Fubo Q4-25 Earnings Recap: The “Growth” Story Stalled, and the Reverse Split Proves It

Why $FUBO earnings validates my Bear Case from December.

Accrued Interest TL/DR: Fubo’s latest Q1 FY 2026 earnings confirm the bear case: The growth story is dead. With subscribers shrinking, ad revenue falling -4% YoY, and management pulling guidance, the company is in survival mode. The announced reverse stock split is the final admission that the Hulu + Live TV merger failed to deliver. Squeezed between YouTube and Netflix—and missing the Olympics this week—Fubo is uninvestable. My “Underperform” rating from December stands—this is a broken thesis.

Introduction

Investing is often about pattern recognition, and right now, the pattern emerging from Fubo ($FUBO) is impossible to ignore. Back in December, during my “12 Days of Pitch-Mas” series, I pitched Fubo as an Underperform for 2026. My thesis was straightforward: the company is a sub-scale operator in a brutal industry dominated by tech giants, and its merger with Disney’s Hulu + Live TV was not a growth engine, but a desperate attempt to gain relevance.

Today, Fubo released its earnings for the first quarter of Fiscal Year 2026 (Calendar Q4 2025), and the market’s sharp sell-off tells you everything you need to know. Fubo stock fell over -20% in morning trading after the release. But if you look past the headlines, the situation is even more dire than the stock price suggests.

Perhaps the most damning signal wasn’t a number at all, but an omission. In the release, Fubo management stated they could not provide future guidance.

This is a massive red flag.

In my December pitch, I predicted they would be forced to lower guidance as the realities of the market set in. The fact that they have chosen to pull guidance entirely confirms that fear. It suggests that too much time has passed without improvement, and management is now too afraid to put a number on paper because they have zero visibility into where the floor is.

In this article, I want to break down exactly what happened in this quarter and explain why these results confirm the bearish predictions I made in Why Fubo Will Underperform in 2026 ($FUBO).

I used to refer to Fubo as a “melting ice cube,” but I realize now that analogy was flawed. Melting implies there was a solid block of value to begin with. Fubo is more like a startup that simply never achieved lift-off. It’s a “Failure to Launch” story—a company that burned through cash on the runway and is now looking for financial engineering to stay airborne.

Here are my 5 key takeaways from the disaster that was Fubo’s Q1 2026.

1. The Ultimate Bear Signal: The Reverse Stock Split

Let’s start with the elephant in the room. You usually don’t announce a reverse stock split when things are going well.

Buried in today’s release was the announcement that Fubo’s Board has approved a reverse stock split in the range of 1-for-8 to 1-for-12. Management spins this as a move to “make the stock more accessible to a broader base of investors” and align the share count with the company’s size.

Translation: The stock price has fallen so low that it is becoming uninvestable for institutions and risks delisting requirements.

When I wrote about Fubo in December, I questioned whether the company had a reason to exist in a world dominated by YouTube TV. A reverse split is often the financial equivalent of a “Hail Mary.” It creates the optical illusion of a higher share price without changing the underlying value of the business. For a company that just completed a “transformational” merger with Hulu + Live TV, resorting to financial engineering this quickly is a massive vote of no confidence in organic price appreciation.

2. Subscriber Growth Has Reversed: “Stuck” User Base

The core of the bull case for Fubo has always been its “Sports First” growth story. The argument was that sports fans are loyal and will pay up for the best bundle.

The data from this quarter undermines that narrative.

