Why Duolingo Will Underperform in 2026 ($DUOL)

12 Days of Pitch-Mas Day 9

Duolingo is priced for perfection, and the market is starting to realize the company is failing to grow into its high valuation. Despite the stock being down over -45% in 2025 and currently trading in the $178–$185 range, the pain isn’t over.

My thesis for 2026 is simple: While it still trades at an expensive growth multiple, Duolingo’s business model resembles an addictive mobile game, not a scalable educational service. This structural flaw limits monetization and future profit margin expansion. Compounding this are existential AI disruption risks and a growing reliance on lower-value international users. Investors are rapidly cutting their earnings multiple as evidence mounts that the low-hanging growth fruit is gone.

For Day 9 of the 12 Days of Pitch-Mas, here is why I am pitching Duolingo, DUOL 0.00%↑ , as an Underperform for 2026.

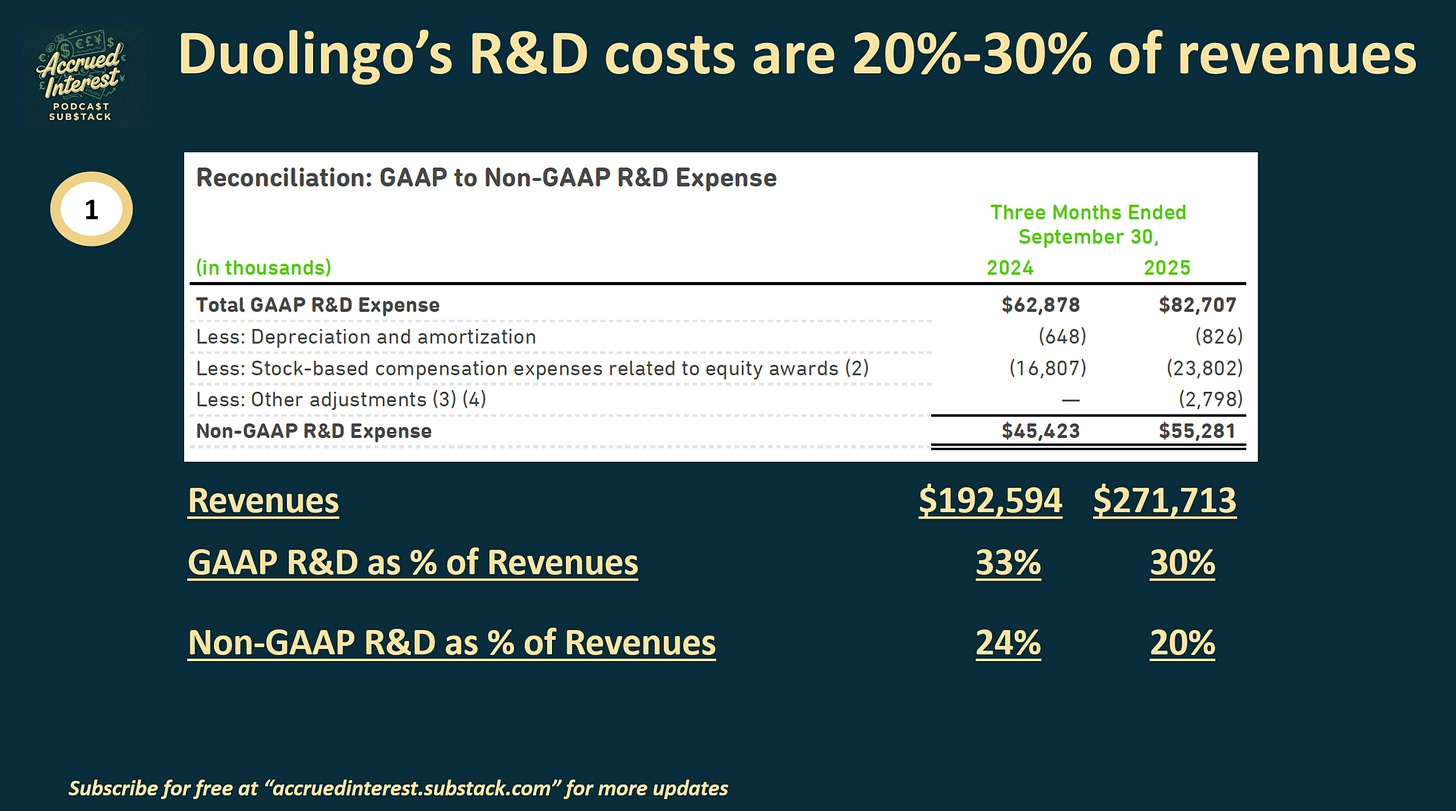

1.The “Mobile Game” Trap — When R&D is just “Retention Marketing”

