Media Stock Insights from Nielsen’s Nov-25 TV Snapshot

Roku Again a Top 5 Platform

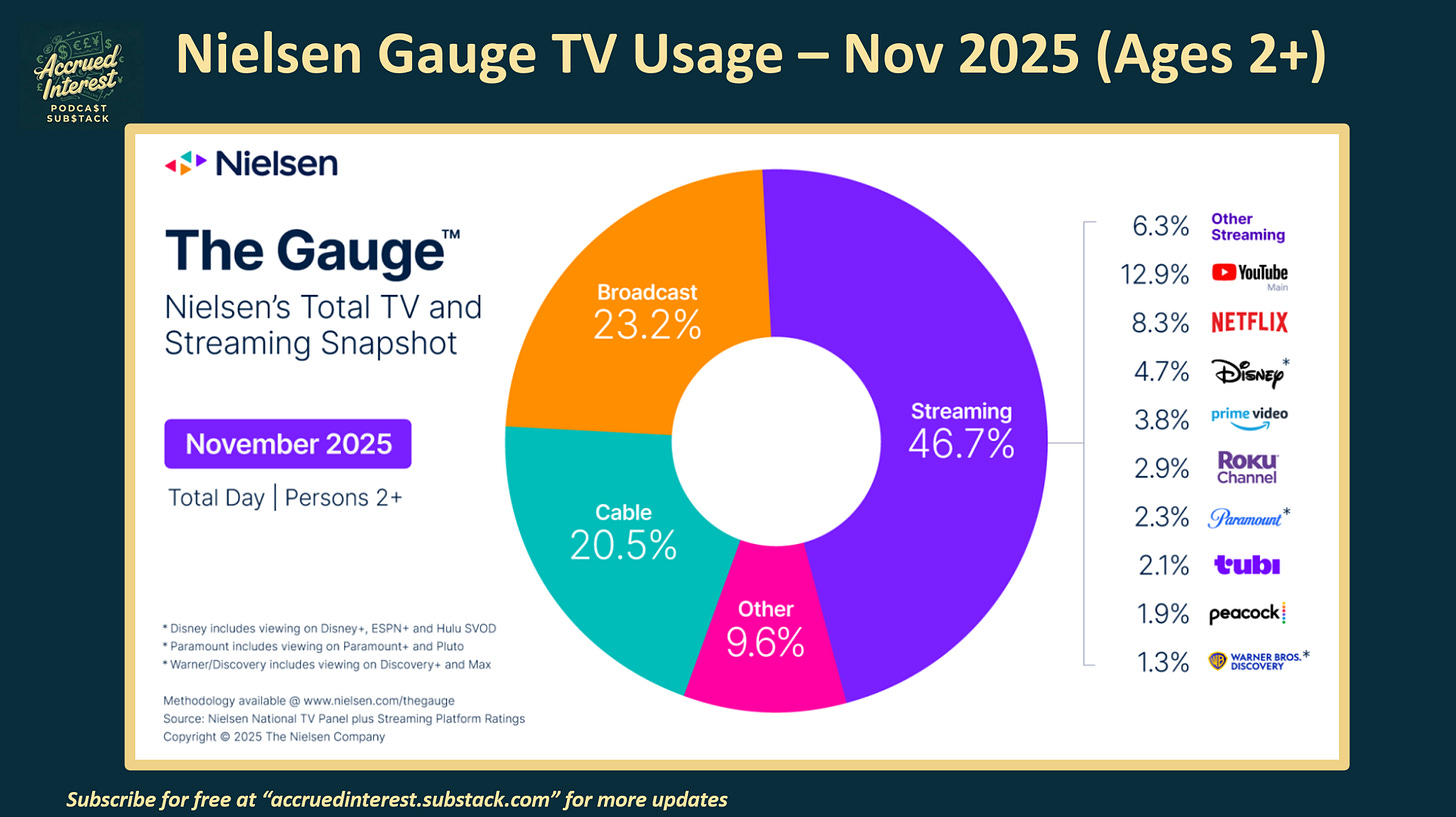

Nielsen is out with its November 2025 Gauge report, exploring what Americans are watching on their big screen televisions (excluding mobile devices). Here are the 3 major themes from the November report:

The Entrenched Dominance of Digital-First Platforms

YouTube remains the undisputed leader in TV viewing with a 12.9% share. Similarly, digital-first competitors like Roku are achieving all-time highs and outperforming legacy media providers in share growth. GOOG 0.00%↑ GOOGL 0.00%↑ , ROKU 0.00%↑

Netflix’s Necessary Pivot Toward Video Podcasting

Despite being #2 , Netflix continues to lag behind YT and is struggling to break the 9% share threshold. To bridge this gap and build daily watching habits for its ad-tier, Netflix is aggressively expanding into video podcasts through major partnerships with Spotify and iHeartMedia. NFLX 0.00%↑, SPOT 0.00%↑ , IHRT 0.00%↑

The Accelerating Decline of Traditional Linear Cable

Linear television continues its downward trend, with cable viewership declines accelerating to -18% year-over-year. Even within the shrinking pool of pay-TV households, consumption is shifting toward “linear streaming” via internet-based apps rather than traditional broadcast or cable feeds. PSKY 0.00%↑ WBD 0.00%↑ , DIS 0.00%↑ CMCSA 0.00%↑

I have been reporting on YouTube’s rise all year. Check out past monthly updates here: Oct, Sep, Aug, July, June, May, April, March, Feb and Jan.

Here are more takeaways from the November report…

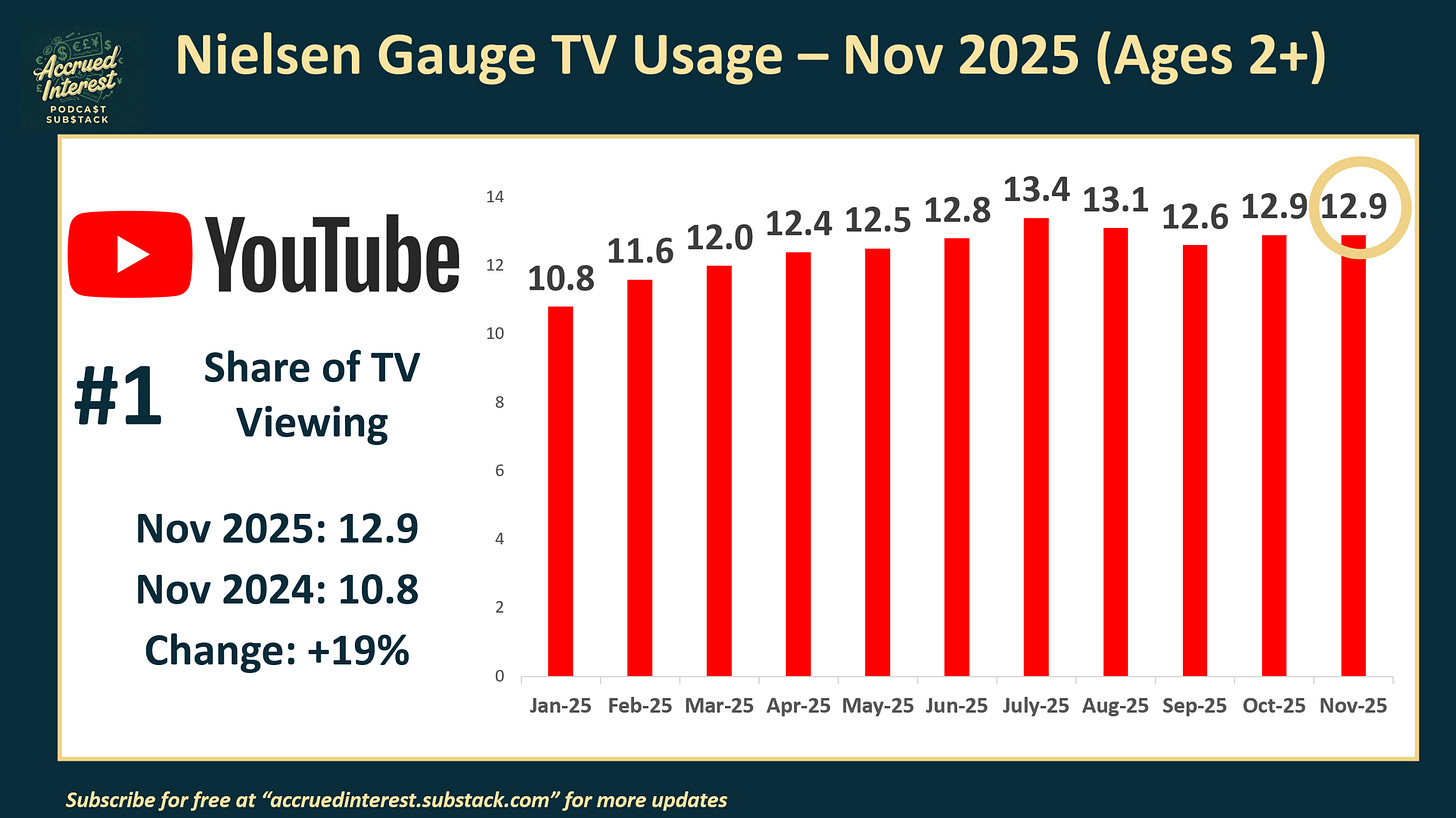

1) YouTube ($GOOGL) #1 with 12.9% share, up +19% YOY and close to 13.4% all-time high in July

YouTube’s share, while up +19% YoY, was flat vs. last month, October. I consider it an accomplishment YT can hold viewership even as we get deeper into the NFL and college football season.

I emphasize YouTube on Accrued Interest because I still think the extent of its dominance is underestimated. Surprisingly, Nielsen’s own monthly recap blog completely omitted any mention or explanation of YouTube.

As I said in my article on Day 1 of the 12 Days of Pitch-Mas, Netflix is going to be telling everyone who cares to listen in 2026 about YouTube. NFLX will argue YT’s growing share means acquiring Warner Bros. will not give them monopoly power.

“Concerns regarding a monopoly are based on outdated market definitions that exclude YouTube”.

