Why Fubo Will Underperform in 2026 ($FUBO)

12 Days of Pitch-Mas Day 8

For the 8th Day of Pitch-Mas, I am pitching Fubo ($FUBO) as an Underperform for 2026. This likely will not come as a surprise to long-time readers of Accrued Interest, as I have been consistently negative on the stock all year. But with the merger between Fubo and Disney’s Hulu + Live TV business now officially concluded, I want to provide a comprehensive update on why my conviction has only deepened.

All 2025, I argued FuboTV was a subpar business destined to trail the market. Now, looking ahead to the media landscape of 2026, I do not think it is out of the question to ask a more fundamental question: Does FuboTV have a reason to exist much longer?

The recent earnings from both Fubo and Disney confirm that the combined entity is heading into a perfect storm of 1) slowing growth, 2) declining ad revenue, and 3) a competitor that is about to change the rules of the game.

Here is why FUBO 0.00%↑ is set to struggle in the new year.

1.YouTube TV’s Existential Threat to Fubo

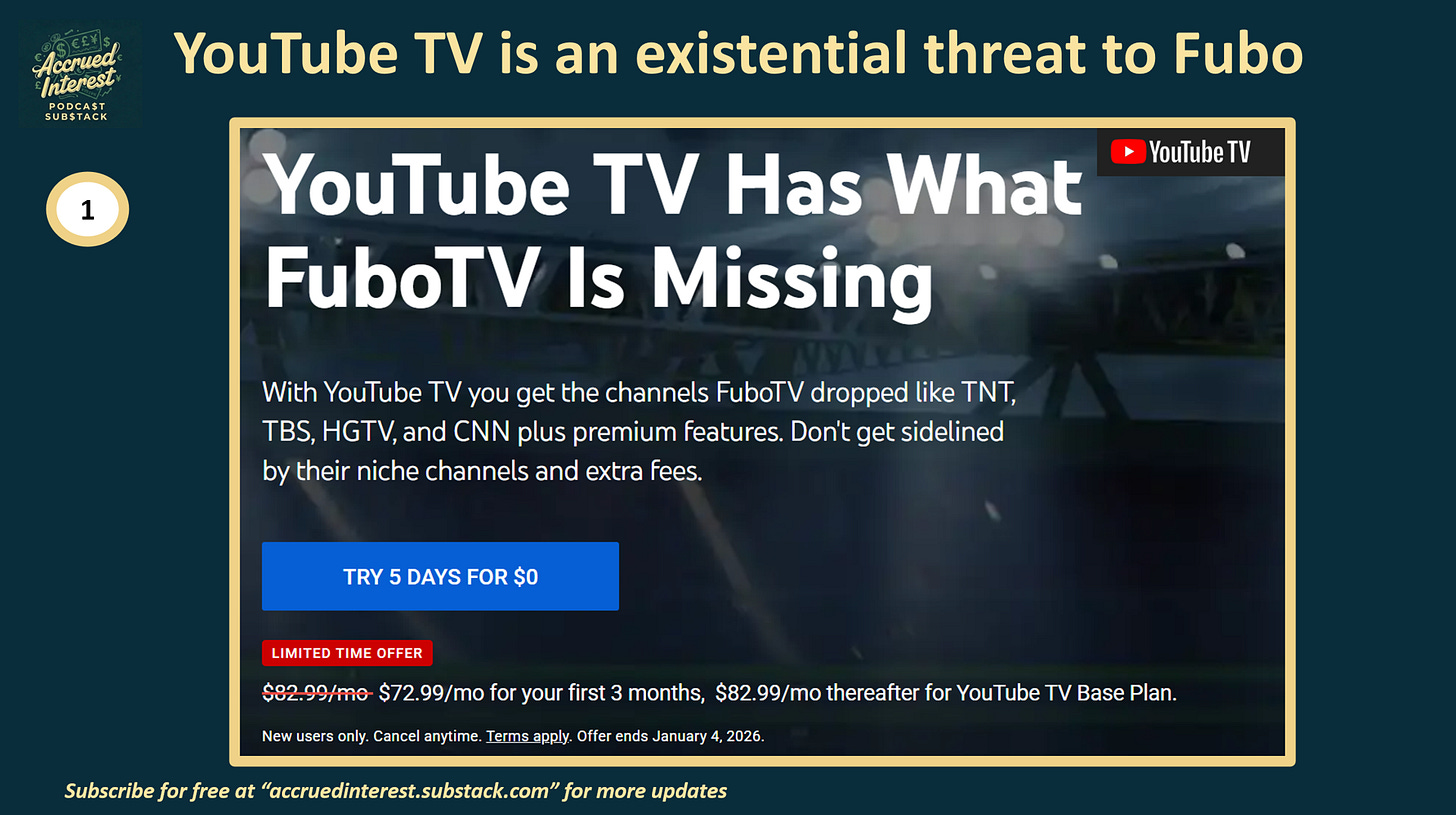

As I covered earlier in the 12 Days of Pitch-Mas series (see my articles on Disney and Google), YouTube TV has announced they are launching genre-specific “skinny bundles” starting next year. Fubo has pivoted its value proposition multiple times, but its core identity has always been the “digital MVPD” (or dMVPD) for sports fans.

Current estimates place YouTube TV at approximately 10 million paying subscribers, making them the #3 pay-TV provider in the U.S. and the fastest growing distributor.

