Why Pinterest Will Underperform in 2026 ($PINS)

12 Days of Pitch-Mas Day 10

For Day 10 of the 12 Days of Pitch-Mas, I am predicting Pinterest will underperform the market for 2026 because the stock is a value trap. Despite having optically healthy financials, the business has reached a growth plateau because its user mix is increasingly shifting towards international markets that monetize at a fraction of what they earn from an American or European user.

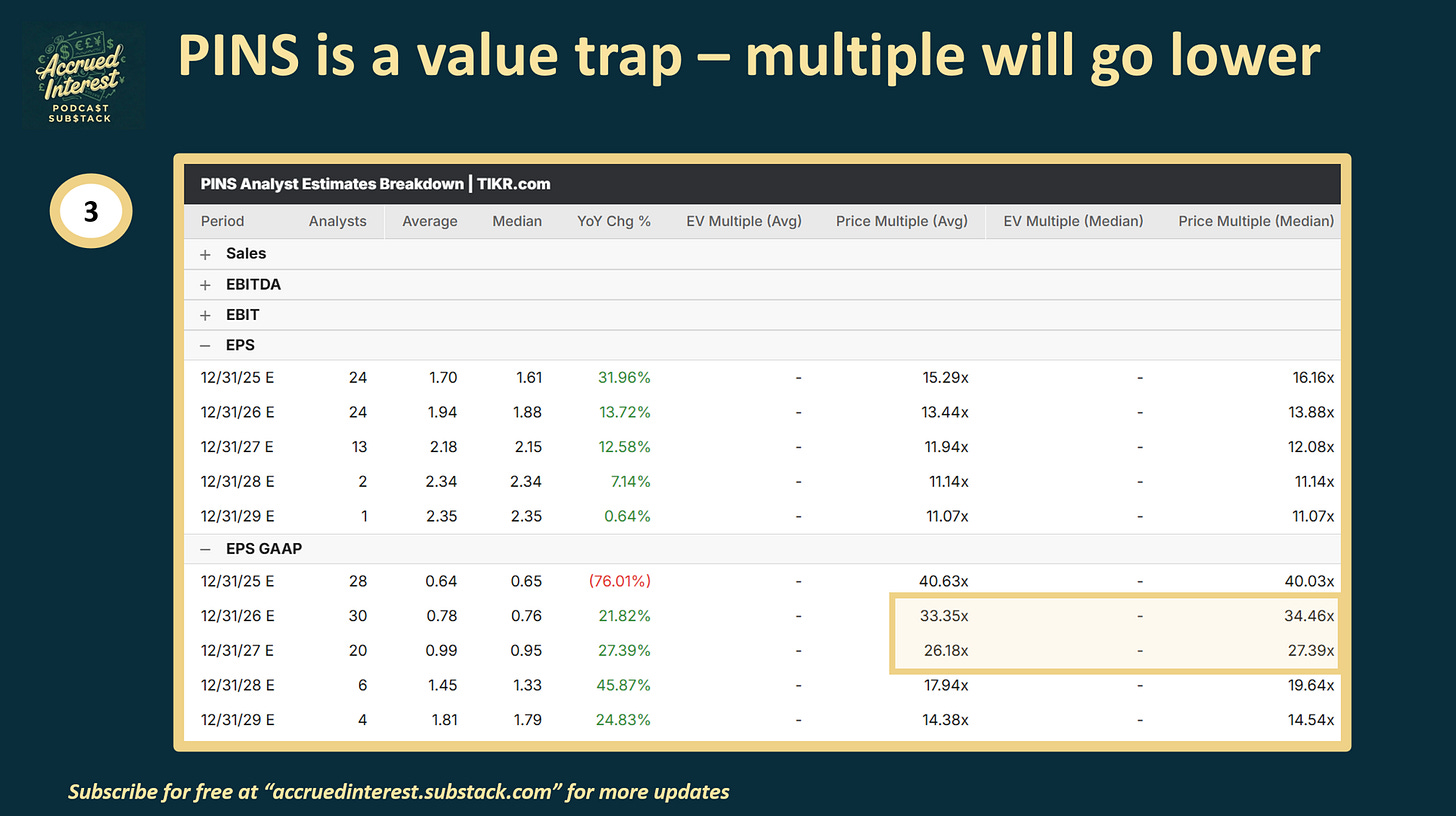

In addition, Pinterest faces the risk of being a long-term “AI loser.” Because Pinterest is primarily a platform people use for discovery, they are at risk as more people use AI-driven recommendations to help them find content. Not to mention the potential that Pinterest is cut out if people use AI agents to do discovery and shopping for them. Trading at $26 a share, ~34x 2026 GAAP EPS, I expect the multiple to contract as revenue growth inevitably slows.