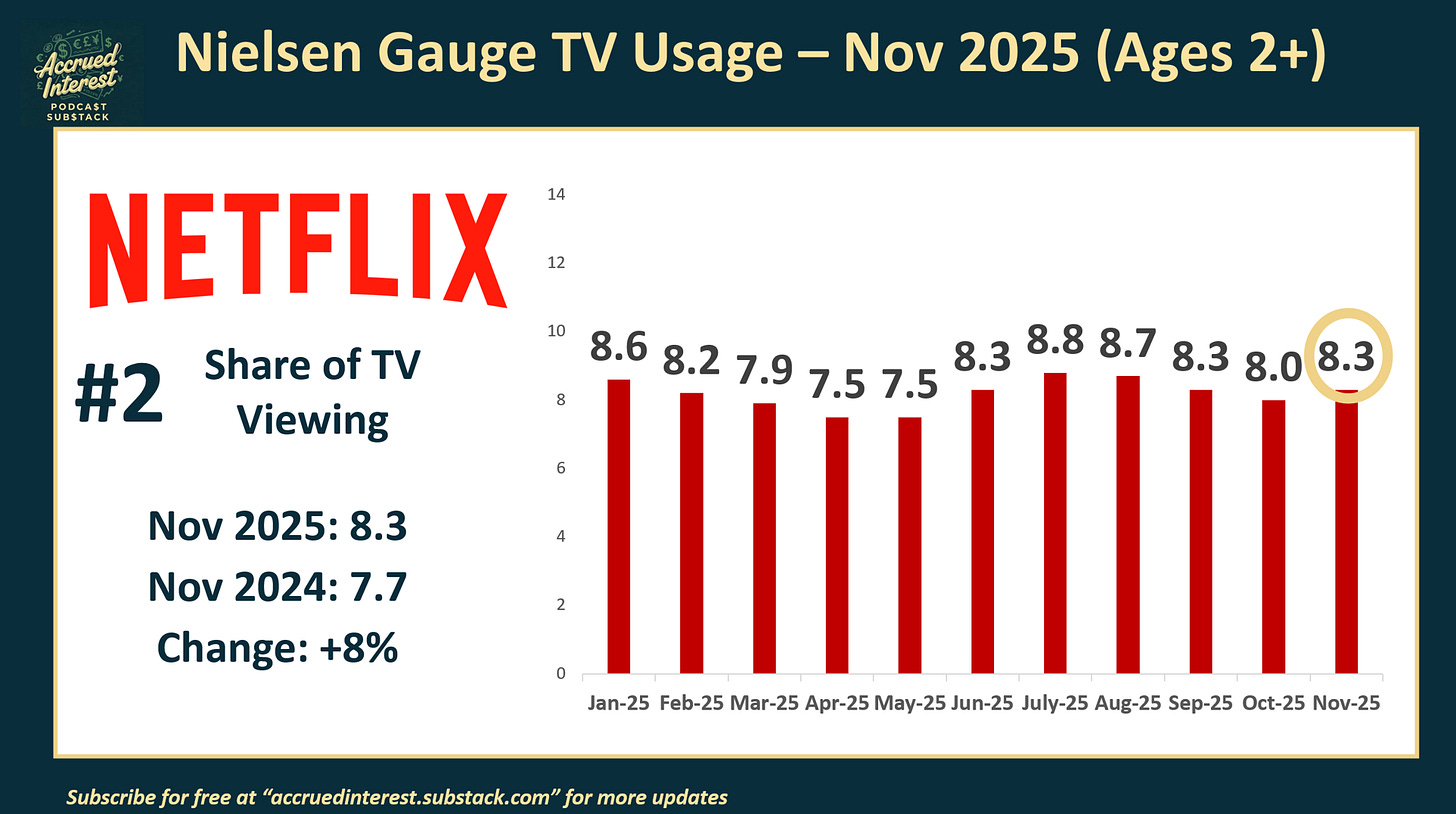

2) Netflix ($NFLX) was #2 with 8.3%, up month-over-month for the first time since July-25

Nielsen’s blog identified the return of Stranger Things for its fifth and final season, as the main contributor to Netflix’s increase vs. Oct.

Netflix continues to lag behind YouTube in viewing share, once again failing to exceed 9% . It shows no signs of closing the gap with the leader.

In my September report, I highlighted how Netflix was bringing more video podcasts onto their platform.

Today we learned Netflix is again expanding its podcast lineup. On December 16th, it was announced that NFLX struck a deal with radio station owner iHeartMedia on video podcasts.

The streaming giant announced a partnership with iHeartMedia to stream new video episodes of more than 15 iHeart Podcasts, including Charlamagne tha God’s The Breakfast Club, My Favorite Murder, Chelsea Handler’s Dear Chelsea, Bobby Bones Presents: The Bobbycast and more.

Podcasts are exactly the type of content that Netflix needs if it wants to increase watchtime on the service as it grows its ad-supported membership tier. As more podcasts become video-first, they can bring their audience over to Netflix and hopefully build a daily watching habit.

