Why Paramount Skydance Won't Win Warner Bros. ($PSKY & $WBD)

12 Days of Pitch-Mas Day 2

Investors were overly optimistic that a Paramount Skydance bid for Warner Bros. Discovery was a foregone conclusion, neglecting to account for the regulatory risks. Yesterday, on Day 1 of Pitch-Mas, I argued that Netflix would be the best owner for the WBD assets. A deal with Netflix faces a much lower probability of regulatory conflict compared to PSKY. Specifically, Paramount’s vertically integrated structure, unlike NFLX, would invite horizontal antitrust scrutiny concerning theatrical market concentration and the consolidation of news outlets CNN and CBS. Lastly, Paramount’s offer introduces risks associated with foreign ownership, whereas Netflix presents a simpler path to approval. For the 2nd Day of Pitch-Mas, I am pitching Paramount Skydance as an Underperform.

Here are 6 reasons why PSKY 0.00%↑ + WBD 0.00%↑ is a riskier deal than NFLX 0.00%↑ + WBD 0.00%↑ .

1. Higher Antitrust Risk (Horizontal vs. Vertical Merger)

The first hurdle for Paramount is that a merger with WBD would be a horizontal merger—combining two direct competitors with overlapping businesses.

Paramount and WBD both own major film studios. Regulators view horizontal mergers with extreme scrutiny because they eliminate a direct competitor, reducing consumer choice.

Advantage Netflix: In contrast, a Netflix/WBD deal is viewed as a vertical merger. Netflix is primarily a distributor. Because Netflix does not have a legacy film studio, there is significantly less competitive overlap.

2. Higher Theatrical Market Concentration

A Paramount victory would drastically consolidate the theatrical movie market, giving the combined entity immense power over movie theaters.

Both Paramount and Warner Bros. are dominant players in theatrical releases. Combining them would allow the new entity to dictate terms to theater chains, creating a potential monopoly in film distribution.

Advantage Netflix: Netflix effectively has 0% market share in theatrical releases. Therefore, acquiring WBD would result in no change to the theatrical market share concentration, making it neutral for theater owners and regulators regarding market power.