Contrast that with Fubo. In their latest Q3-2025 earnings, Fubo reported 1.63 million North American subscribers. Even after combining with Hulu + Live TV (which I will discuss below), the new entity has approximately 6 million subscribers. YouTube TV is nearly double their size and growing faster.

The “Sports-First” Skinny Bundle

YouTube TV leading with a price-competitive, sports-focused skinny bundle is an existential threat. Until now, YouTube TV’s only real weakness was that it forced subscribers to take the full base package.

But in 2026, they are removing that friction. When YouTube TV offers a cheaper, sports-heavy package that undercuts Fubo’s base price, Fubo’s main differentiator evaporates. Why would a consumer pay a premium for Fubo’s interface when they can get the same sports content on Google’s superior infrastructure for less money?

The Google Subsidy

Because YouTube TV is part of the Alphabet empire, it does not need to make a standalone operating profit. Google can afford to run YouTube TV at breakeven—or even a loss—to capture market share. I do not need to see the exact pricing of the new bundles to know the outcome: Google will price it lower than Fubo can match without destroying their already thin margins.

The “Neutralized” Disney Advantage

Bulls love to argue that the recent merger aligns Fubo with Disney, granting them “Most Favored Nation” status on carriage rates. However, any advantage gained from the Disney deal, YouTube has likely already neutralized. In their recent settlement with Disney, YouTube secured the right to offer Disney’s premium sports content (ESPN, WWE, etc) in their new flexible packages.