Despite being down -10% for the year, here are three reasons why I believe Pinterest has more downside in 2026.

1.The “Empty Calorie” Growth Problem: Users Are Growing, But Revenue Isn’t Following

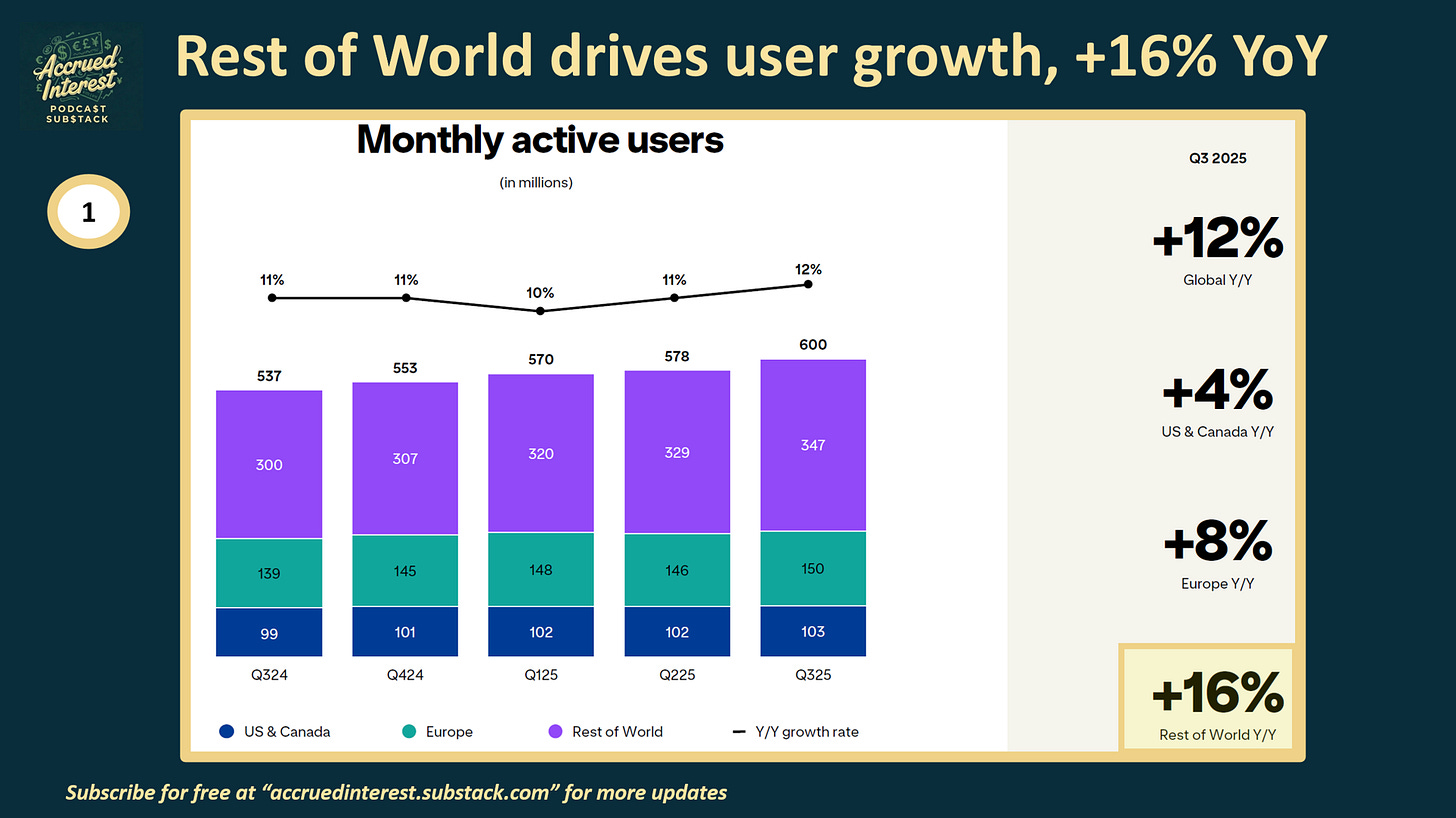

The headline number for Pinterest looks great: 600 million monthly active users (MAUs). However, not all users are created equal in the eyes of the monetization Gods. The growth story is misleading because the newest users are not the ones driving the free cash flow of the business.

