Media Stock Insights from Nielsen’s Dec-25 TV Snapshot

Streaming Eats the Christmas Goose

If you thought the “death of linear TV” narrative was overblown, December 2025 just delivered a reality check that not even the biggest broadcast bulls can ignore. Nielsen is out with its December 2025 Gauge report, exploring what Americans are watching on their big screen televisions (excluding mobile devices).

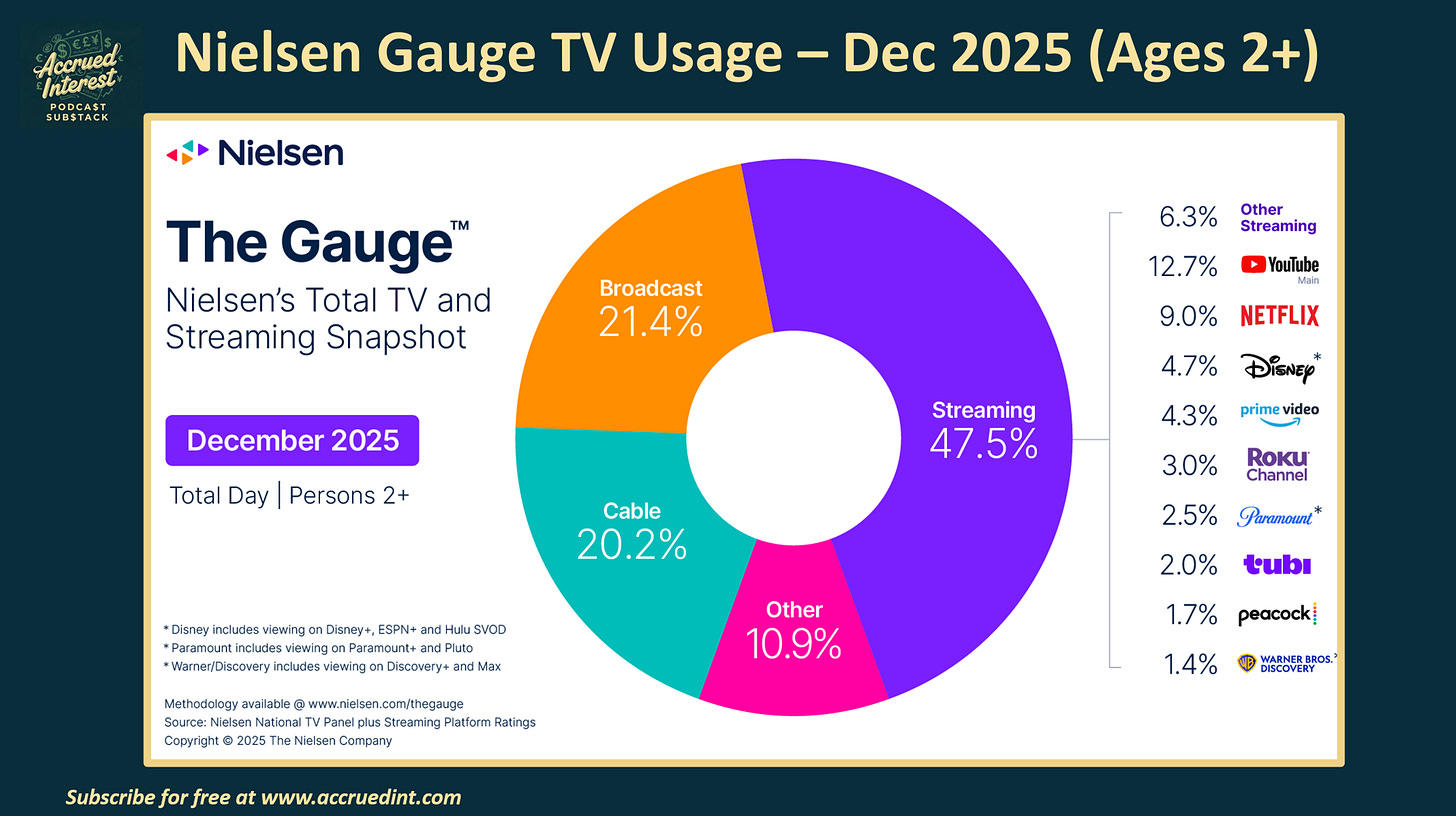

Streaming viewership didn’t just break records; it shattered them, capturing a historic 47.5% of total TV usage. The story isn’t just about the “slow drift” away from cable anymore—it’s about a structural collapse accelerated by the very content that was supposed to save it: Live Sports.

