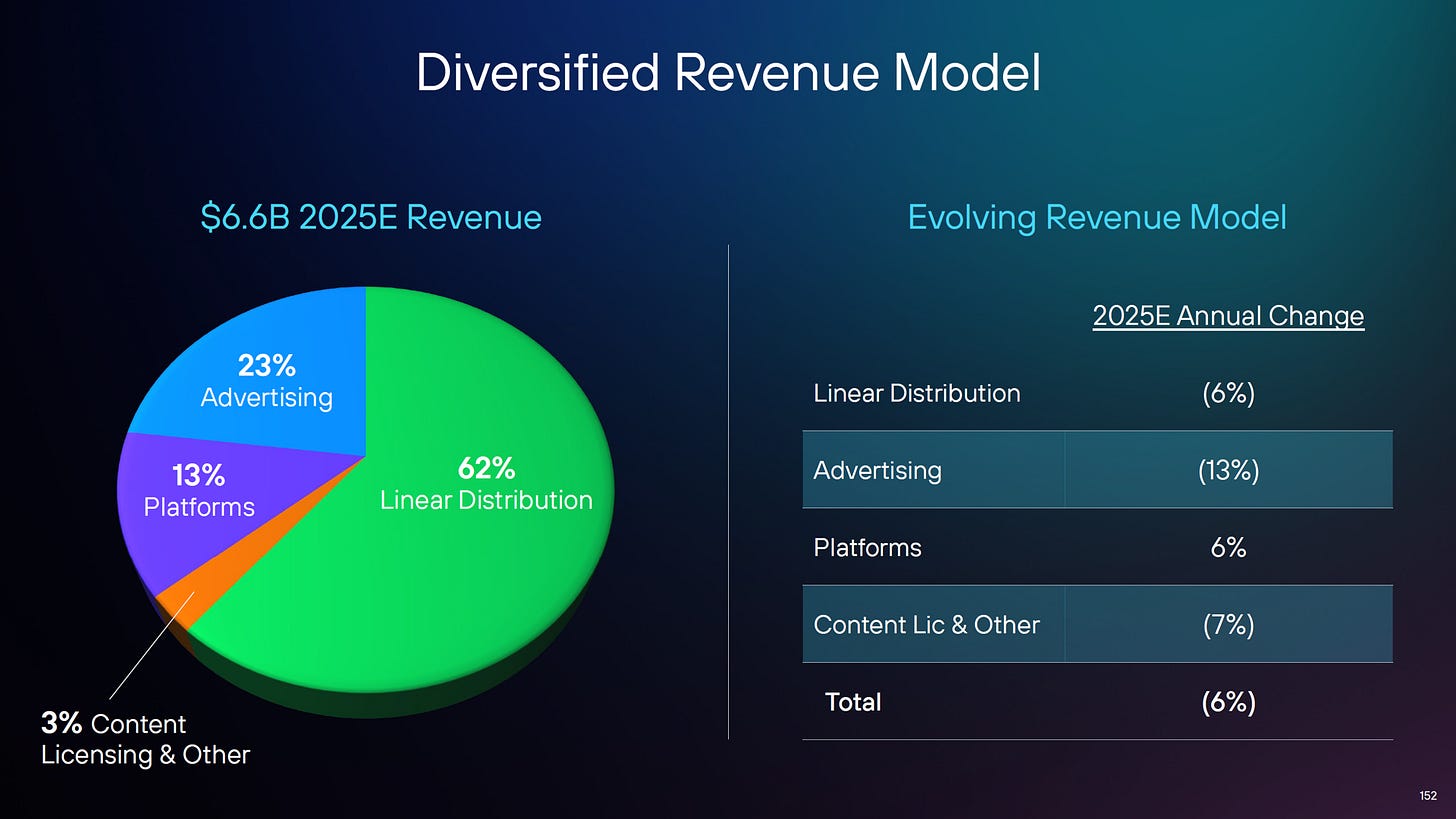

Revenue Decline by Segment - Pg. 152

Revenue diversification provides little benefit if almost all revenue lines are correlated and moving in the same direction.

Linear distribution revenue (monthly subscriber fees) risks falling faster than -6% due to intense competition from YouTube TV and other streamers impacting the cable bundle.

Unfortunately, advertising revenue is declining even faster than distribution revenue.

Ad buyers know they will not be compelled to advertise on Versant platforms once NBC Universal’s leverage is gone in a few years.