The U.S. Plateau: The high-value North American market—the engine of Pinterest’s profitability—is clearly stalling. U.S. & Canada MAUs grew only +4% YoY for Q3-2025. This is a mature market, and without significant user growth here, the company is relying entirely on squeezing more dollars out of the same people.

The “Rest of World” Dilution: Pinterest’s user base is growing fastest in regions where they make pennies on the dollar. In Q3-2025, Rest of World (ROW) users grew +16% YoY to 347 million, making up nearly 60% of the total user base.

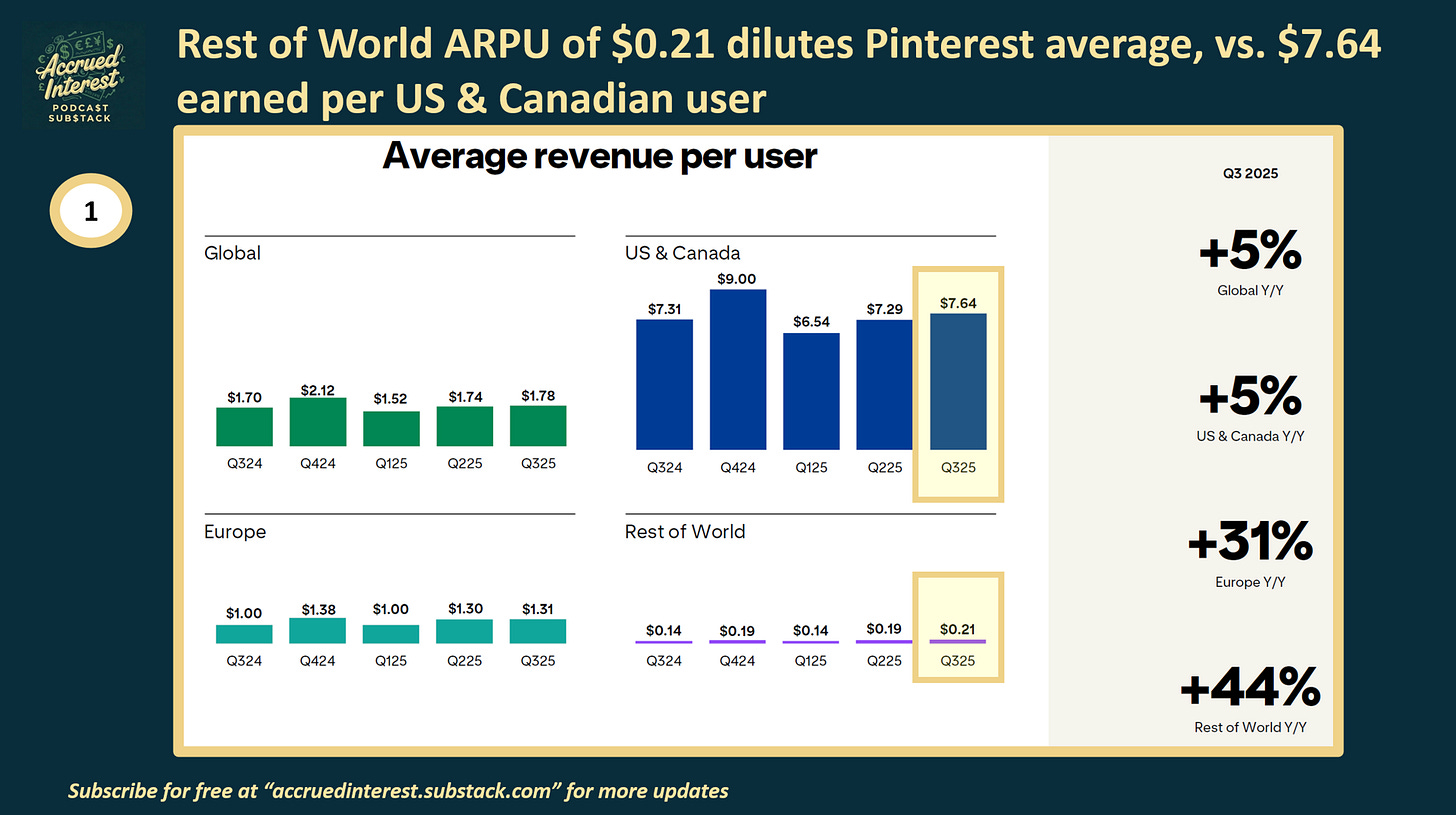

Average Revenue Per User (ARPU) for these users is only $0.21. Compare that to the U.S. & Canada ARPU of $7.64. This effectively means that Pinterest is adding millions of users each quarter who barely move the revenue needle.