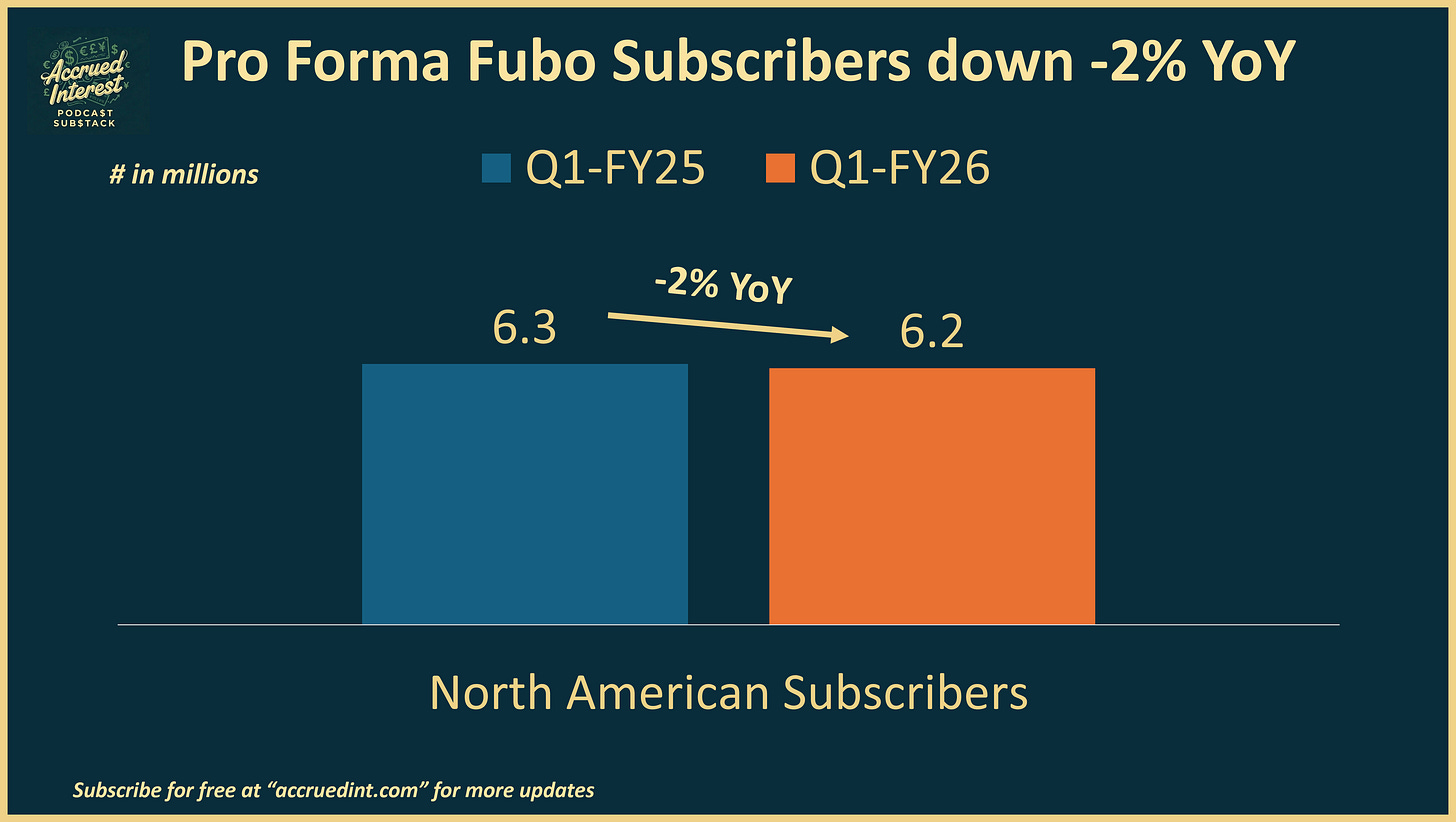

Total North American Subscribers: 6.2 million.

Comparison: This is down from 6.3 million in the comparable prior-year period

Let that sink in. On a pro forma basis—combining Fubo and Hulu + Live TV—the subscriber base shrank year-over-year.

In my December article, I highlighted the “Stuck Subscriber Base” at Hulu + Live TV, noting that it had fallen -4% YoY. Today’s earnings confirm that this trend has continued. Fubo isn’t growing; it is churning.

Why is this happening? As I predicted, the “Sports-First” skinny bundle from YouTube TV is eating their lunch.

YouTube TV is growing past 10 million subscribers because they have the scale to offer better pricing and the “Google Subsidy” to run at breakeven. Fubo, meanwhile, is losing subscribers despite having the “combined strength” of Hulu. If you are shrinking in Q4, historically a strong quarter for TV adds—you are in structural decline.

3. Advertising Revenue is Shrinking (Yes, Shrinking)

If the subscriber numbers were bad, the advertising numbers were worse.

