Why AppLovin Will Outperform in 2026 ($APP)

12 Days of Pitch-Mas Day 12

For the last day of the 12 Days of Pitch-Mas, I am closing out the year just as I started it: as a self-professed AppLovin bull. Looking back on 2025, I’m seriously proud to have been one of the earlier and most vocal voices on both Substack and Twitter. Not only did I identify APP before the stock rocketed, but I also stood up for the company against short seller allegations that turned out to be bogus. With questions about their legitimacy finally behind them, I expect 2026 to be the year more marketers wake up to AppLovin’s true potential— it is the first ad tech platform in years that offers an effective, scalable channel that’s a real alternative to Meta. While I am not calling for another +100% year for the stock, I fully expect the company to outperform the S&P 500 as new advertisers from all corners of the globe jump onto their platform, driving revenue spend through 2027.

Here are four reasons why I am still bullish on AppLovin in 2026.

1. E-Commerce Roll-out will drive 2026 growth

The pivot from gaming to e-commerce is a fundamental expansion of AppLovin’s total addressable market (TAM) that is already showing acceleration. While the bears were busy fretting about “tapped out” gaming audiences, management spent December proving that AppLovin can drive top-of-funnel discovery for physical goods just as effectively as they do for digital ones. The data shared recently at Nasdaq-Morgan Stanley Investor Conference in London, confirms that $APP is effectively aiming to become a smaller, leaner version of Meta, but for the “open” mobile web.

Massive Scalability: It took only months to scale roughly 600 initial advertisers to a $1 billion run rate spend during the pilot phase. This will be significantly higher in 2026, both in terms of advertiser count as well as total spend.

Performance Parity with Meta: Management noted at the UBS Conference this December that for the first time, advertisers are seeing Return on Ad Spend (ROAS) and scale that is comparable to the “market leader”, which is Meta. CEO Adam Foroughi emphasized this confidence at UBS:

“We really do have the core technology that’s working and driving performance across multiple categories now. And the rest of the path for us is just go get more customers.”

Incremental Wins: Unlike search (which captures existing intent), $APP helps users discover products they didn’t even know they wanted. At the Nasdaq conference, Foroughi highlighted that this creates purely incremental spend for brands, rather than just cannibalizing their existing organic traffic.

2. AppLovin is better at identifying incremental sales

One of the stickiest points of friction for large e-commerce players was the fear of paying to “re-acquire” their own loyal customers. AppLovin recently solved this with the launch of their “Prospecting” tool, which utilizes data integrations to ensure ad spend is focused strictly on net-new customer acquisition. This technical unlock is what will allow the biggest brands in the world to open their wallets fully in 2026.

Flipping the Switch: Pilot results discussed at the Nasdaq investor event showed that brands using the standard model saw about 40% of sales come from new customers. When they toggled on the “Prospecting” feature, that number jumped to 80% almost immediately.

Seamless Integration: AppLovin’s models now integrate with Shopify and major attribution vendors, meaning Axon (AppLovin’s AI) knows exactly who has purchased from a brand before. This creates a “set it and forget it” trust level for advertisers.

Maximized Wallet Share: By solving the incrementality problem, $APP removes the ceiling on ad spend. Brands no longer must cap their budgets to avoid waste; they can spend if the ROI holds. As CFO Matt Stumpf put it at UBS, the goal is to verify “whether or not advertisers... are able to see the same return on ad spend that’s consistent with those return goals that they’re putting on to other platforms... and then are they able to hit those goals at a scale that is consistent with what they’re doing on other channels.”