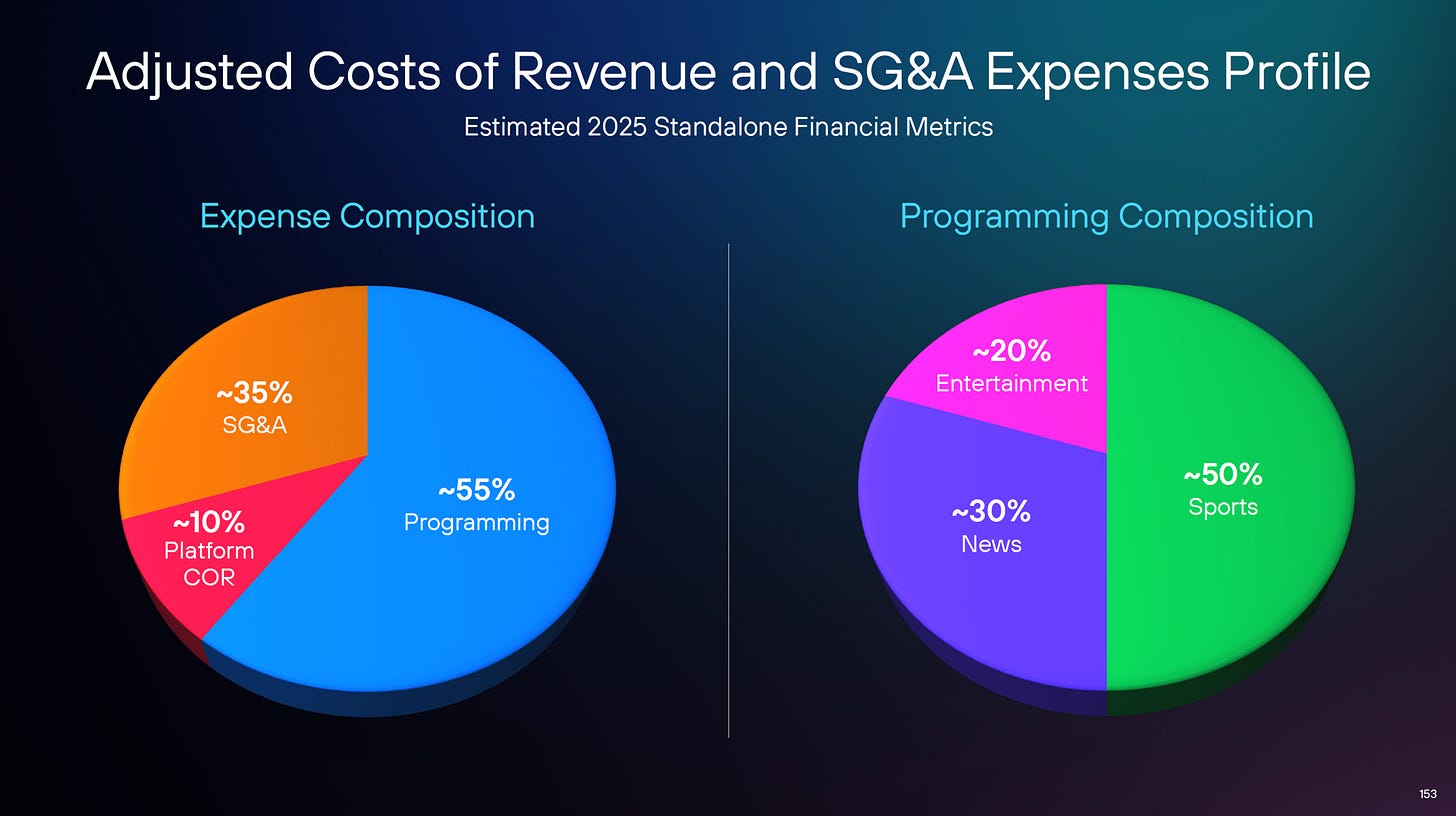

The Cost Cutting Dilemma - Pg. 153

Fixed Costs: 55% of expenses are programming (Sports). These costs are rising due to Big Tech bidding.

Only One Lever: The only thing they can cut is SG&A (people). This confirms the Private Equity playbook: slash overhead, not content.

The Private Equity Playbook - Pg. 156

One of the biggest benefits Versant has going for it is starting with a relatively underlevered balance sheet.

The Real Plan: Private Equity is the only viable exit.

The Mechanics: 1) Lever-up (from 1.0x to 5-6x), 2) Dividend recap to pay themselves back, 3) Strip and sell the parts (Golf, CNBC), etc.

