Nexstar + Tegna: Capped Upside and Regulatory Risk ($NXST)

12 Days of Pitch-Mas Day 4

I am still bearish on Nexstar because the problems facing broadcast TV— people ditching cable for services like YouTube TV—are only going to get worse. After they buy Tegna, Nexstar will be the biggest player, which means they will be the most exposed to all these industry headaches. Sure, the Tegna deal might give them some breathing room to cut costs, but it will not create any new revenue, which is the only way to survive long-term. The stock is likely to be dead money until late 2026, with the ~10% deal spread signaling some doubt in the market that the merger will ultimately close. For the 4th Day of Pitch-Mas, I am pitching Nexstar as an Underperform.

Here are 5 reasons why I expect NXST to underperform the S&P500 in 2026.

1. Proposed merger with Tegna will cap upside

Nexstar is strategically “doubling down” on the declining broadcast television business at precisely the wrong time. The acquisition of more broadcast assets cannot solve the core problem of lacking organic growth, reinforcing my view that M&A is not a sustainable strategy for a public media company.

Deal Spread Risk: The ~$2.30 market spread on the proposed $22.00 per share, all-cash offer for Tegna by NXST suggests investor concern about the deal’s regulatory approval. With the stock currently at ~$19.70 and closing not expected until the latter half of 2026, the extended regulatory period means your capital will be tied up all year. This long timeframe, coupled with a capped potential return, makes the investment less appealing, especially given today’s higher interest rate environment.

Deal Uncertainty: The acquisition faces an ongoing antitrust review from the Department of Justice (DOJ), and the market consensus points to possible delays or failure due to the “trauma” of previous failed broadcast deals.

Worst-Case Scenario: If the deal fails to close by the deadline, both NXST 0.00%↑ and TGNA 0.00%↑ will be left in a materially weaker position. Time is not your friend when your business is a melting ice cube, sitting atop a lot of debt on the balance sheet.

2. M&A deals can still fail to close, even during Republican administrations

Relying on potential deregulation or a “business friendly” administration to push complex, scaled mergers through federal review carries significant inherent risk.

Historical Precedent: The disastrous failure of the Sinclair-Tribune deal in 2018 serves as a clear warning that even transactions approved initially can be blocked by the FCC over concerns regarding station independence and close ties (sidecar arrangements).

Regulatory Complexity: Despite lobbying efforts advocating for deregulation to compete against Big Tech, the DOJ and FCC still require a “heavy lift” to ensure compliance with local ownership rules. Broadcast bulls are expecting the current administration to raise the 39% national ownership cap, which is severely restricting the ability to make acquisitions.

Other TV competitors will fight the deal: I just want to caution everyone that just because a CEO agrees with the FCC and the sitting U.S. President, there are still competitors to NXST 0.00%↑ who want to kill the deal.

For example, Chris Ruddy, President of Newsmax has led a campaign against the proposed Tegna deal . He argued that the deal, if approved, would create an overly large local TV giant, which would harm independent media brands like NMAX 0.00%↑ .

Charles Herring, President of One America News Network (OAN) has also voiced opposition, aligning with Newsmax’s stance that raising the ownership cap is a threat to fair competition.