Ad Pricing Pressure: Because the mix of ad impressions is shifting towards these lower-monetizing international users, Pinterest’s overall ad pricing is taking a hit. In Q3-25, ad pricing declined -24% YoY. They are serving +54% more ad impressions just to keep revenue growing, which is the definition of “hustling backwards”.

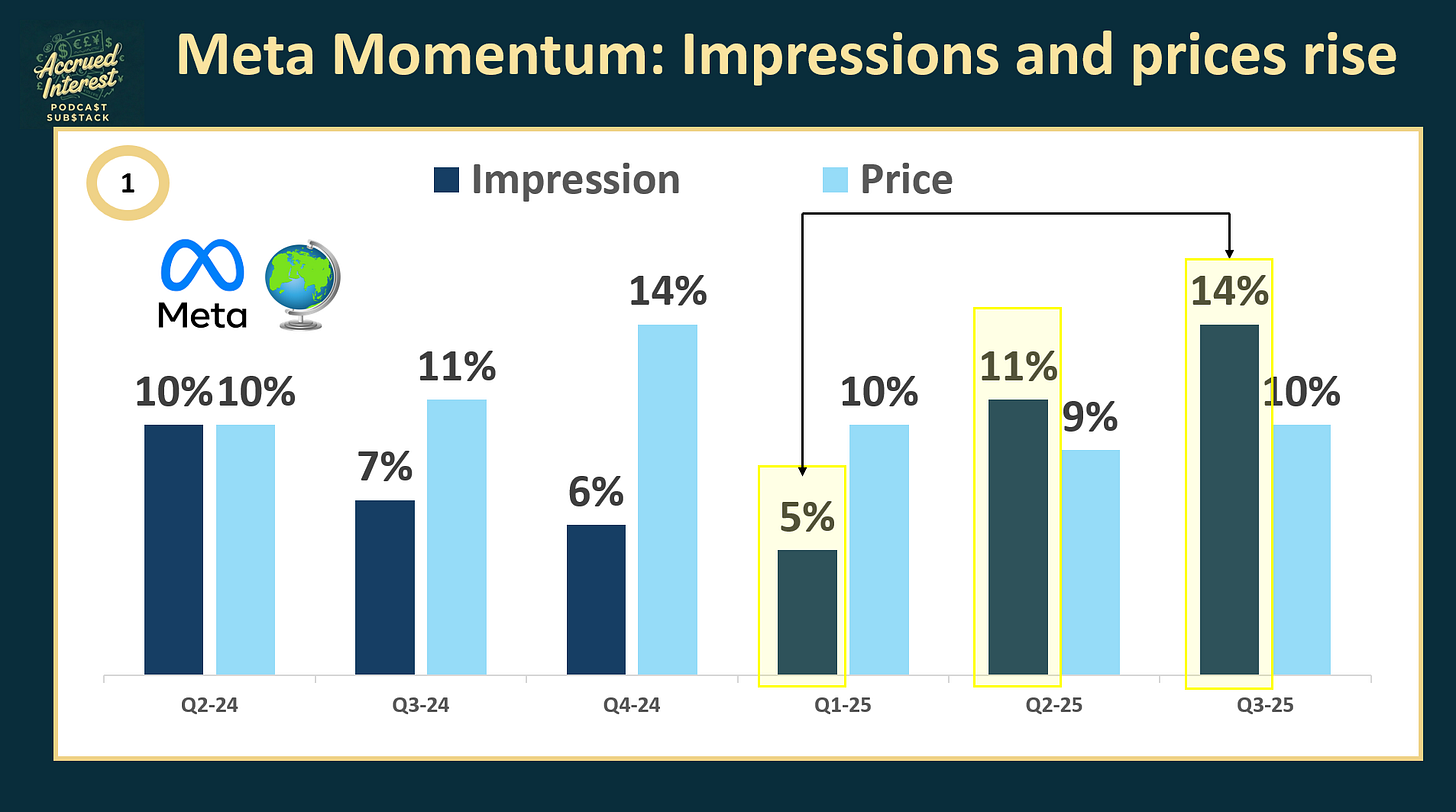

For an example of what healthier revenue growth looks like - check out my article from the 5th Day of Pitch-Mas, Why Meta Will Outperform in 2026 ($META). You will notice that for Meta’s revenue mix, both impressions and pricing are showing growth year over year. Ideally you do not want either of those metrics to turn negative, like we are seeing here with Pinterest.