2.Combining Melting Ice Cubes: The Hulu + Live TV Problem

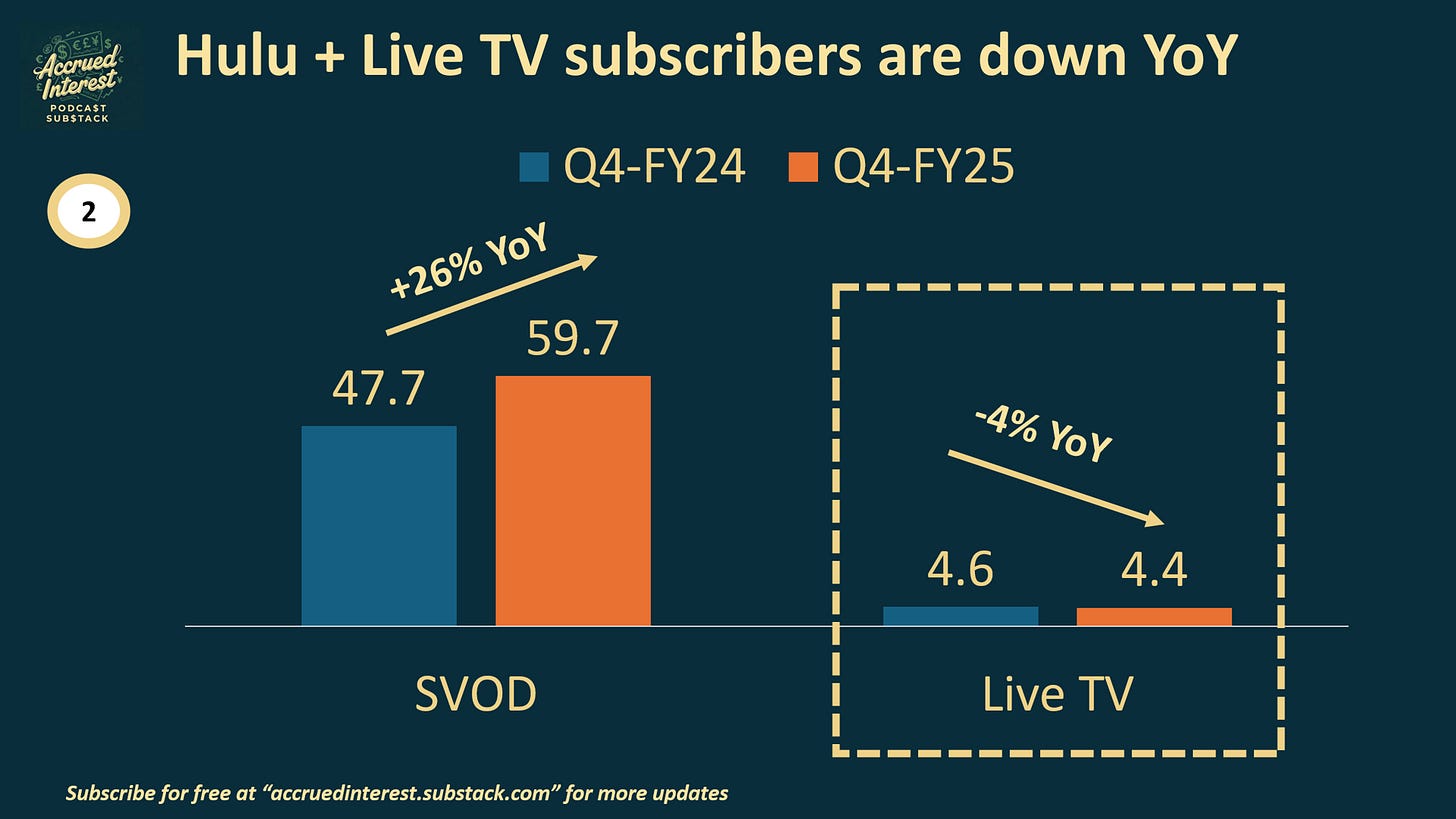

Another reason I expect Fubo to underperform in 2026 is the stagnation at the newly acquired Hulu Live business. Investors are not paying close enough attention. Despite the combined entity retaining the “Fubo” name, the Hulu portion is bigger and will have a much larger impact on the business. Fubo is now effectively a Hulu Live proxy, and the data from Disney’s financials paints a concerning picture.

The “Stuck” Subscriber Base

According to Disney’s FYQ4 2025 earnings, Hulu + Live TV subscribers fell -4% YoY to 4.4M from 4.6M. At the same time, Hulu’s SVOD (subscription video on demand) business grew +26% to over 59.7 million subs from 47.4M the priory year.

This divergence confirms my long-held thesis: the consumer market is moving away from large linear bundles, whether they are delivered via a cable box or an app. Fubo did not get a growth engine in Hulu Live, but rather another legacy cable package that streams over the internet.

Synergies Won’t Save the Top Line

The “synergies” from this deal—estimated at $120 million, or less than 2% of combined revenue—are simply not enough to offset the lack of organic growth. Cost-cutting can only do so much.