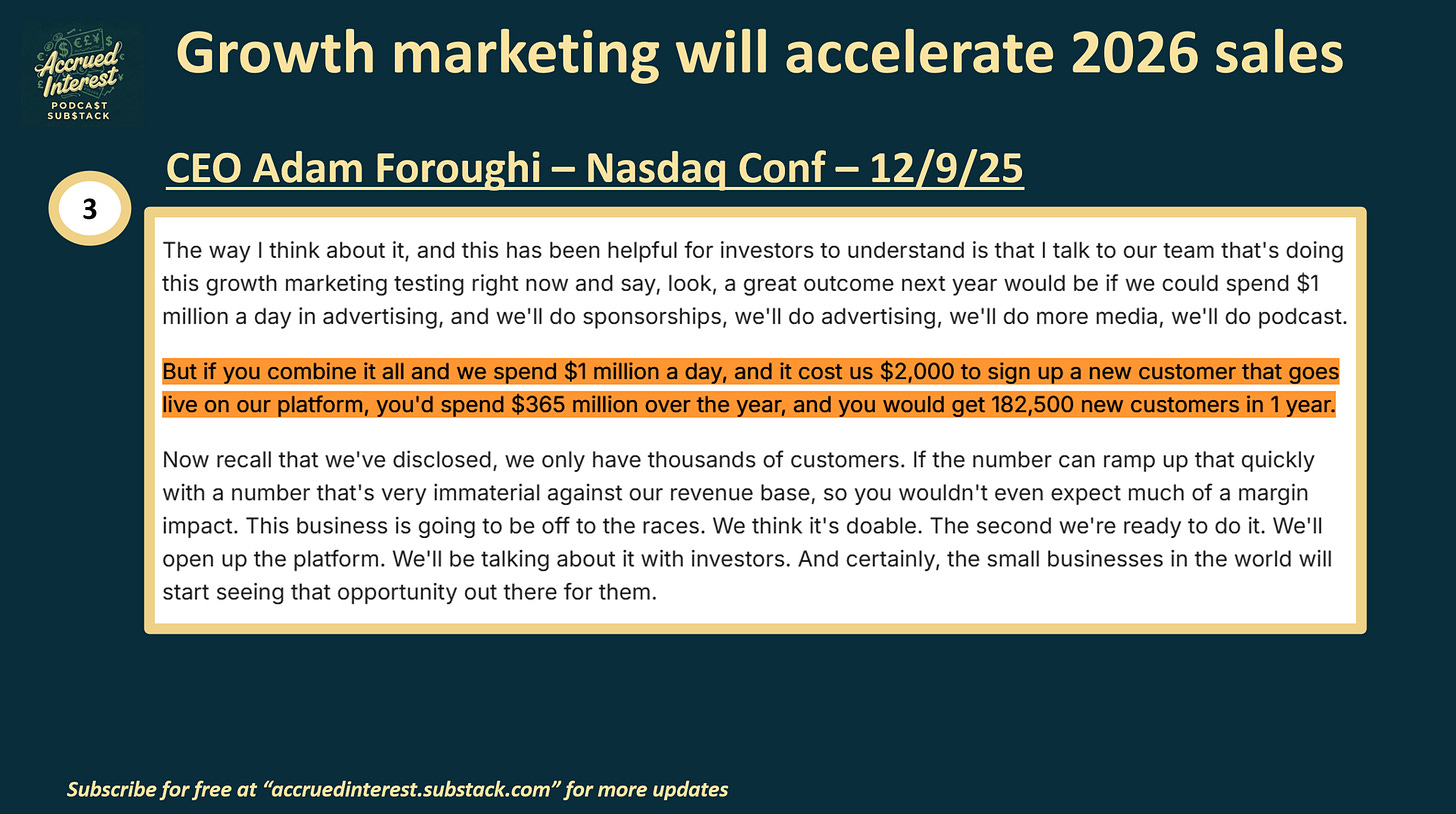

3. Marketing spend in 2026 will accelerate sales

APP Management played it smart by initially keeping the e-commerce platform in a “referral-only” state to stress-test their automated fraud and quality systems. However, once floodgates open in early 2026, AppLovin is not waiting for customers to find them. They will be launching an aggressive B2B user acquisition campaign.