2.The Existential Threat: Pinterest is an “AI Loser”

Pinterest is another digital media company that is squarely in the crosshairs of potentially being disrupted by AI. The entire premise of Pinterest is visual discovery—scrolling through digital vision boards to find inspiration. AI is fundamentally changing that behavior across the internet. Pinterest is fighting a war on two fronts: against improved traditional search and against new AI behaviors that bypass “browsing” entirely.

Search is Changing: CEO Bill Ready talks about Pinterest being distinct from more traditional Google Search, but I strongly disagree.

As I outlined in my article from the 3rd Day of Pitch-Mas, “AI advancement is expanding search engines beyond text, allowing Google to use Search to find information in videos, images, and the real world.”

As users shift to ChatGPT or Gemini for “discovery” queries, Pinterest loses top-of-funnel traffic that it desperately needs to feed its ads business.

The “Agentic” Commerce Risk: As AI agents become smarter in 2026, the “search and scroll” model is in danger. If I can just tell an AI agent, “Find me a 3-D printed Pokémon-inspired cellphone charging station under $100,” and it instantly surfaces the best options from across the web, why do I need to spend 20 minutes scrolling through Pinterest boards? The “inspiration” phase is being compressed by AI efficiency.

Lack of First-Party Data: Analysts have rightly pointed out that in an AI-driven ad world, the platforms with the best “purchase data” demand a premium. Amazon knows what you bought. Meta knows who you are. Pinterest only knows what you looked at. That’s a weaker signal for training AI ad models, making their ads less efficient compared to other, larger digital media competitors.

3.Pinterest is a Quintessential Value Trap

PINS stock, PINS 0.00%↑ is currently $26 per share. Bulls will tell you the stock is cheap on an adjusted basis, trading at 14x 2026 non-GAAP EPS. But low multiples on a structurally challenged business are the classic signature of a value trap.

Little Margin of Safety: To be conservative, let’s look at GAAP EPS, and by that measure the stock is trading at roughly 34x 2026 GAAP EPS (based on ~$0.75-$0.80 median estimates). That is not cheap enough for a company with decelerating high-value growth. If revenue growth slips because of the international mix shift, that multiple could easily compress to 20x or lower.

The “Profitless” Pivot: Management is pivoting hard to “Performance Advertising” to compete with Meta, but this is expensive. They are ramping up infrastructure spend for AI (GPUs, etc.) to power these tools. In Q3-25, cost of revenue and R&D expenses continued to climb as they attempt to keep up. I would expect incremental costs from AI implementation to work against any margin expansion in 2026 and beyond.

CONCLUSION

Reflecting on my posts this year, I find it notable that in June, I began considering a long-term investment in Pinterest in the article Pinterest ($PINS) - Is the Market Wrong? However, my view later shifted, and I ultimately couldn’t support the bull thesis. Although I never formally designated PINS as an “Underperform,” I stopped recommending the stock in late July. This was because I found other digital advertising companies, such as AppLovin, Google, and Meta, to be more compelling opportunities. Ultimately, my investment focus remains on businesses that I believe can sustain double-digit revenue growth for a minimum of the next three to five years.

In 2026, I expect the market to wake up to the fact that international users don’t pay the rent, and AI agents might just do Pinterest’s job better than Pinterest does. I’m avoiding $PINS and looking for better opportunities elsewhere.

If you found this interesting, do not forget to subscribe. And please come back for Day 11 of Accrued Interest’s 12 Days of Pitch-Mas! You can find prior days here:

Day 1 - Why Netflix Should Acquire Warner Bros. NFLX -1.49%↓ , WBD 0.00%↑

Day 2 - Why Paramount Skydance Won’t Win Warner Bros, PSKY 0.00%↑

Day 3 - No Bonus Points for Creativity—Just Buy Google, GOOGL 0.00%↑ , GOOG 0.00%↑

Day 4 - Nexstar + Tegna: Capped Upside and Regulatory Risk, NXST 0.00%↑ , TGNA 0.00%↑

Day 6 - Why Disney Stock Will Underperform in 2026, DIS 0.00%↑

-Accrued Interest