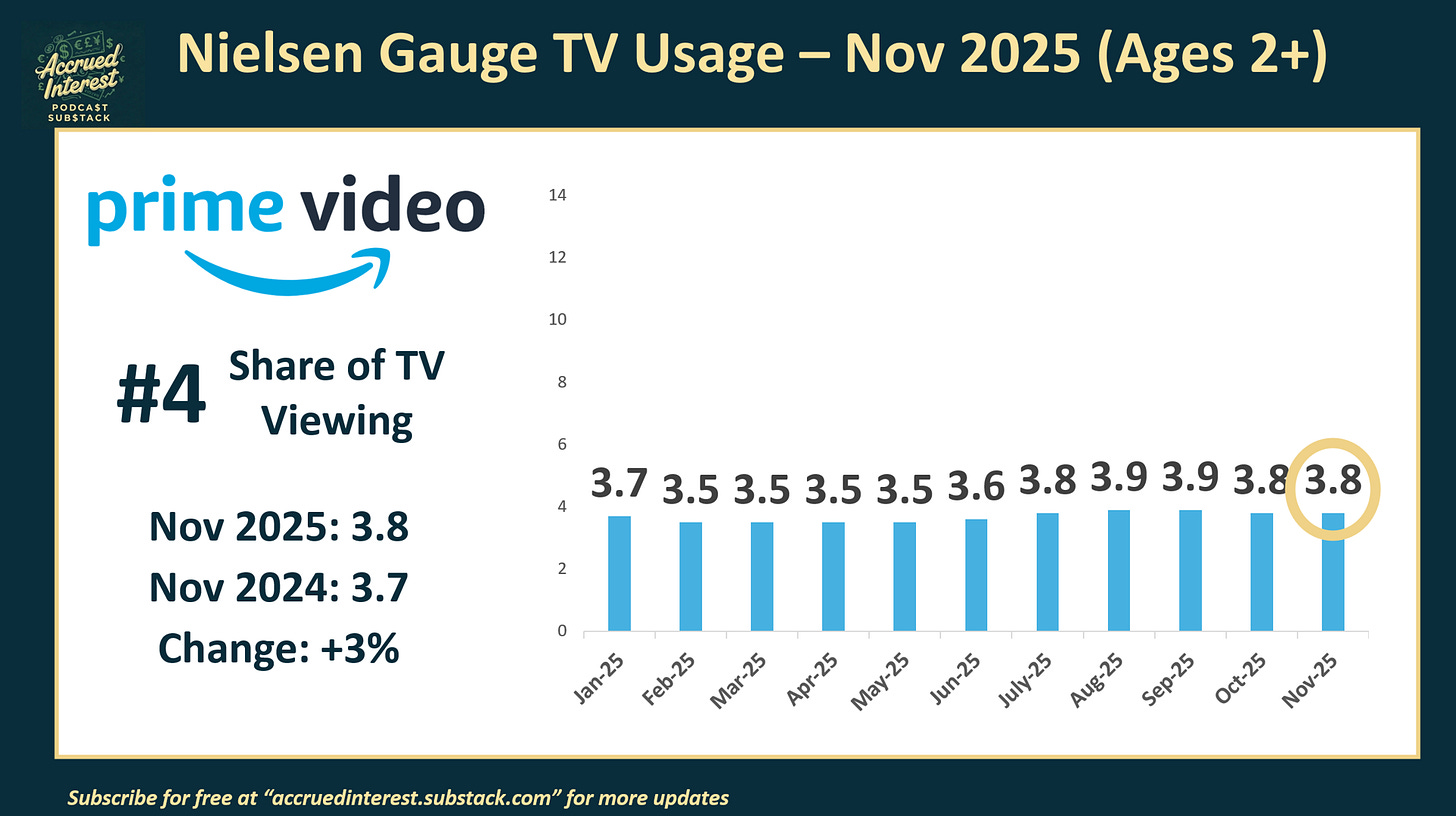

3) Prime Video ($AMZN) was again #4 with 3.8% share

Prime Video’s share was up only a most +3% YoY and has been relatively flat in the 3.8% to 3.9% range ever since July.

Prime Video is like Roku, in that it is both a platform to watch content from other providers as well as a producer of original content themselves. Also, both services have a lucrative “channels” business - where they let consumers easily subscribe to a wide array of other streamers.

Nielsen did not highlight any major contributors, or detractors, to Amazon’s numbers this month.