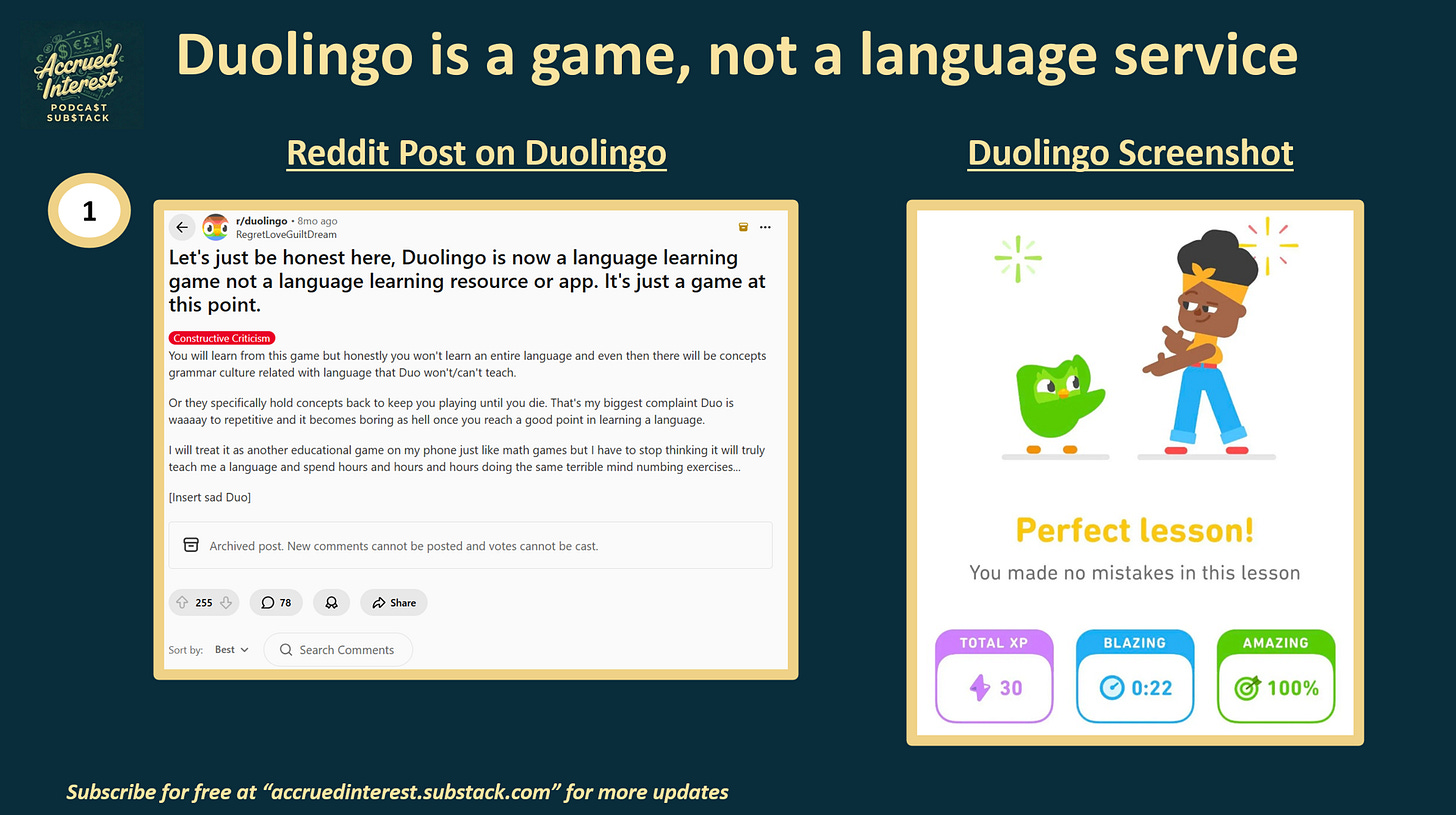

My biggest variant perception on Duolingo vs. the bulls, is that I believe Duolingo is fundamentally a gaming company. While bulls want to present this as a serious, high-value education platform, it is really a fun, sticky app with gamified language learning.

For years, investors have cheered Duolingo’s high R&D spend as evidence of “innovation.” Let’s look at the reality. A sizable portion of that “innovation” isn’t spent on making you a better speaker; it’s spent on making the app more addictive.

Gamification Over Education: Duolingo’s “product improvements” are almost always centered on the “streak,” leaderboards, and the Duo mascot. In the latest Q3 2025 commentary, it’s clear that management is doubling down on “brand love” over “monetization optimization.”