Now, I want to be fair to the bull case here for a moment. As I discussed in my recent Netflix Q4 Recap, there is undeniable upside to having a fully integrated, world-class ad tech stack. Netflix, for example, projected meaningful increases in fill rates as they optimized their inventory. In theory, Fubo moving to the Disney Ad Server should offer similar benefits—better targeting, higher CPMs, and access to a broader demand pool.

But Fubo is not Netflix.

Netflix owns its ecosystem entirely. Disney owns its ecosystem entirely. Fubo, in this new arrangement, is a third party. While the cooperation with Disney might improve mechanics, at the end of the day, an advertiser still must actively decide to buy Fubo inventory.

Disney is not incentivized to prioritize Fubo over its own Owned & Operated (O&O) platforms like Disney+ or ESPN. If a premium ad dollar comes in, Disney will push it to their higher-margin, wholly-owned properties first. Fubo isn’t being aggressively packaged as a core component; it’s an add-on.

The numbers bear this out:

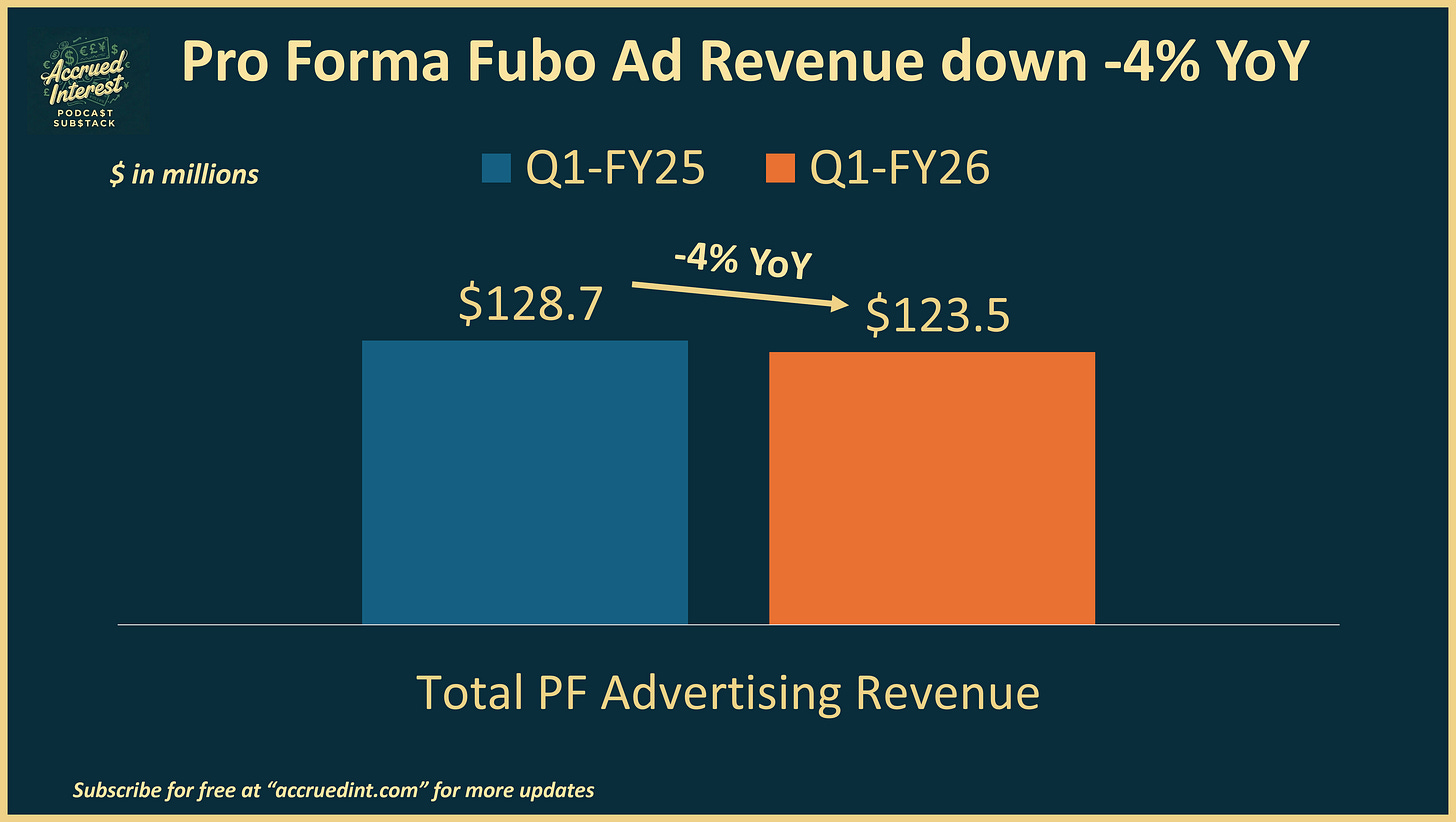

Pro Forma Advertising Revenue: $123.5 million.