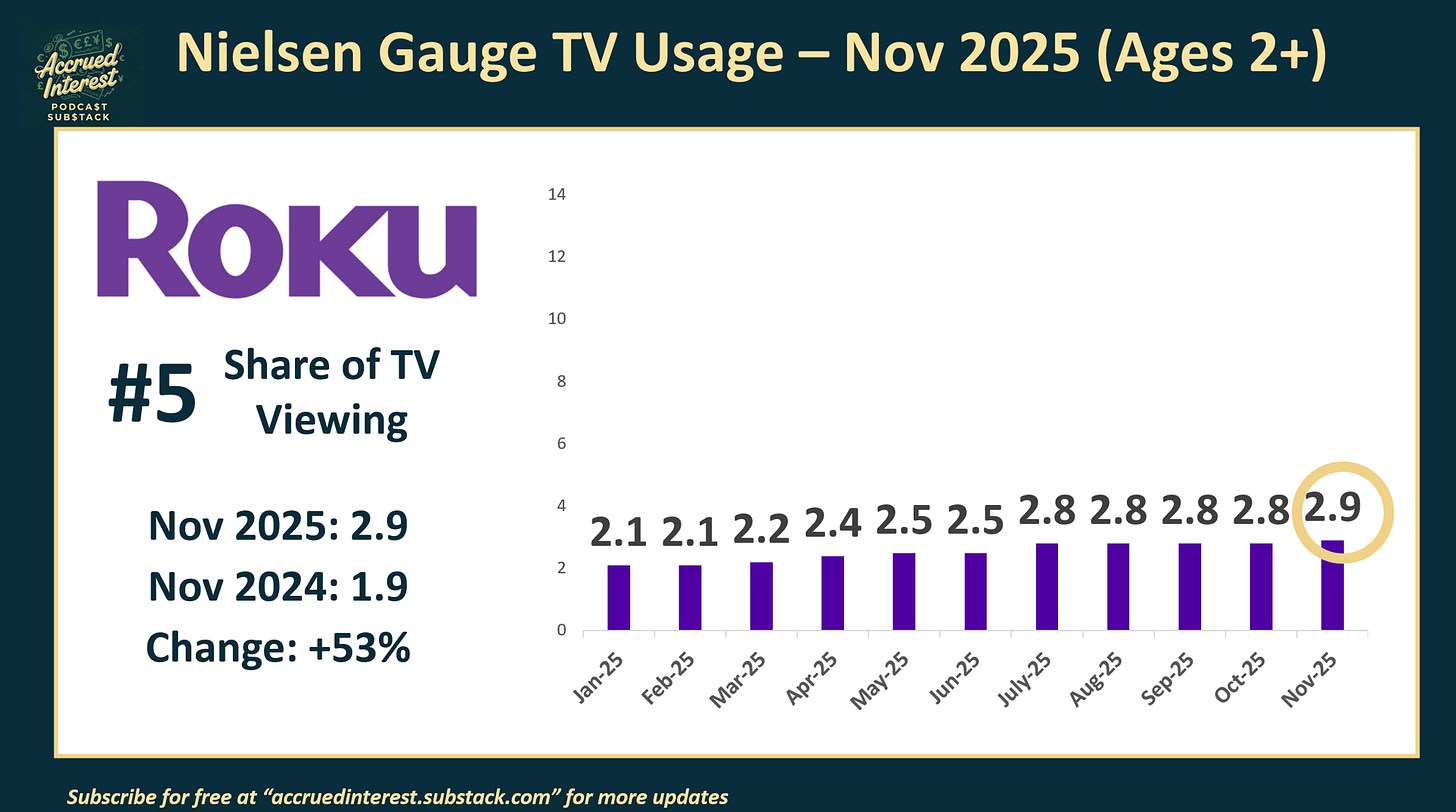

4) Roku ($ROKU) was #5 with 2.9% share

I said last month when I added Roku to my monthly update for the first time, I was too late on following this company and won’t make the mistake of overlooking them again!

Roku viewership growth of +53% YoY was impressive, adding a full +1.0 share point, but it was still growing from a small base. It is worth noting however, that almost none of the other streamers, besides YouTube, have shown gains that large so it is worth celebrating.

Nielsen called out Roku for having a +20% jump among viewers 25-34 YoY. While it did not cite any specific content that drove the increase, it still reflects a new all-time high for the platform.