December gave us a glimpse of the future, and it looks terrifying for legacy media. With the NFL moving marquee games to Netflix and Prime Video, we saw streaming capture 54% of TV usage on Christmas Day. The moat protecting the cable bundle—live sports—has been bridged. Below, I break down the winners (YouTube, Netflix, Roku) and the losers (everyone clinging to a coaxial cable) to help you navigate your media portfolio in 2026.

I reported on YouTube’s rise all last year. Check out past monthly updates here: Nov, Oct, Sep, Aug, July, June, May, April, March, Feb and Jan.

Here are more takeaways from the December report…

TV Market: The Ice Cube is Melting Faster

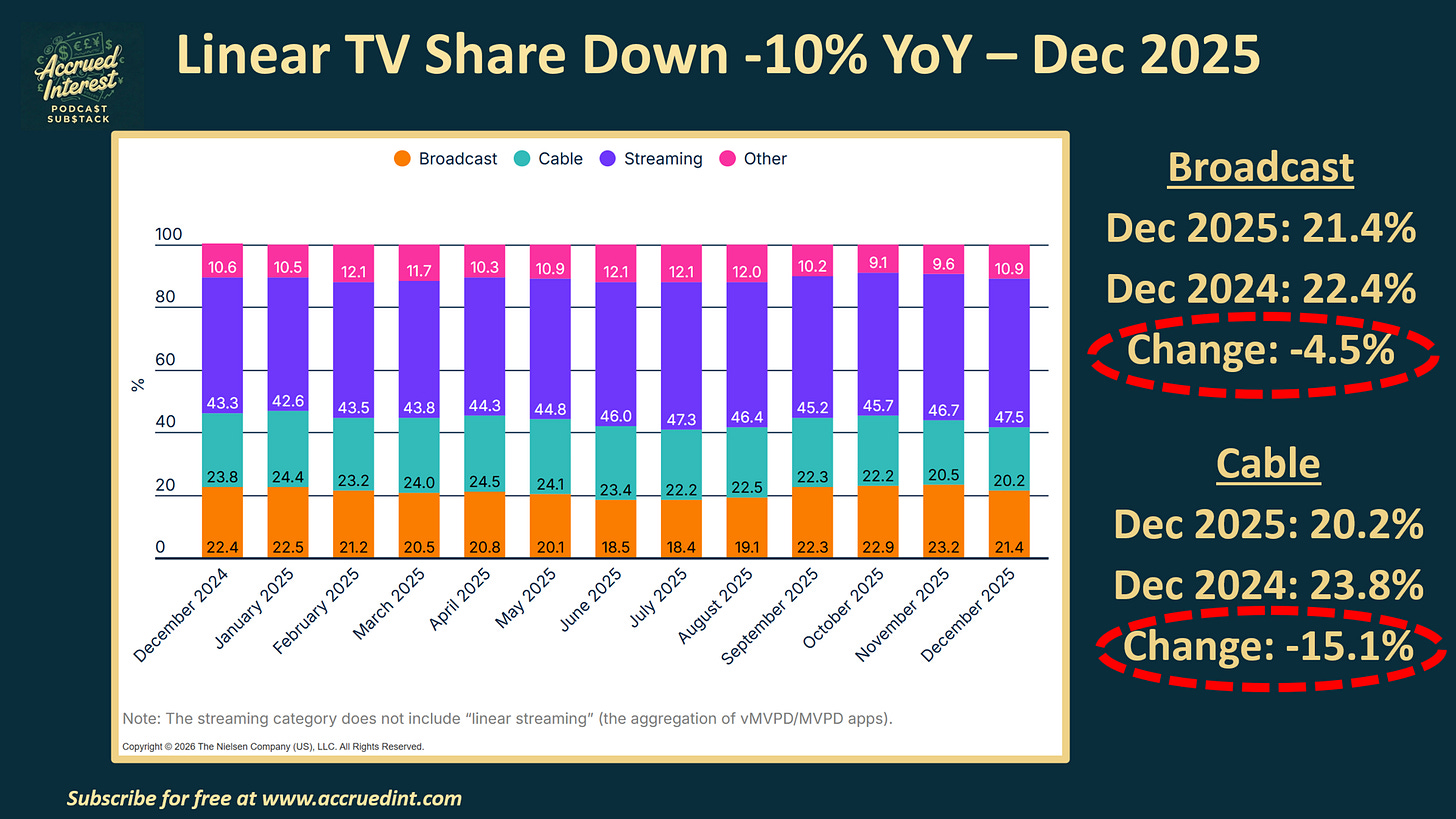

Linear TV was down -10% YoY: The combined share of Broadcast + Cable fell to 41.6%, which is now almost 6 share points lower than Streaming at 46.7%.

Cable’s freefall continues: While Broadcast was down a “manageable” -4.5%, Cable plummeted -15.1% YoY, dropping from 23.8% share last year to just 20.2% today.

Don’t mistake “less bad” for “good”: Broadcast bulls often tell me their business is safer because it’s declining slower than cable. That is the definition of complacency. Remember my 12 Days of Pitch-Mas thesis on Nexstar ($NXST): Broadcasters rely on the cable bundle for distribution revenue. If the cable ecosystem collapses (down -15%!), broadcast will inevitably get caught in the gravitational pull.

Sports are the accelerant: December proved that moving sports to streaming speeds up cord-cutting. By putting NFL games on Netflix and Amazon, the leagues are effectively handing their most valuable content to the executioners of the cable bundle.

Relevant Tickers: DIS 0.00%↑, PSKY 0.00%↑ CMCSA 0.00%↑ , WBD 0.00%↑, SBGI 0.00%↑ , NXST 0.00%↑ , FUBO 0.00%↑

Here is how the major publicly traded players performed in December and what it means for their respective stocks.