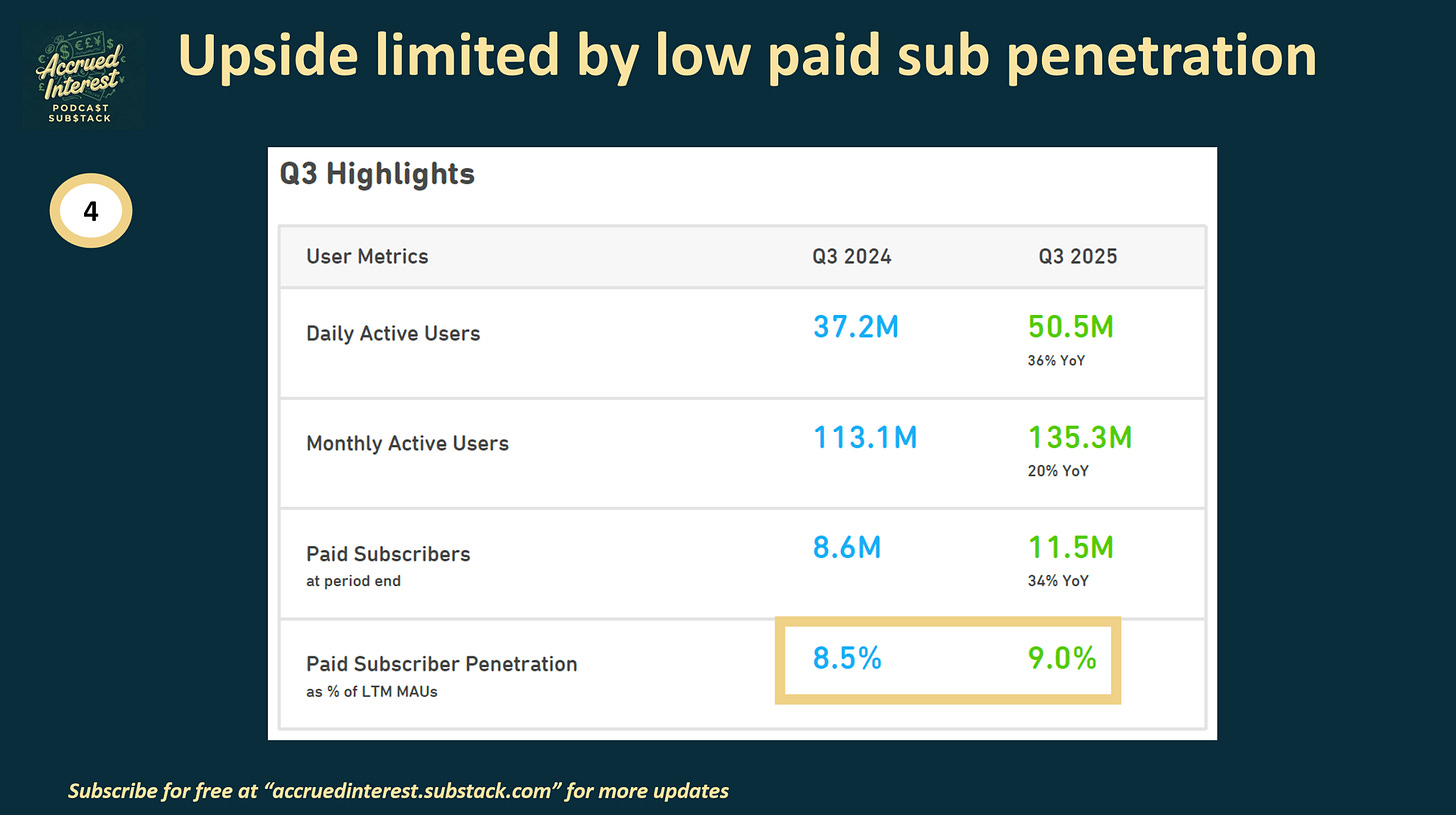

The Engagement Mirage: DUOL recently hit 50.5 million Daily Active Users (DAUs) during Q3-25. But for a growth stock, engagement is only as good as the revenue it generates. If you must spend millions to keep users “playing” without a clear path to them “paying,” your business model is essentially a treadmill.

The “Luckin Coffee” Growth Strategy: Management’s recent focus on non-traditional marketing—like the 10-million beverage partnership with Luckin Coffee—drives DAUs, but it does not drive high-intent learners. It drives casual users who are notoriously difficult to convert to the paid tiers.

2.The AI Disintermediation Risk is Real

AI is an existential threat, and the risk will keep a permanent ceiling on Duolingo’s earnings multiple going forward.

The AI Disruption is Real: Forget the current valuation; AI alone is a reason to be underweight the stock.

LLMs as Translation Killers: Large Language Models (LLMs) have already mastered language translation. As more consumers get mobile access to AI (Gemini, ChatGPT, Claude), the perceived need to learn a new language just to communicate will decrease. The pace of LLM improvement is exponential.

The Competitive Mobile Landscape: Duolingo’s service lives on the mobile app, meaning it competes directly with every other app and piece of software—including every AI chatbot added to a user’s phone. Every new LLM is a new competitor.

Voice Translation as a Standard Feature: A competitor will eventually seamlessly integrate real-time voice translation into the mobile operating system, making language translation a commoditized feature.

3.The Monetization Pivot (A Red Flag in Disguise)