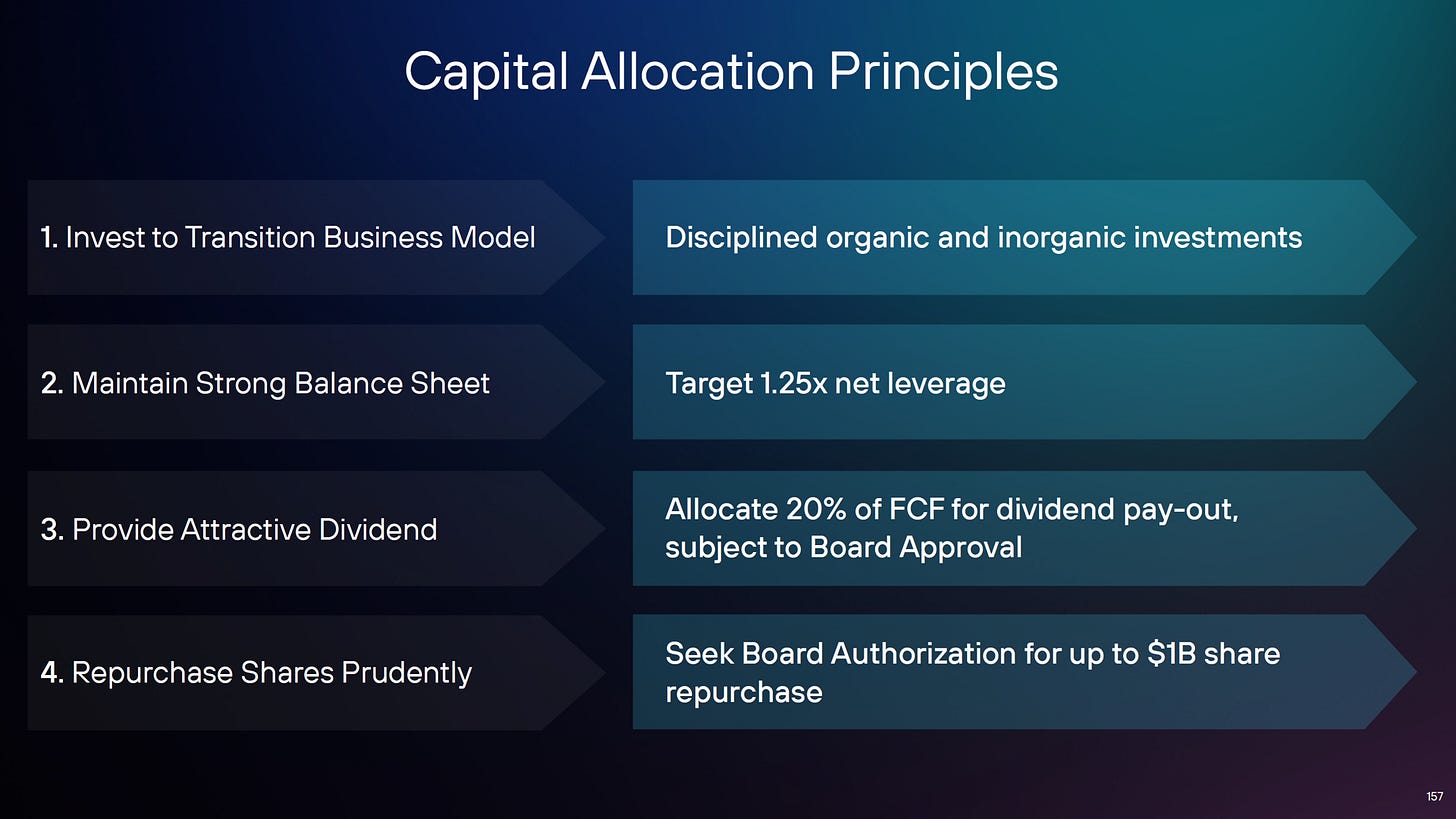

Financial Engineering is Not a Strategy - Pg. 157

Saying that they will be “disciplined” with their investments is a tacit acknowledgement they won’t do anything drastic before a post-2028 take-private transaction.

Defensive Buybacks: Buying back stock is a short-term bid to prop up the price, not a strategy.

Maximize Equity: The goal should be equity creation for a sale, not defending a daily stock price.

Catching a Falling Knife - Pg. 159

The financial outlook for 2026 on page 159 explains the biggest reason Versant’s earnings multiple will stay low.

2026 Outlook: Revenue down -3% to -7%, YoY. FCF down -13% to -27%, YoY.

No Multiple Expansion: Investors will not pay a premium for a business shrinking free cash flow at double-digit rates.

Verdict: Wait for the inevitable breakup in 2027-2028.

CONCLUSION

Versant is a subscale entity caught in a brutal cycle of negative operating leverage. When single-digit revenue leaks trigger double-digit free cash flow floods, you aren’t looking at a “transformation”—you’re looking at a structural trap.

However, this deep dive was essential. By stripping away the “Logo Soup,” we can focus on the assets that should be sold vs. the ones that need to be harvested for cash.

What’s Next:

Part Two: I’ll drop my formal stock pitch, synthesize these findings, and explain why the stock’s “low multiple” should not make you complacent.

Part Three: I will lay out the exact strategy I would use to dismantle this company and unlock the equity if I were advising the board.

Remember - don’t catch the falling knife before you know where the floor is!

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

You can always reach me at simeon@accruedint.com.

Thank you for covering this company! Not much analysis on it yet from others

The 2028 cliff analysis is brutal. That's basically the entire thesis, once the NBC protection disappears and 55% of carriage deals come up for renewal with no leverage, the bottom falls out. The negative operating leverage math (6% revenue drop causing 15% FCF decline) confirms this isn't just declining, its accelerating downward. What I dunno if PE will even want to touch this given how capital intensive sports rights are.