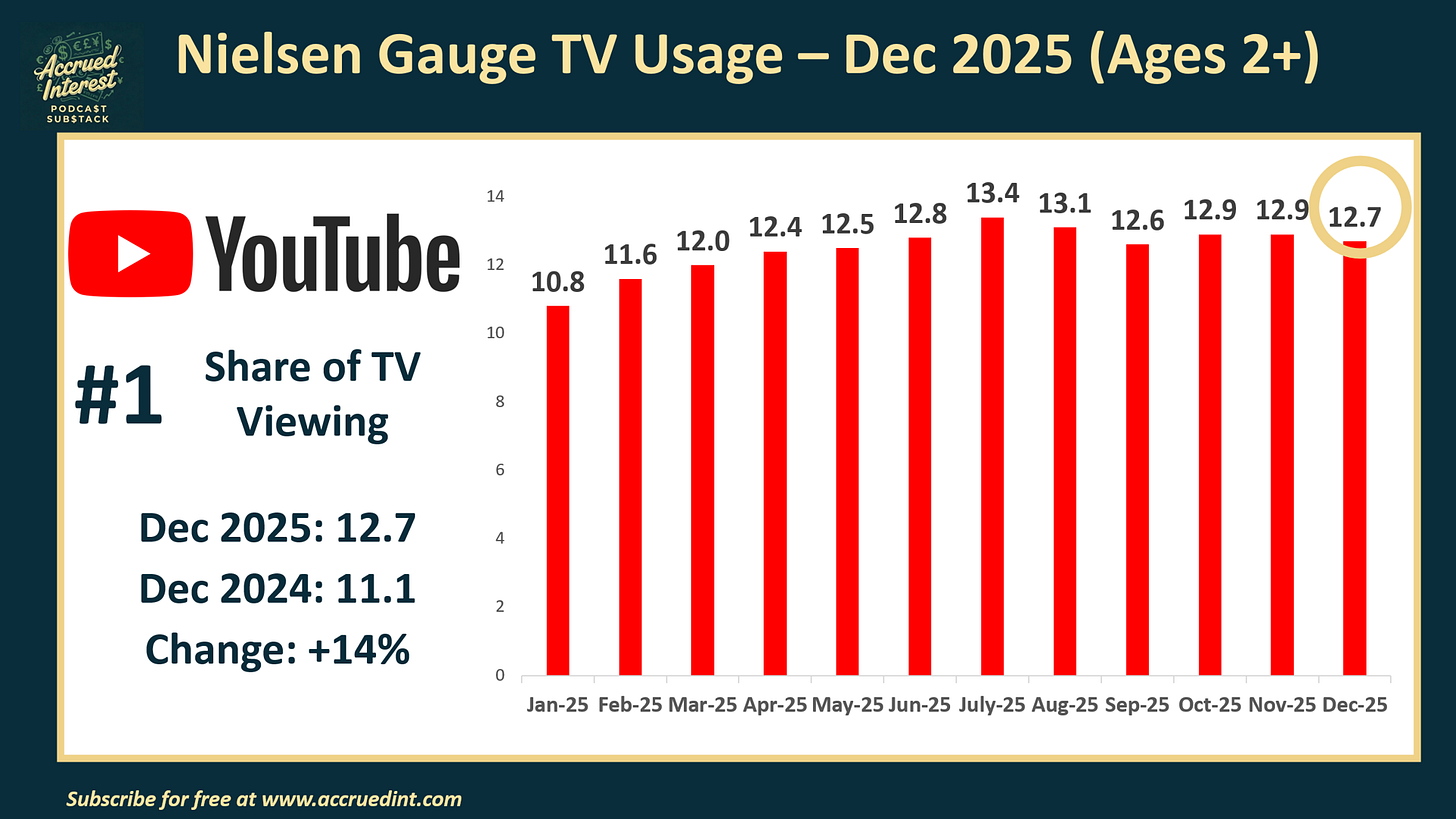

1) YouTube ($GOOGL) #1 with 12.7% share, +14% YoY

The boring, dominant juggernaut: I sound like a broken record, but you cannot ignore this data. YouTube held the #1 spot for total TV usage again, growing +14% YoY from 11.1% to 12.7%.

Consistency is King: While other streamers rely on hit shows to spike their numbers, YouTube’s algorithmic dominance provides steady, compound growth. It is the single biggest structural threat to every other media company on this list.

Pray they don’t get NFL games: It is even more impressive YT has reached #1 without a slate of exclusive NFL games. The service aired its first-ever exclusive NFL game back in Sept-2025 for the Kansas City Chiefs vs. the Los Angeles Chargers in São Paulo, Brazil. (FYI - YouTube is currently the exclusive home for NFL Sunday Ticket, offering out-of-market Sunday afternoon NFL games for an add-on price.)