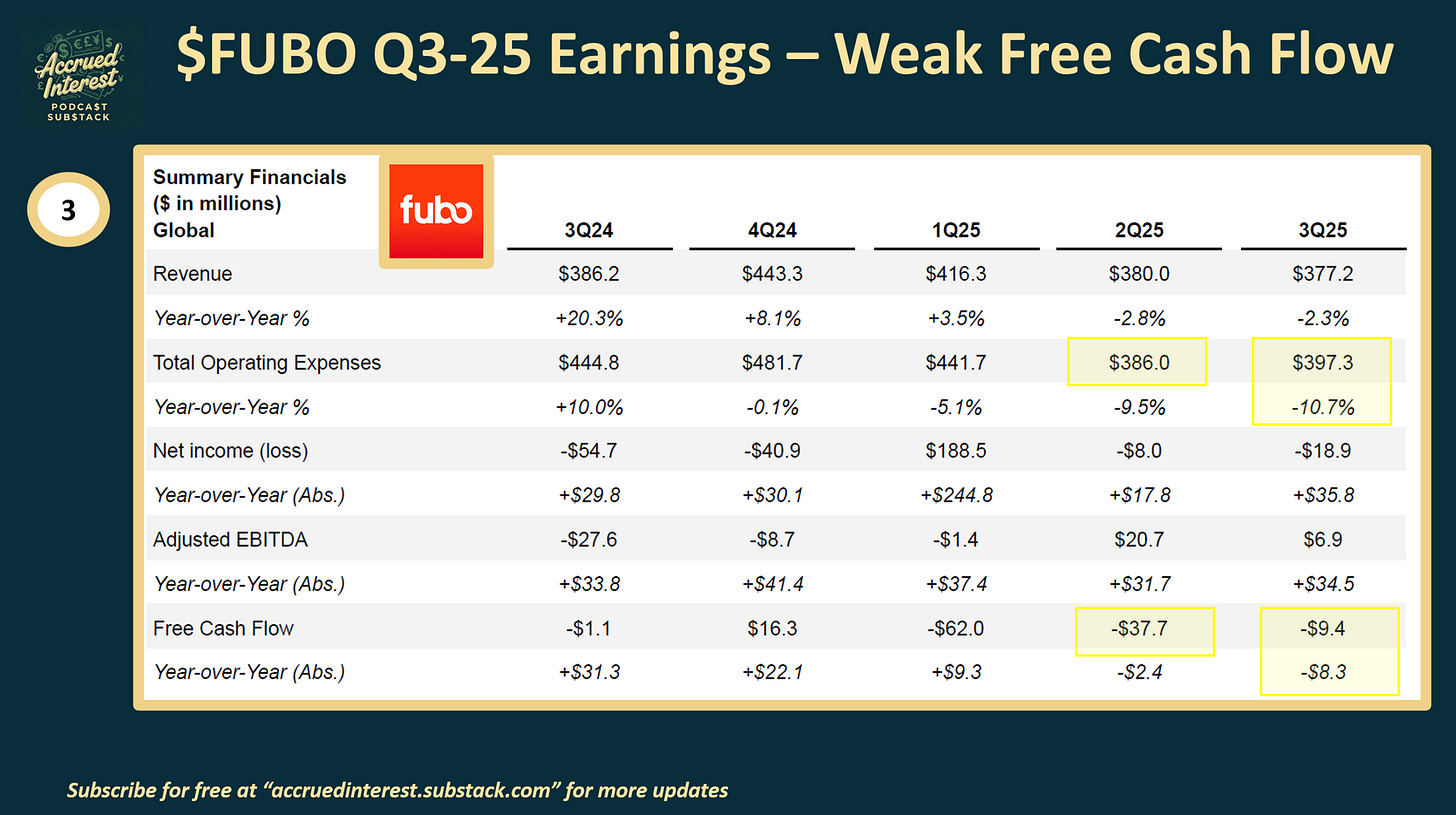

3. Fubo’s Q3-2025 Financials: A Warning Sign

If we look closely at Fubo’s standalone Q3-2025 results, we see cracks in the foundation that should worry any long-term investor. For the full deep-dive on the earnings, please see my November article, Fubo TV Q3-2025 Earnings Recap, from which I will refer to highlights.

Fubo still cannot consistently grow revenue to cover its fixed costs

Revenue for Q3-25 was down -2.3% and Q2 down -2.8% YoY.

Being a digital MVPD is a high fixed-cost business so you NEED revenue growth to survive long-term.

ARPU is falling without enough subscriber growth to make up the difference

North American subs were +1% but total revenue fell -2%

With no advertising business at Fubo, more pressure on Hulu + Live

North American ad revenue decreased -7% YoY to $25 million.

Now to be fair, Disney is going to be taking over much of the Ad Sales function now that the merger with Hulu + Live has closed. I am just skeptical it will be enough to turn things around here.