3. More Drastic Job Losses

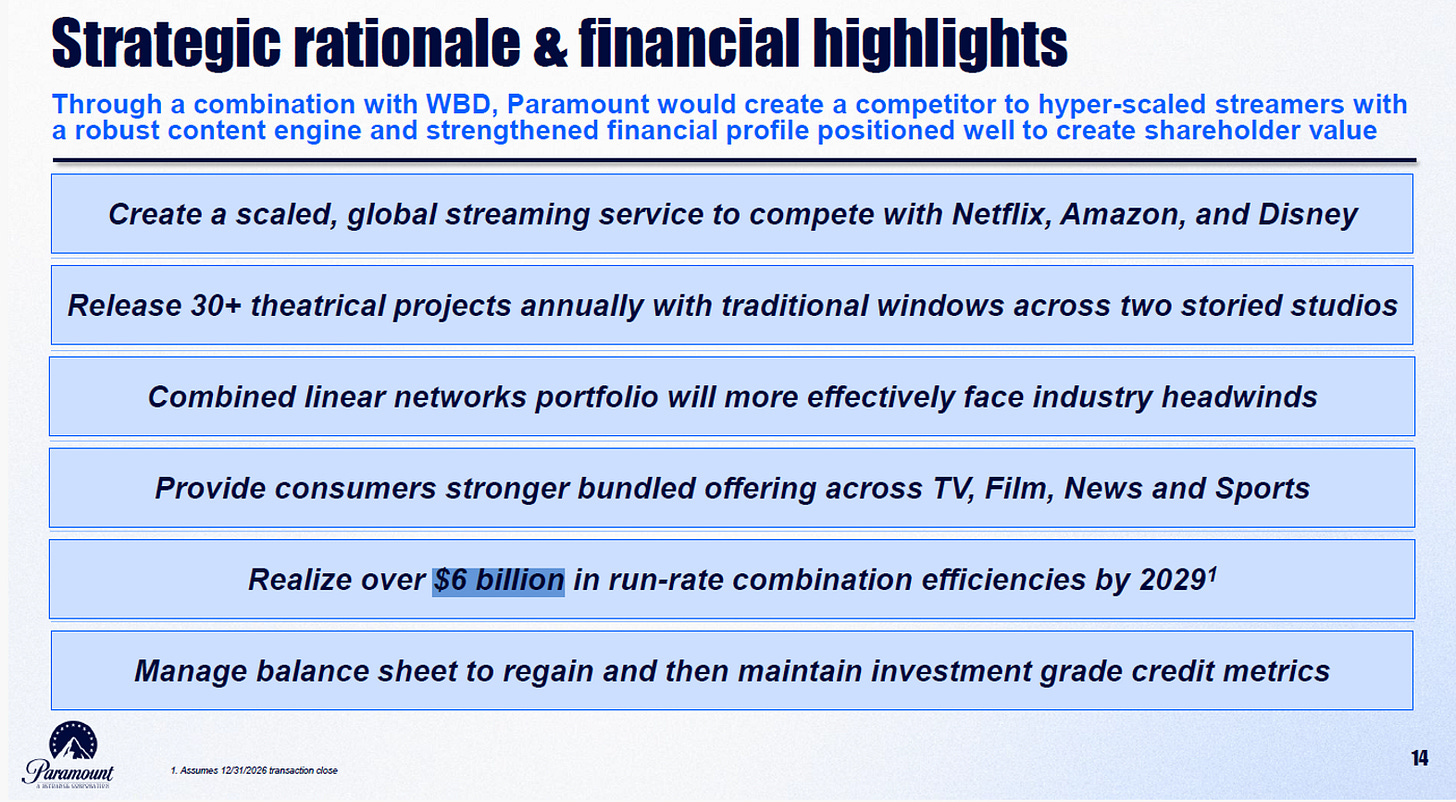

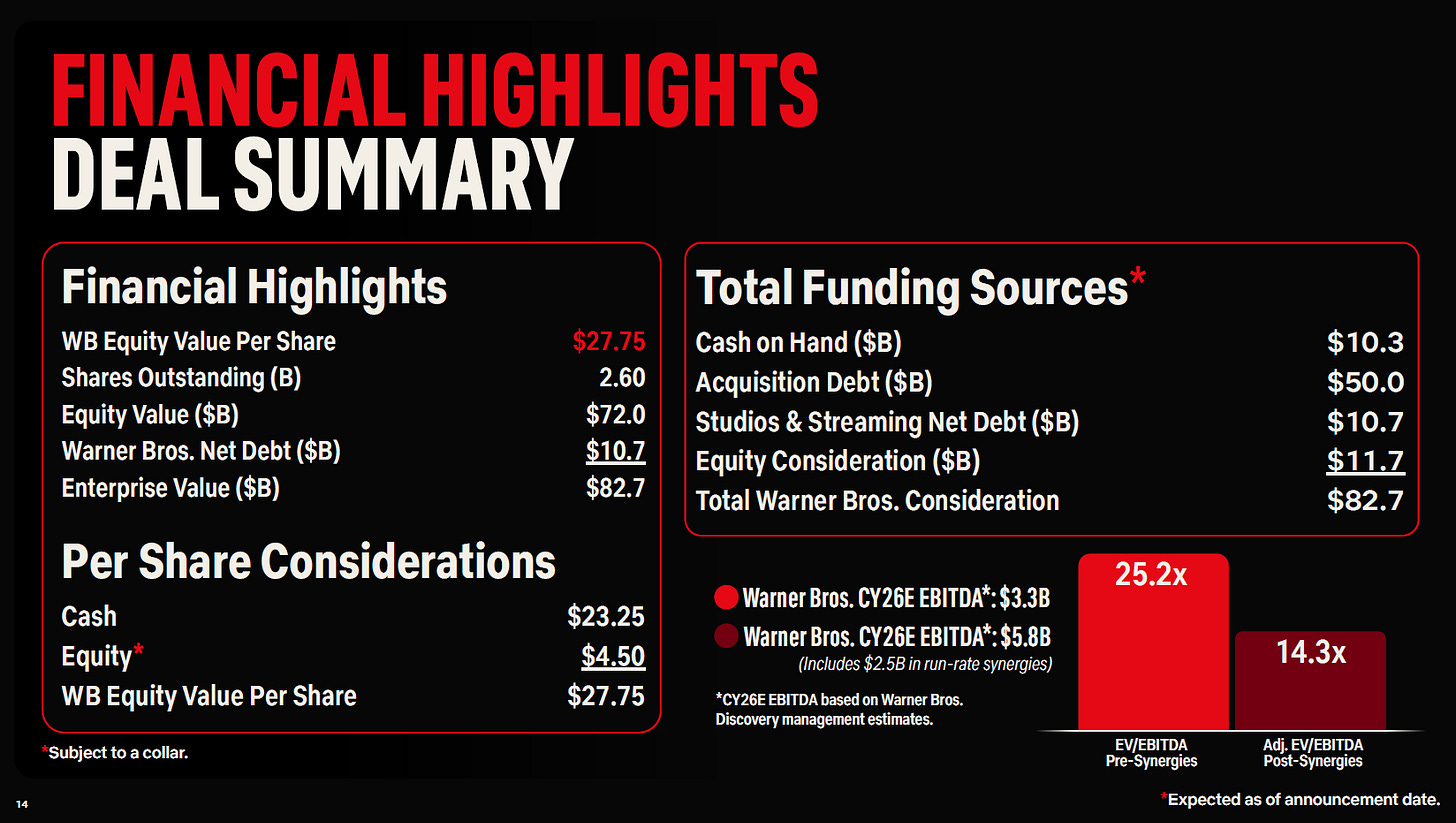

While “synergies” sound positive to investors, to regulators and unions, they signal layoffs. Paramount’s bid relies on aggressive cost-cutting that Netflix’s does not.

Paramount has projected $6 billion+ in cost synergies, significantly higher than Netflix’s projected $2–3 billion. High synergies in a horizontal merger (two studios combining) inevitably mean eliminating redundant departments, leading to mass firings.

Advantage Netflix: Because Netflix does not have a large studio infrastructure, it needs WBD’s workforce to expand its production capacity. WBD employees are far more likely to retain their jobs under Netflix ownership.

4. News Media Consolidation Risk (CBS & CNN)

The merger would combine two of the nation’s largest news organizations, triggering intense scrutiny from the FCC and political watchdogs.

Paramount owns CBS News, and WBD owns CNN. Merging these two distinct major news voices would severely reduce diversity in the news landscape.

Advantage Netflix: Netflix has no news division, so acquiring CNN would present no issues regarding the consolidation of news power.

5. National Security & Foreign Ownership (CFIUS)

Paramount’s bid relies heavily on foreign capital, which introduces national security risks that Netflix’s bid avoids entirely.

Paramount’s funding includes billions from sovereign wealth funds in Saudi Arabia, Qatar, and Abu Dhabi. While Paramount claims these investors will waive voting rights, the Committee on Foreign Investment in the United States (CFIUS) may still block the deal due to concerns over foreign influence on sensitive assets like CBS News and CNN.

Advantage Netflix: Netflix’s bid does not rely on foreign sovereign wealth financing, removing this layer of regulatory complexity.