Relevant Tickers: GOOG 0.00%↑ GOOGL 0.00%↑

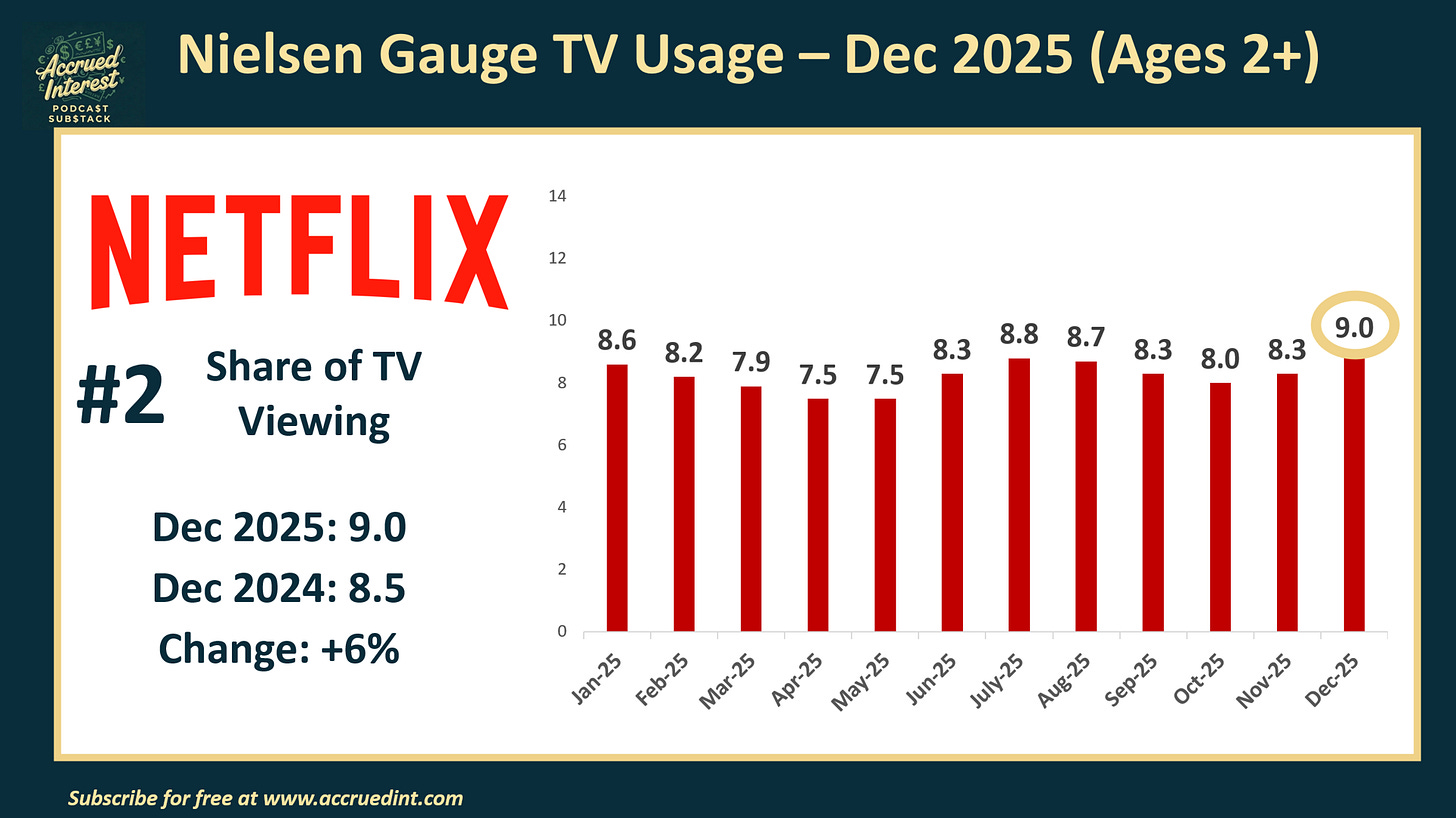

2) Netflix ($NFLX) #2 with 9.0% share, +6% YoY

Breaking the ceiling: I have previously written that Netflix seemed stuck at an ~8% ceiling in total TV watch time. In December, they finally smashed through, reaching 9.0% share, a +6% increase from last year.

The “Barbell” Strategy works: This record share was not just a lucky spike; it was a coordinated attack. Netflix aired back-to-back NFL games on Christmas Day and immediately followed them with new episodes of Stranger Things.

Thesis Pivot: If Netflix can successfully operationalize live sports events to funnel viewers into their scripted library, their total TV share could sustainably stay above 9% in 2026. This was one of several reason I was bullish on Netflix in my 12 Days of Pitch-Mas write-up a few weeks ago.