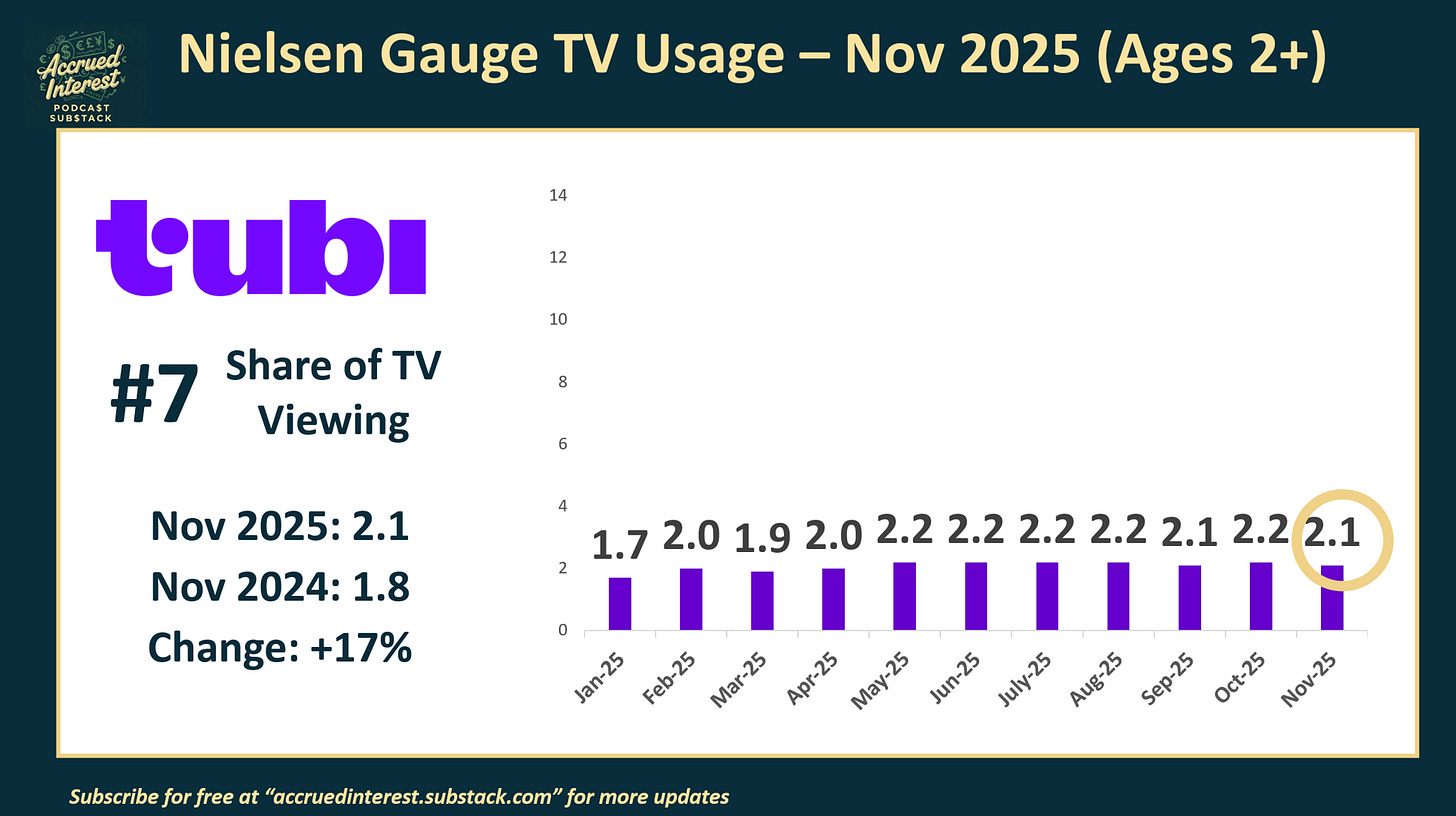

5) Tubi ($FOX / $FOXA) was #7 with 2.1% share

Tubi fell one spot to #7 because Paramount+ had double-digit growth, driven by NFL games and the new season of the original series Landman.

After getting a boost from airing the Super Bowl back in February, taking its viewership share north of 2%, Tubi has stayed in the low 2’s for the entire year. The service’s growth was +17% compared to Nov 2024, but basically flat with last month’s 2.2%.

Tubi is a fascinating streaming service, particularly for achieving a 2% share. It has done so without relying on consistent major sports programming or having a single breakout hit show or movie.

Many people are still underestimating or perhaps unaware of this “little streamer that could.” It holds a larger share than both Peacock (1.9%) and the combined Warner Bros. Discovery apps (HBO Max and Discovery + at 1.3%).