6. Political Strategy Backfire (”Influence Peddling”)

Paramount’s strategy of leveraging political connections appears to be alienating the very regulators they need to win over.

Reports suggest Paramount executives believed their ties to the Trump administration (via the Ellison family and Jared Kushner’s involvement) would guarantee regulatory favor. This perceived “cronyism” has reportedly frustrated DOJ officials, who may now scrutinize the deal even more harshly to prove they are not “for sale”.

Conflict of Interest: The involvement of Affinity Partners (run by Jared Kushner, the President’s son-in-law) creates an immediate conflict.

Advantage Netflix: They are not doing any of the above!

CONCLUSION

The bidding war’s eventual outcome is unpredictable, making the odds more of an art than a science. This battle of the Hollywood media moguls is expected to continue well into 2027. Regardless of the initial victory for Netflix, I anticipate the fight for Warner Brothers will be protracted by inevitable lawsuits and legal challenges. While I do not recommend shorting PSKY stock, I do expect its shares to underperform the S&P 500 in 2026, irrespective of its success in acquiring WBD.

If you found this interesting, don’t forget to subscribe. And please come back tomorrow, for Day 3 of Accrued Interest’s 12 Days of Pitch-Mas!

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

Exceptional regulatory analysis here. The CFIUS angle with sovereign wealth fund exposure from Gulf states is often underweighted when people compare these bids. That combined with CBS+CNN consolidation probably turns this into a 18-24 month approval nightmare even if they clear the first hurdles. Markets seem way too optimstic on PSKY's chances.

I enjoyed this Simeon! Thanks for the analysis.