Relevant Tickers: NFLX 0.00%↑

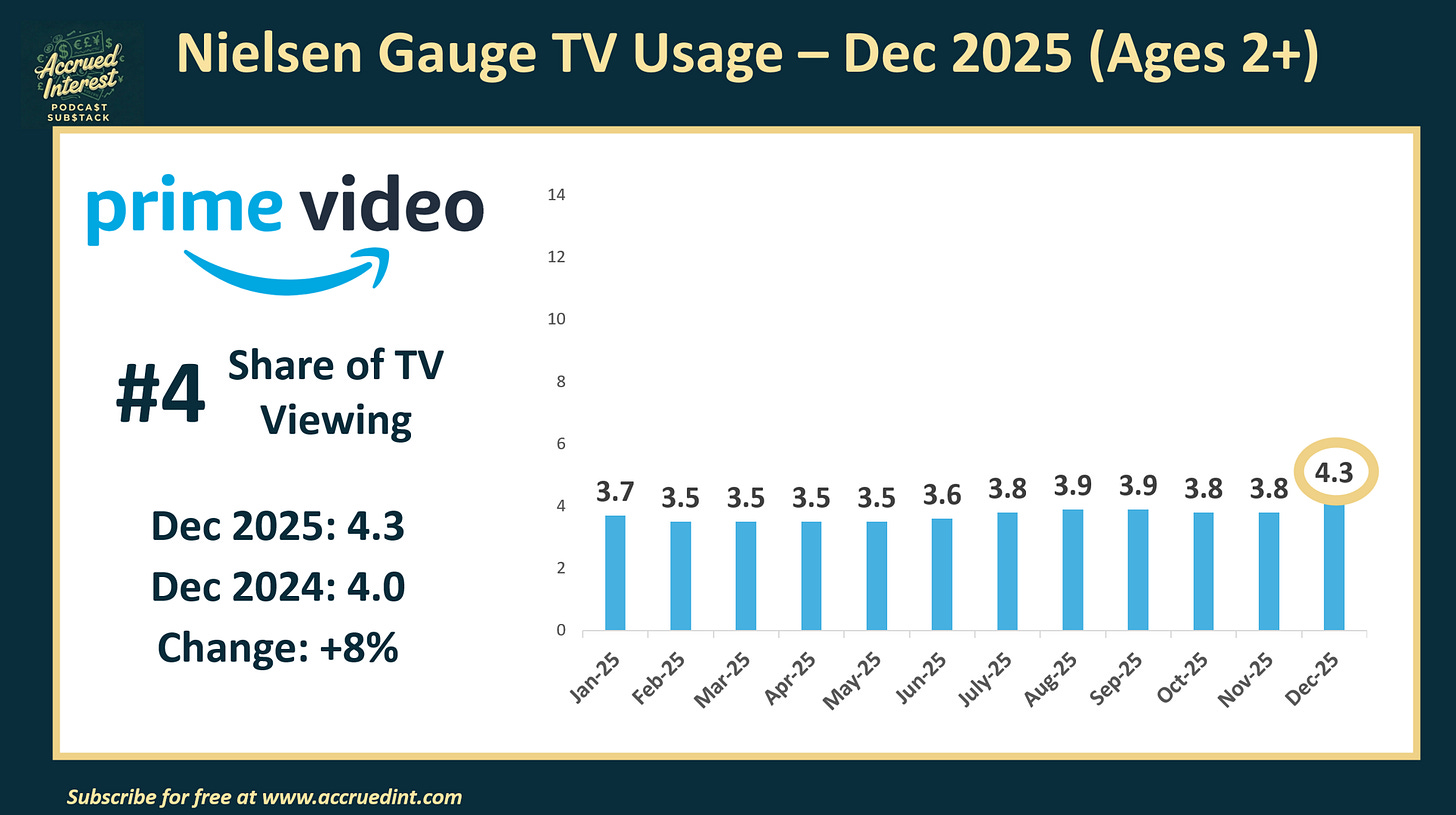

3) Prime Video ($AMZN) #4 with 4.3% share, +8% YoY

Football is the driver: Prime Video hit a platform-best 4.3% share, up +8% YoY from 4.0% last year.

Strategic scheduling: This surge was driven largely by Thursday Night Football, including a record-setting Christmas Day game. Amazon is proving that if you buy sports rights, viewers will follow you off the cable bundle – even without many other hit shows.