Prior Year: $128.7 million.

Growth: -4% decline.

Management is promising that the migration to the Disney Ad Server later this month will fix this. But as an analyst, I don’t pay for promises; I pay for performance. A -4% decline suggests advertisers simply do not view Fubo as a “must-buy” in a crowded market.

4. The “Profitability” Mirage

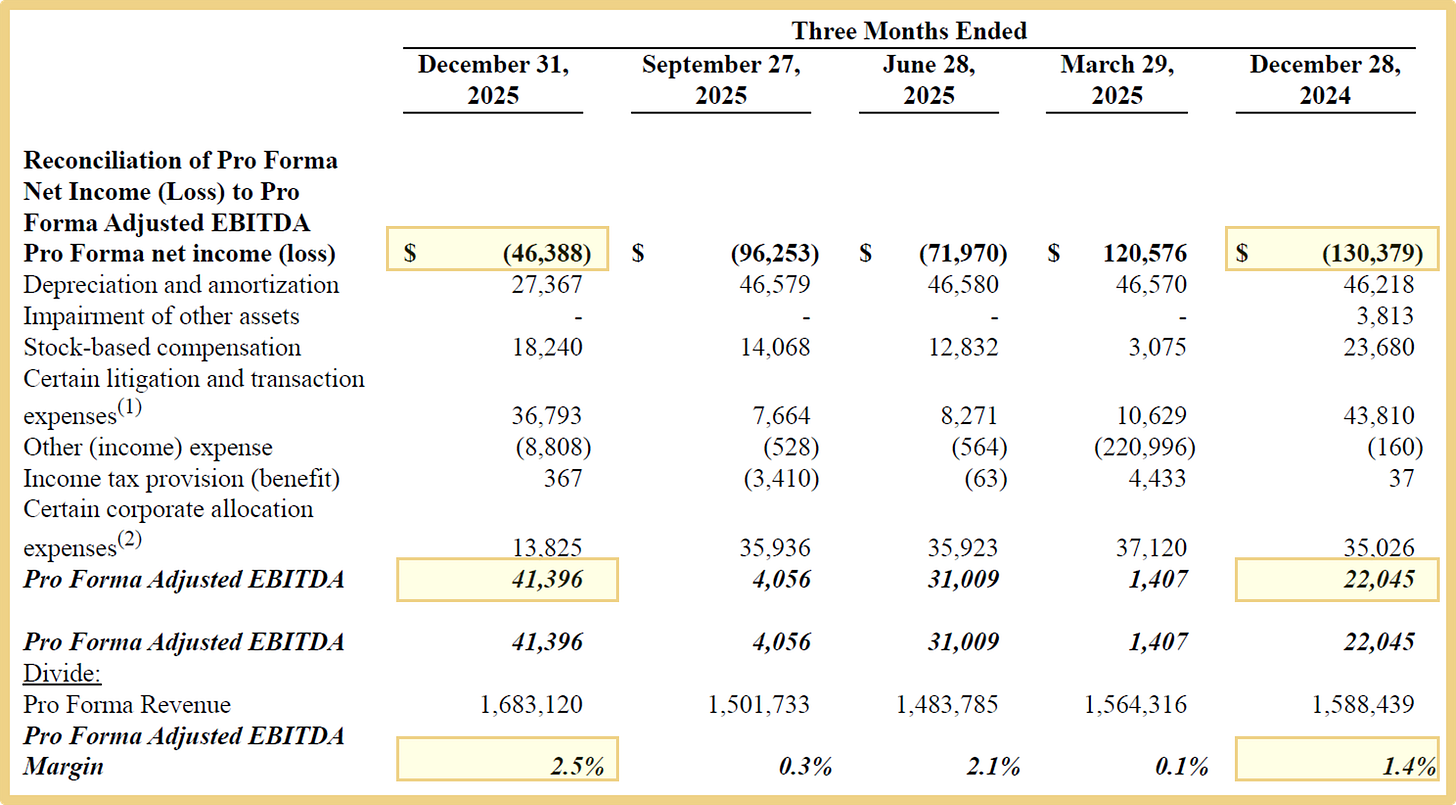

Fubo proudly announced positive Pro Forma Adjusted EBITDA of $41.4 million. On the surface, this looks like progress compared to the $22 million in the prior year.