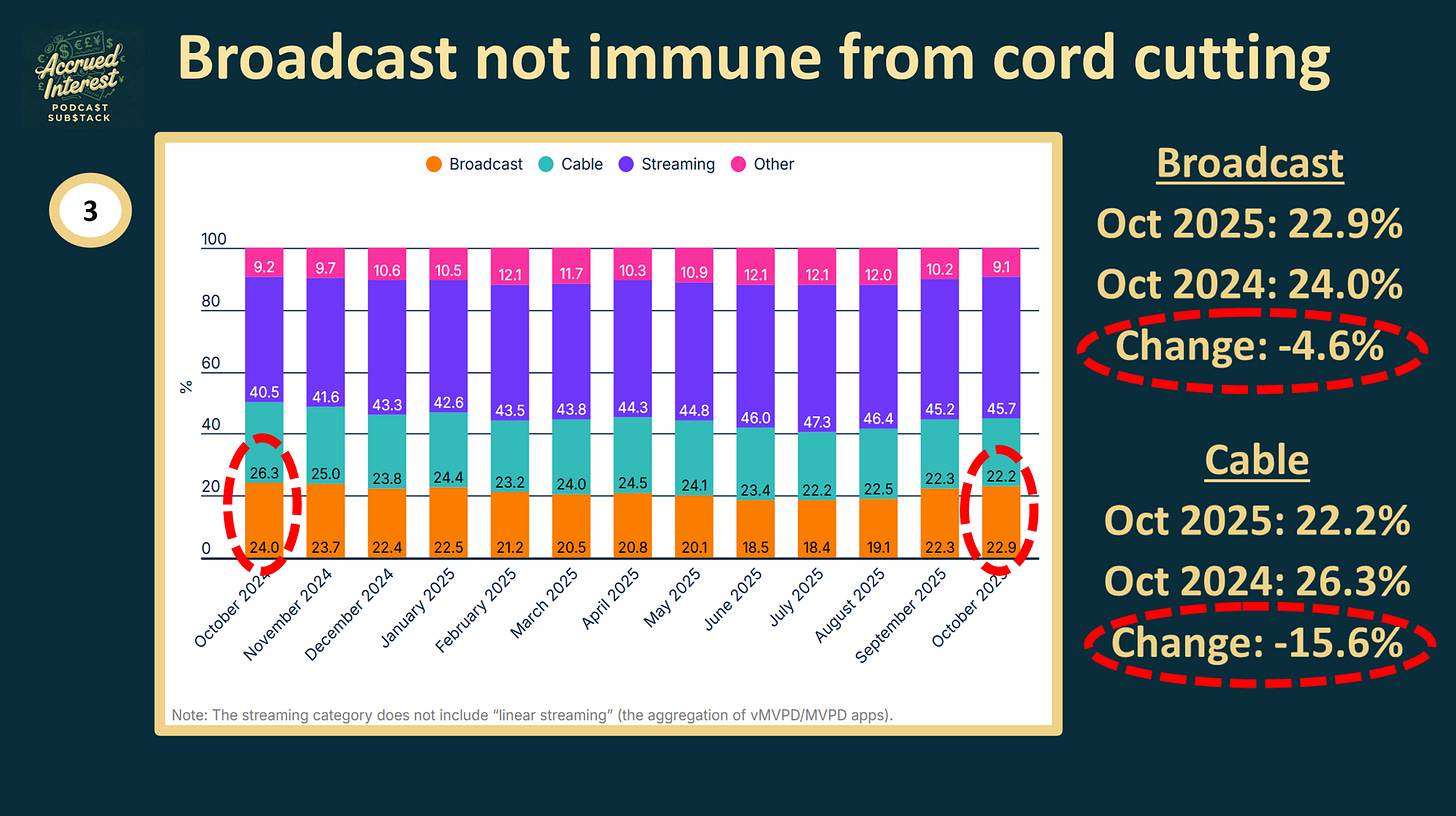

3. Broadcast TV not immune from cord cutting

The rate of pay-tv subscriber and linear viewership decline has failed to stabilize and continues to accelerate, posing a critical long-term threat to the core broadcast advertising business model.

Viewership Decline: Linear television (broadcast and cable combined) is experiencing double-digit declines in viewership YoY. For Oct-2025 combined linear consumption was down -10.3% YoY.

Broadcast Erosion: While cable networks suffer double-digit declines, broadcast, though declining slower, is also losing share (e.g., Oct-2025 Broadcast -4.6% YoY)

Digital Disruption: This audience erosion is largely driven by disruptive streaming platforms like YouTube, which achieved new all-time highs in big-screen TV share for 2025 and continues to take viewing minutes away from the entire traditional pay-tv bundle.

4. YouTube TV will directly attack the bundle in 2026

Virtual MVPDs (vMVPDs) like YouTube TV are reaching scale and exerting negotiating leverage that undermines the value proposition of traditional cable, and broadcast content is on the front line of this conflict.

Content Parity Threat: Recent agreements (such as the Disney/YouTube TV deal) grant vMVPD subscribers’ access to premium sports and exclusive content previously used to retain traditional cable subscribers. This content parity will accelerate subscriber attrition from cable.

Network Priorities Shift: As Big 4 networks compete fiercely with Google/YouTube, they will prioritize their own-and-operated streaming platforms and network assets, potentially at the expense of their local broadcast partners. Content owners may choose to air content exclusively on their streamers to bypass government intervention and maximize monetization.