Relevant Tickers: AMZN 0.00%↑

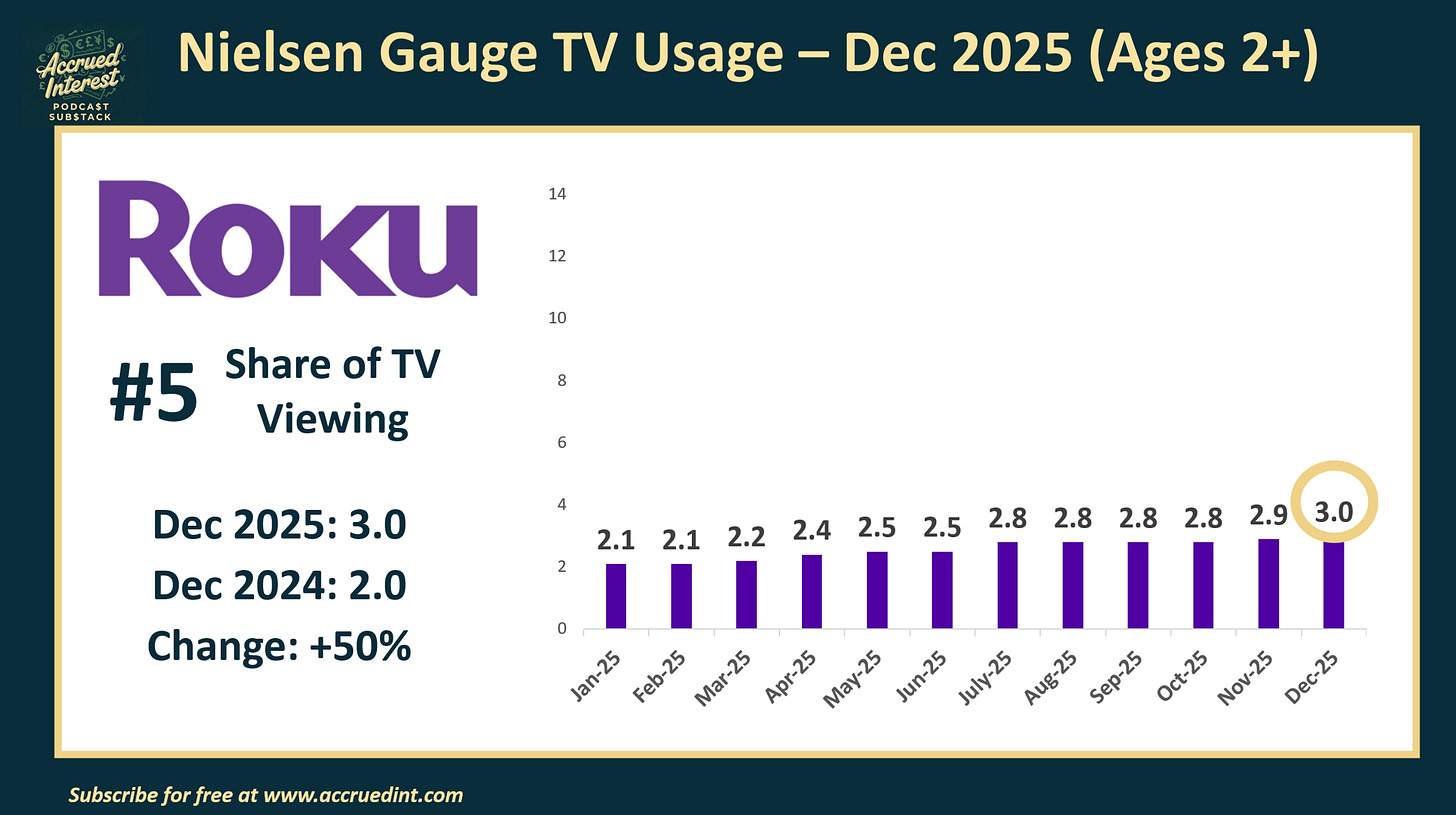

4) Roku Channel ($ROKU) #5 with 3.0% share, +50% YoY

The quiet winner: While we focus on the subscription giants, The Roku Channel quietly grew +50% YoY, jumping from a 2.0% share last year to 3.0% today.

FAST is real: As subscription fatigue sets in, people are being reminded that “free” is always a powerful value proposition. Roku is capturing the viewers who are churning out of paid services as well as those who avoid the pay TV bundle altogether.