But as a value investor, the only metric that truly matters for long-term viability is Free Cash Flow, and on that front, the picture remains ugly.

“Adjusted EBITDA” is often a metric used to hide the true cost of doing business. When you look at the Net Loss, Fubo posted a Pro Forma Net Loss of -$46.4 million.

This lack of GAAP profitability is exactly why investors are losing patience. You can sell a growth story with losses (like early Netflix or Amazon), or you can sell a value story with profits (like legacy media). Fubo is offering neither—shrinking growth and continued losses. This is not a Free Cash Flow machine; it is a capital-intensive business with razor-thin margins.

Furthermore, management cited “working capital timing” and a build-up in accounts receivable to explain poor operating cash flow.

Let’s be clear: for a digital subscription business, if you are spending time explaining away working capital swings, you are wasting everyone’s time.

That is not the core problem. The problem is that the unit economics are structurally challenged, and no amount of working capital management can fix a business model that fails to generate real cash.

5. The Content Cliff: Losing NBCU Was Just the Start

In the earnings release, management tried to spin the loss of NBCUniversal content as a win. They stated, “The subscriber impact following the removal of NBC content has been better than our expectations.”

This is corporate speak for “We lost fewer subs than we thought we would.” But they did lose subs. And more importantly, they are about to face a massive test.

The Winter Olympics start Friday 2/6.

Think about the timing. Fubo is pitching itself as a “Sports First” destination, yet they do not carry the channels (NBCU/Versant) that are broadcasting one of the largest sporting events in the world. When sports fans realize they can’t watch the Winter Games on Fubo, they aren’t going to wait around. They are going to sign up for YouTube TV or Peacock immediately.

This content gap virtually guarantees that Fubo will be a net loser of subscribers in Q1 2026. You cannot claim to be the home of sports and then sit on the sidelines for the Olympics.

Additionally, they announced a new “reseller arrangement” with ESPN to put Fubo Sports in ESPN’s commerce flow. This sounds nice but think about the strategic implication: Fubo is becoming a downstream reseller for Disney/ESPN. They are ceding the direct customer relationship. If ESPN is the storefront and Fubo is just a product on the shelf, who owns the customer? ESPN does. This aligns with my thesis that Fubo is slowly being converted into a utility for Disney rather than a standalone competitor.

CONCLUSION

This earnings report was not a stumble; it was a confirmation of a broken thesis.

The announcement of a reverse stock split—and the refusal to provide future guidance—is the final nail in the coffin for the growth narrative. It is an admission that the market has lost faith in the equity story and that management has lost visibility into the business.

Looking ahead to the rest of 2026, the outlook is grim. We are moving toward a “Two-Horse Race” in the TV living room between Netflix ($NFLX) and YouTube ($GOOG/$GOOGL).

Netflix has won the engagement war (see my Netflix Q4 Recap).

YouTube has won the linear replacement war with its cheaper skinny bundles.

Fubo is squeezed in the middle—charging a premium price for a worse product with shrinking content (no NBCU during the Olympics). They are trying to compete with giants using a balance sheet that requires a reverse split to stay afloat.

I reiterate my Underperform rating. Do not catch the falling knife. This startup never found its wings, and it’s a long way down.

-Accrued Interest

Relevant Tickers: FUBO 0.00%↑ , DIS 0.00%↑ , GOOGL 0.00%↑ GOOG 0.00%↑ , NFLX 0.00%↑

Disclaimer: The information presented in this Substack is for educational purposes and should not be construed as investment advice. Investors should make their own decisions regarding the prospects of any company discussed here, as I am not a registered investment advisor.

You can always reach me at simeon@accruedint.com.