50% Weekly Growth: Even in its current referral-only state, the e-commerce business line is growing 50% week-over-week, according to updates at the UBS conference. This creates immense momentum heading into the public launch in 2026.

The $1M/Day Marketing Plan: At the Nasdaq conference, Foroughi outlined a bold plan to spend up to $1 million a day on their own performance marketing to onboard hundreds of thousands of small businesses. He told the audience: “If you combine it all and we spend $1 million a day... you would get 182,500 new customers in 1 year. ... This business is going to be off to the races.”

Gen AI as the Equalizer: To help small businesses, AppLovin is launching tools that automatically scrape a brand’s website to generate platform-optimized video and static ads. While video generation is still pricey ($100–$200 per output), static image generation is down to ~$1, allowing for massive, cost-effective creative testing.

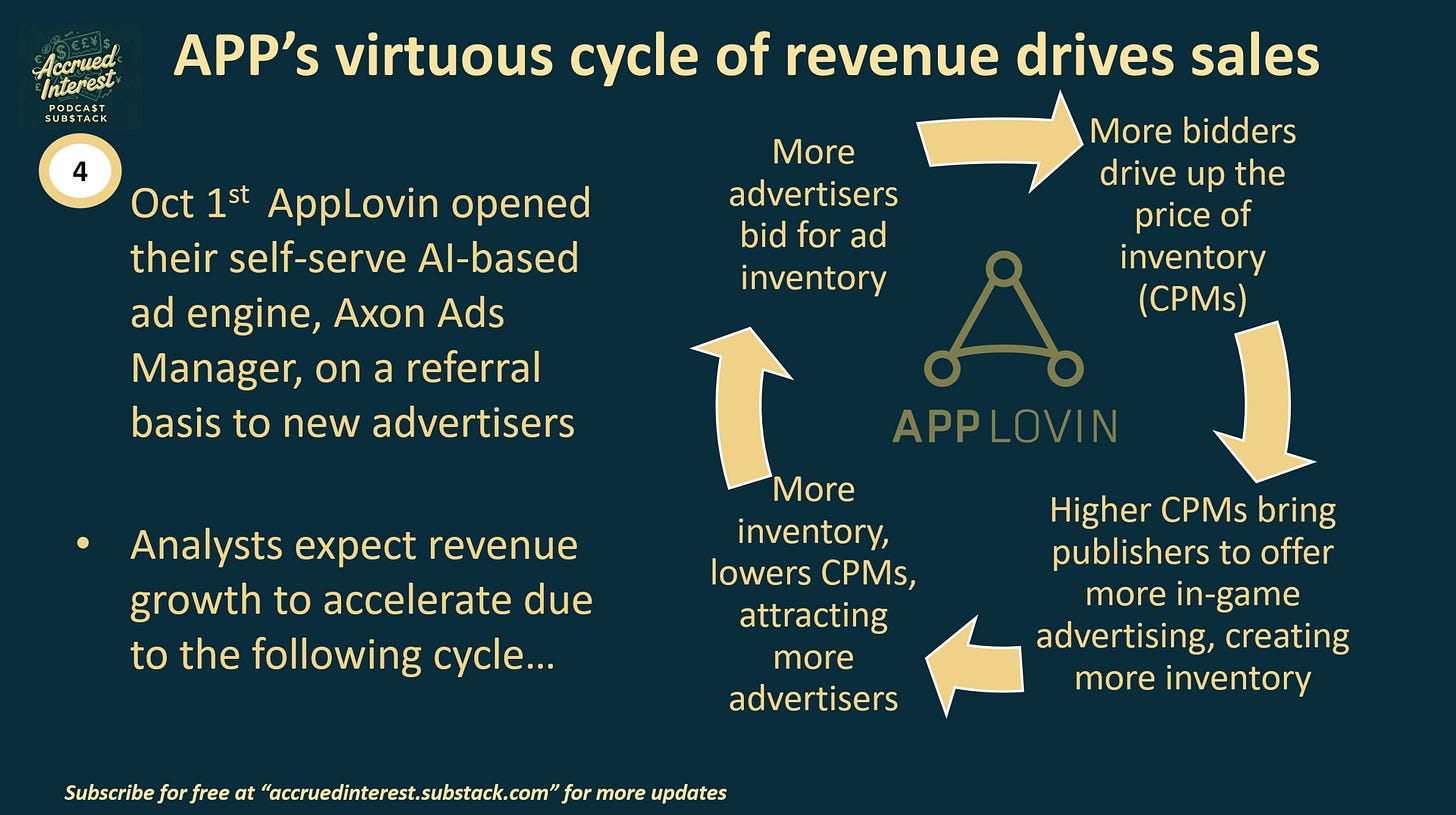

4. APP’s virtuous revenue cycle will continue in 2026

While everyone is looking at the shiny new e-commerce object, the core gaming business remains a cash cow that is benefiting from the e-commerce shift. Shifting toward e-commerce ads doesn’t just diversify revenue; it increases the total supply of ad spots within the same user session, creating a virtuous revenue cycle.

Shorter Ads, More Reps: Gaming ads often include long playable demos. E-commerce ads are “snackier” (static images or short videos). This means users spend less time watching a single ad, allowing them to play more levels and trigger more total impressions per session.

Attention Arbitrage: Despite being shorter, the engagement is high. The average watch time for e-commerce ads on $APP is 35 seconds, miles ahead of the 7-second average on social platforms.

Healthy Ecosystem: Higher ad load leads to more revenue for publishers. Publishers then reinvest that money back into AppLovin for their own user acquisition, creating a virtuous cycle. As CFO Matt Stumpf noted at the Nasdaq conference, the gaming vertical itself is still projected to grow 20% to 30%, stating: “We think that... it’s very, very robust in terms of growth because that technology is still relatively nascent.”