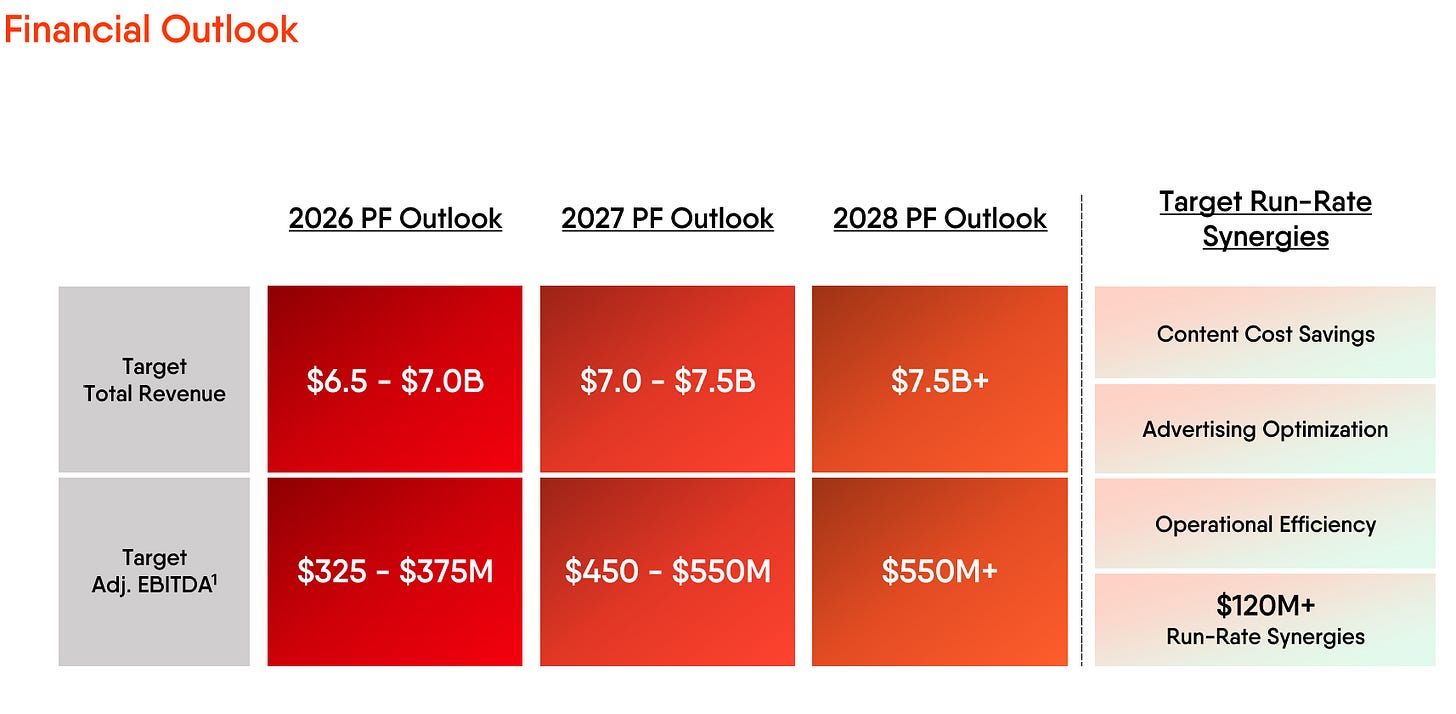

4. Fubo Management Preparing to Lower Guidance

I predict Fubo management is preparing to lower their 2026 and 2027 guidance. Since the merger closed, the CEO has been asking shareholders for patience to give them time to combine the financials.

Posturing for Bad News

As I have mentioned to readers before, I have worked in strategic finance and FP&A roles at publicly traded media companies. I have learned to judge a business by how management presents its financials.

This silence suggests Fubo will release lowered financial guidance in early 2026, using this waiting period to soften the impact. Positive news would have been released immediately to boost the stock. The delay indicates they are crafting a narrative to explain why the new company will be less profitable than initially promised.

CONCLUSION

As I said many times, I do not explicitly recommend that you short any stock in my write-ups. Fubo is a volatile name with high short interest, which means the stock can move violently on thin news.

However, as a long-term value investor, I see a bleak future for FUBO 0.00%↑ . To own this stock in 2026, you need a strong conviction that the combination of Fubo and Hulu Live will spark a wave of new sign-ups.

I simply do not see that happening.

I recommend shareholders consider taking profits before the streaming television wars enter a new, bloody phase in 2026. If Fubo gets into trouble again, there will be no more mergers to save the business.

If you found this interesting, do not forget to subscribe. And please come back for Day 9 of Accrued Interest’s 12 Days of Pitch-Mas! You can find prior days here:

Day 1 - Why Netflix Should Acquire Warner Bros. NFLX -1.49%↓ , WBD -0.28%↓

Day 2 - Why Paramount Skydance Won’t Win Warner Bros, PSKY 0.15%↑

Day 3 - No Bonus Points for Creativity—Just Buy Google, GOOGL -0.03%↓ GOOG 0.07%↑

Day 4 - Nexstar + Tegna: Capped Upside and Regulatory Risk, NXST -0.30%↓ , TGNA 0.36%↑

Day 6 - Why Disney Stock Will Underperform in 2026, DIS 0.92%↑

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.