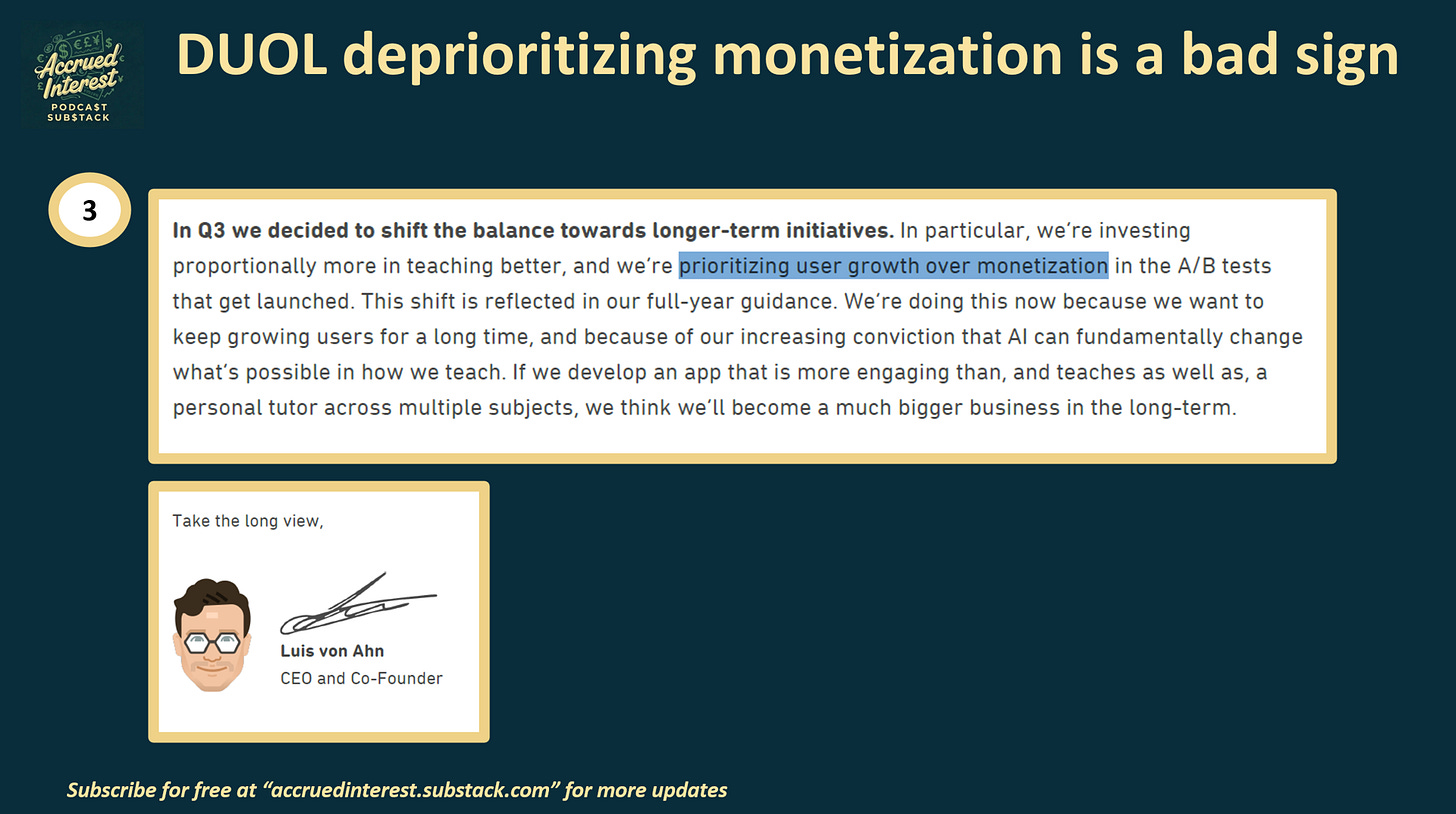

In the most recent Q3-25 earnings call, management signaled a strategic shift: they are prioritizing long-term user acquisition over immediate monetization. In analyst-speak, that is usually a way of saying, "the easy money has been made."

Softening Guidance: The Q4 2025 bookings guidance of $330M–$335M was below analyst consensus estimates of $344M. This was a sign that the subscription engine is cooling.

Pausing “Aggressive” Experiments: Management is backing off on A/B testing for paywalls because they fear user burnout. When a company stops trying to optimize its primary revenue stream to protect “user vibes,” the growth story is effectively on life support.

4.Structural Limitations in Monetization

Duolingo’s monetization engine is stalling, evidenced by slow paid conversion and negligible ad revenue.

The Paid User Plateau: Duolingo cannot convert its massive user base fast enough to justify its growth multiple.