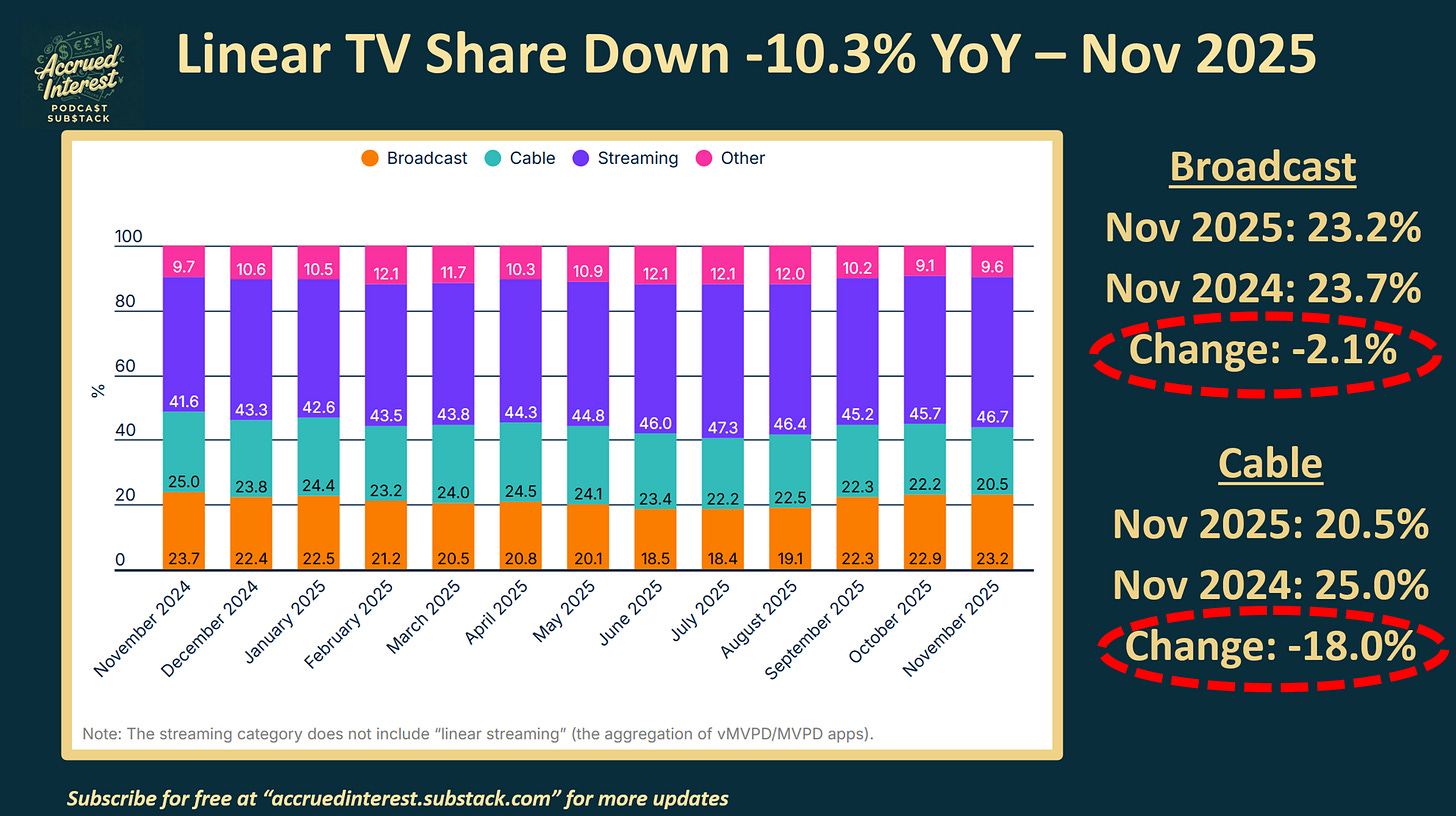

6) Linear losses continue, with both broadcast and cable down YoY

While the combined figure for linear is -10.3% YoY, the same rate as October, the splits for broadcast and cable were different this time. Broadcast viewership declines slowed to only ~2% this month (vs. -4.6% decline we saw in October). However, Cable viewership declines accelerated this month, down -18.0% (20.5% vs. 25.0%).

I wanted to note how the Nielsen blog where they post their own recap of the monthly results highlighted a stat that speaks to the future of television consumption. Specifically, even consumers who are in the shrinking pool of households with traditional pay TV packages - more of them are consuming these linear channels over the internet. Nielsen labels this “linear streaming.”

To clarify - “linear streaming” is “defined as live broadcast and cable content viewed through MVPD/vMVPD services like YouTube TV and cable provider app. Linear streaming is excluded from the streaming category in The Gauge.”

Nielsen touted that “linear streaming” on Thanksgiving this year was the 2nd highest they had recorded. It was behind only by Super Bowl Sunday February-2025 when Fox steamed the big game on Tubi.

I expect linear streaming to increase in the coming months and years as YouTube TV inevitably becomes the largest pay TV provider in the U.S in either 2026 (or 2027), as I mentioned in my Google pitch for my 12 Days of Pitch-Mas series.

-Accrued Interest

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.