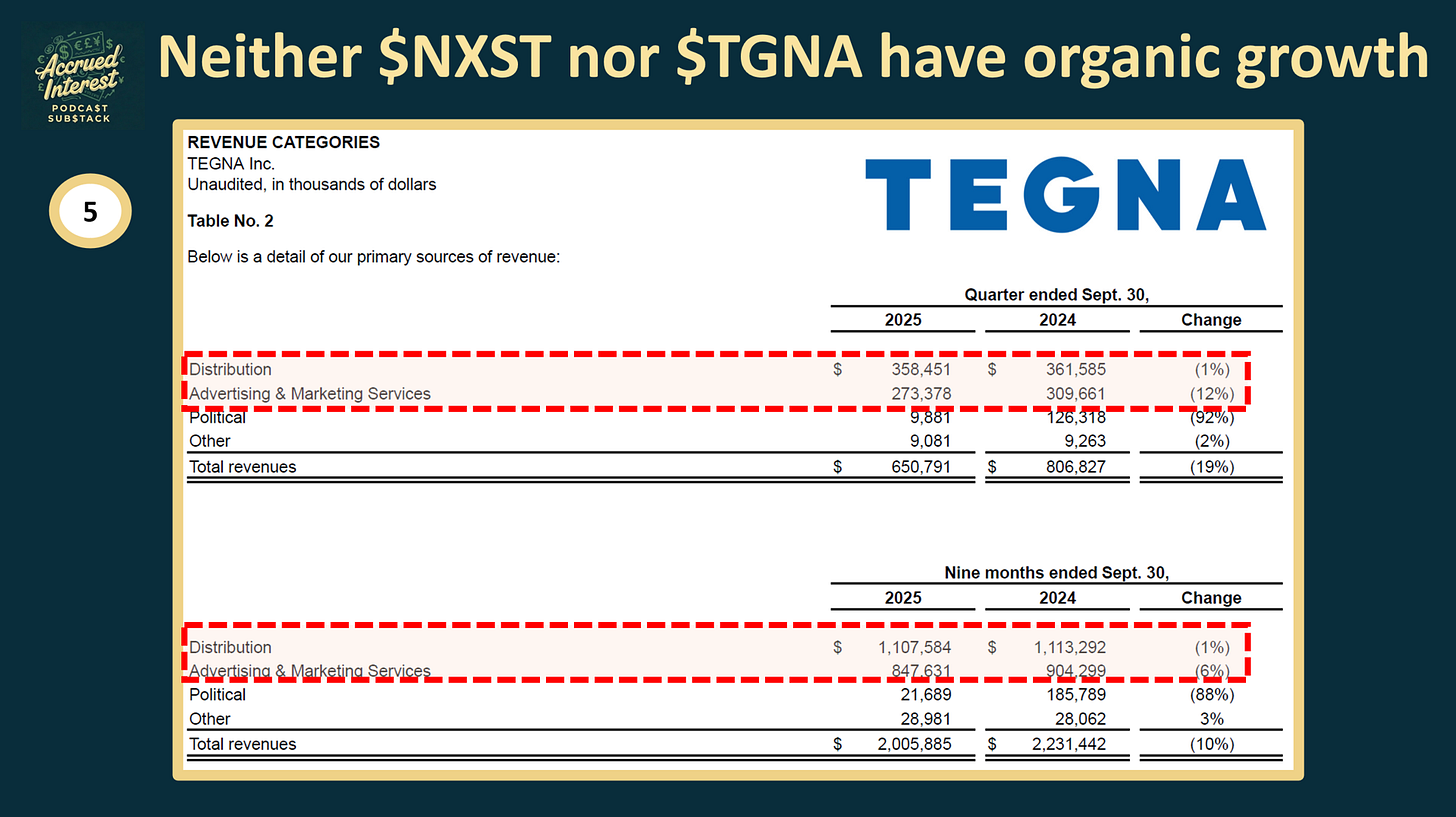

5. Neither NXST nor TGNA have any organic growth

The core performance of both companies, particularly outside of cyclical political years, demonstrates insufficient organic growth to withstand persistent industry decay and high-fixed costs.

Core Advertising Decline: Nexstar’s core non-political advertising revenue was effectively flat in Q3 2025, suggesting a stagnant market. Tegna’s Q3 2025 Advertising and Marketing Services (excluding political) fell -12% YoY.

Distribution Revenue Stagnation: Distribution revenue, traditionally a high-margin, stable segment used to offset subscriber losses, is now struggling. Nexstar’s distribution revenue decreased by -1.4% YoY in Q3 2025 due to accelerated subscriber attrition. Tegna’s distribution revenue also declined by -1%.

CONCLUSION

The convergence of accelerating cord-cutting, intensifying competition from vMVPDs like YouTube TV, and mounting regulatory uncertainty surrounding the Tegna deal creates a perfect storm for Nexstar. Based on the events of 2025, I see no reason to change my bearish position on the stock. Core advertising and distribution revenue are showing continued secular decline, and cannot deliver the growth necessary to support the company’s size or valuation.

The only way for Nexstar to successfully escape its current predicament is to follow the lead of other media stocks and surrender – like WBD 0.00%↑ . As I said in previous coverage of the Nexstar / Tribune merger, the real winners in media are the shareholders who take the buyout!

For a deeper discussion, my full thoughts on the broadcast industry and media landscape can be found in the interview on Ep.221 of the Business Breakdowns podcast, hosted by Zack Fuss.

And if you found this interesting, do not forget to subscribe. And please come back for Day 5 of Accrued Interest’s 12 Days of Pitch-Mas! You can find prior days here: Day 3 GOOGL 0.00%↑ , Day 2 PSKY 0.00%↑ , and Day 1 NFLX 0.00%↑ .

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.