Slow Conversion Rate: The paid penetration rate only grew by 50 basis points (from 8.5% to 9.0%) in one year. At this rate, it would take a decade to convert less than two out of ten users. This is why investors are cutting the multiple.

Lack of Ad Revenue Potential: Over 90% of Duolingo’s users are non-paying, yet they generate less than < 10% of total revenue from advertising. Compare this to Meta or Google, who have mastered the art of monetizing the “free” user. Duolingo’s inability to squeeze value out of its massive free base limits the stock’s upside.

The International Drag on ARPU: The shift toward international users is limiting monetization.

Saturation in the US: Over half of billings come from outside the US, a sign that the company is close to saturation in the higher-value US market.

Lower-Value Customers: My rule of thumb in digital services: US users are typically the most valuable customers, driving the highest Average Revenue Per User (ARPU). Relying on international growth, without a corresponding increase in ARPU, is bearish. The lower earnings multiple reflects this shift to a lower-value user mix.

The Profit Margin Plateau: There is little room left for margin expansion, removing a key pillar of the bull case.

The “Cost” of AI: Bulls argue that Duolingo’s new AI tier, Duolingo Max, is a tailwind. However, in Q3 2025, Gross Margins declined by 40 basis points to 72.5%.

The 900 Basis Point Cap: Management stated that Full Year incremental margins were expected to be 37.9%, only 9.0 percentage points higher than current margins (~29%).

Lack of Operating Leverage: Bulls love the 100% EBITDA-to-Free Cash Flow conversion, but the company’s implied 60% incremental cost to serve a new user is too high for a pure digital mobile game. This lack of rapid operating leverage—driven by the prohibitive cost of marketing/retention and the Apple/Google App Store tax—puts a natural ceiling on long-term profitability.

CONCLUSION

Duolingo will continue to underperform the market in 2026 as its earnings multiple contracts further. Investors are realizing that all the “low-hanging fruit” growth has been harvested. The lack of material improvement in monetization—due to its structural reality as a mobile game, not an educational service—means the stock will never get credit for its double-digit user growth, even if it surpasses my expectations. At 24x 2026 adjusted EPS (43x 2026 GAAP EPS), you are not paying for a “learning utility”; you are paying for a mobile game that is losing its pricing power. Duolingo is an excellent product, but it is becoming a mediocre stock.

If you found this interesting, do not forget to subscribe. And please come back for Day 10 of Accrued Interest’s 12 Days of Pitch-Mas! You can find prior days here:

Day 1 - Why Netflix Should Acquire Warner Bros. NFLX -1.49%↓ , WBD -0.28%↓

Day 2 - Why Paramount Skydance Won’t Win Warner Bros, PSKY 0.15%↑

Day 3 - No Bonus Points for Creativity—Just Buy Google, GOOGL 0.00%↑ GOOG 0.00%↑ ↑

Day 4 - Nexstar + Tegna: Capped Upside and Regulatory Risk, NXST 0.00%↑ , TGNA 0.00%↑

Day 6 - Why Disney Stock Will Underperform in 2026, DIS 0.00%↑

-Accrued Interest

I love the cover photo

I definitely agree that Duolingo is definitely an addictive game and not the best way to actually learn a language but I’m not sure they need an incredibly high conversion rate/conversion growth IF they keep growing overall users.

Free users are generating little in ad revenue bc from my testing right now all of their ads are internal ads about upgrading to the paid tier. Even mixing in 10% external ads would boost that ad revenue. I actually think they should decrease the frequency of ads so they don’t kill the user experience.

Right now I just can’t value the AI risk. It doesn’t work in every scenario but effective real time translation seems right around the corner (I know early versions exist today). If everyone already walks around with airpods for listening to music and it automatically translates there’s no need to learn other languages. Same with Zoom automatically translating a video call. I’m not sure if near perfect versions of this translation are 1 year away or 5.