Relevant Tickers: ROKU 0.00%↑

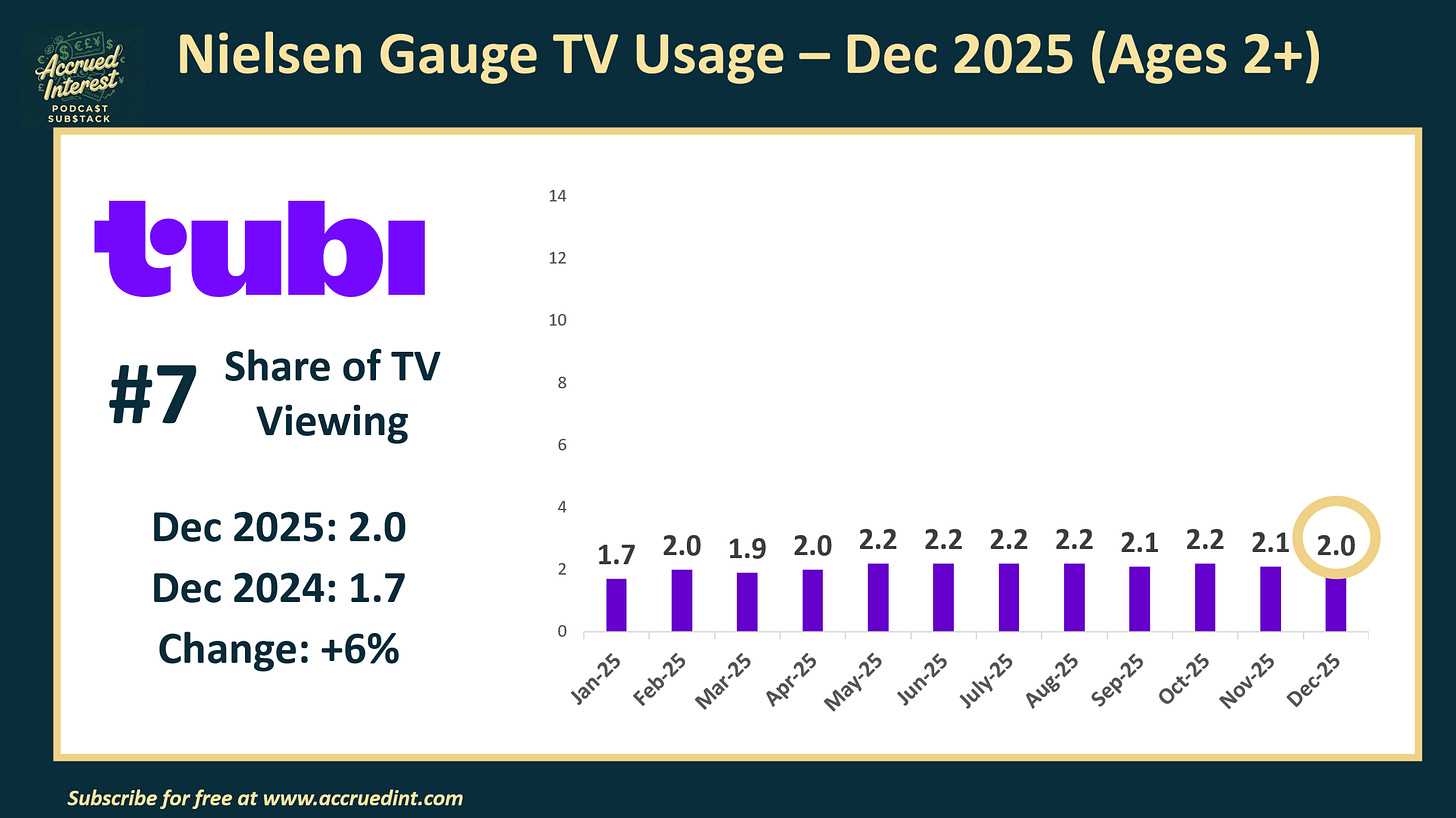

5) Tubi ($FOXA) #7 with 2.0% share

The Hidden Gem: While investors focus on Fox’s legacy cable assets, I have been documenting how Tubi has quietly becoming a monster in the AVOD space. It hit 2.0% share in December, up from 1.7% a year ago.

Beating the “Paid” Guys: Context is everything here. At 2.0% share, Tubi is now accounts for more big screen TV watch time in the U.S. than Peacock (1.7%), HBO Max/Discovery (1.4%), and is nearly tied with Paramount+ (2.5%).

Sports isn’t everything: Tubi proves you don’t need billions in exclusive sports rights to win. You just need a deep library and a “free” price point. For Fox ($FOXA), this is the hedge against the decline of the cable bundle that the market is still underappreciating.

Relevant Tickers: FOXA 0.00%↑ FOX 0.00%↑

CONCLUSION

The December Nielsen Gauge report is yet another tombstone for the old cable model. When we have reached the point where streaming accounts for the majority of big screen TV viewing on Christmas Day, that tells me that the consumer has officially moved on. Investors still clinging tight to legacy media stocks hoping for the viewer attrition to subside, are fruitlessly swimming against a current they cannot overcome.

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

You can always reach me at simeon@accruedint.com.