CONCLUSION

To be clear: I expect APP 0.00%↑ to outperform the S&P 500 in 2026, but don’t expect another +110% year. The company soared from a $300 stock to nearly $700 a share largely because of multiple expansion. The stock now trades at 50x 2026 consensus earnings, so I wouldn’t bet on further multiple expansion from here.

However, I maintain that we are still in the early years of what is arguably the most efficient ad tech platform since Facebook. Sell-side analysts currently project AppLovin revenue of about $8 billion in 2026 and $10 billion in 2027, a notable increase from this year’s nearly $6 billion. My perspective is that as the company completes its global expansion and launches its self-serve platform, it will vastly enlarge its addressable market that will exceed current sales forecasts.

Markets are unpredictable, AppLovin might not beat the index next year. Nevertheless, I see a ton of revenue upside over the next 2 – 3 years and am maintaining my overall positive stance on the company.

Thanks for joining me for my first annual 12 Days of Pitch-Mas series! You can catch up on all previous entries (one through eleven) at the links below.

Day 1 - Why Netflix Should Acquire Warner Bros. NFLX -1.49%↓ , WBD -0.24%↓

Day 2 - Why Paramount Skydance Won’t Win Warner Bros, PSKY 0.07%↑

Day 3 - No Bonus Points for Creativity—Just Buy Google, GOOGL 0.56%↑ , GOOG 0.48%↑

Day 4 - Nexstar + Tegna: Capped Upside and Regulatory Risk, NXST -0.85%↓ , TGNA -0.77%↓

Day 6 - Why Disney Stock Will Underperform in 2026, DIS 0.50%↑

Day 9 - Why Duolingo Will Underperform in 2026, DUOL -0.52%↓

Day 10 - Why Pinterest Will Underperform in 2026, PINS -0.35%↓

If you found my research helpful this year, don’t forget to like and subscribe. I have some great plans in store for 2026!

-Accrued Interest

This piece couldn’t have come at a better time.